5 Alarming Signs the US Is Slipping Further Into Recession This October

October 2025 brings mounting evidence of a looming US recession. Leading economists and job market data caution that nearly half of the country faces contraction, with critical indicators increasingly hard to dismiss.

The US economy is flashing warnings across multiple fronts—from widespread regional slowdowns to declining credit quality and government gridlock. While headline figures appear strong, deeper analysis reveals growing risks and heightened uncertainty.

1. Nearly Half of US States Already in Recession

One of the most alarming developments is the geographic spread of economic stress. Mark Zandi, Chief Economist at Moody’s Analytics, has stated that 22 states and the District of Columbia are already experiencing economic downturns characterized by job losses and weak growth.

Furthermore, he noted that another 13 states are ‘treading water,’ leaving the national economy fragile and vulnerable to further shocks.

“The economy is still not in recession, but the risks are very high. We’re on the precipice,” Zandi told MarketWatch.

2. The Recession Setup Is Back

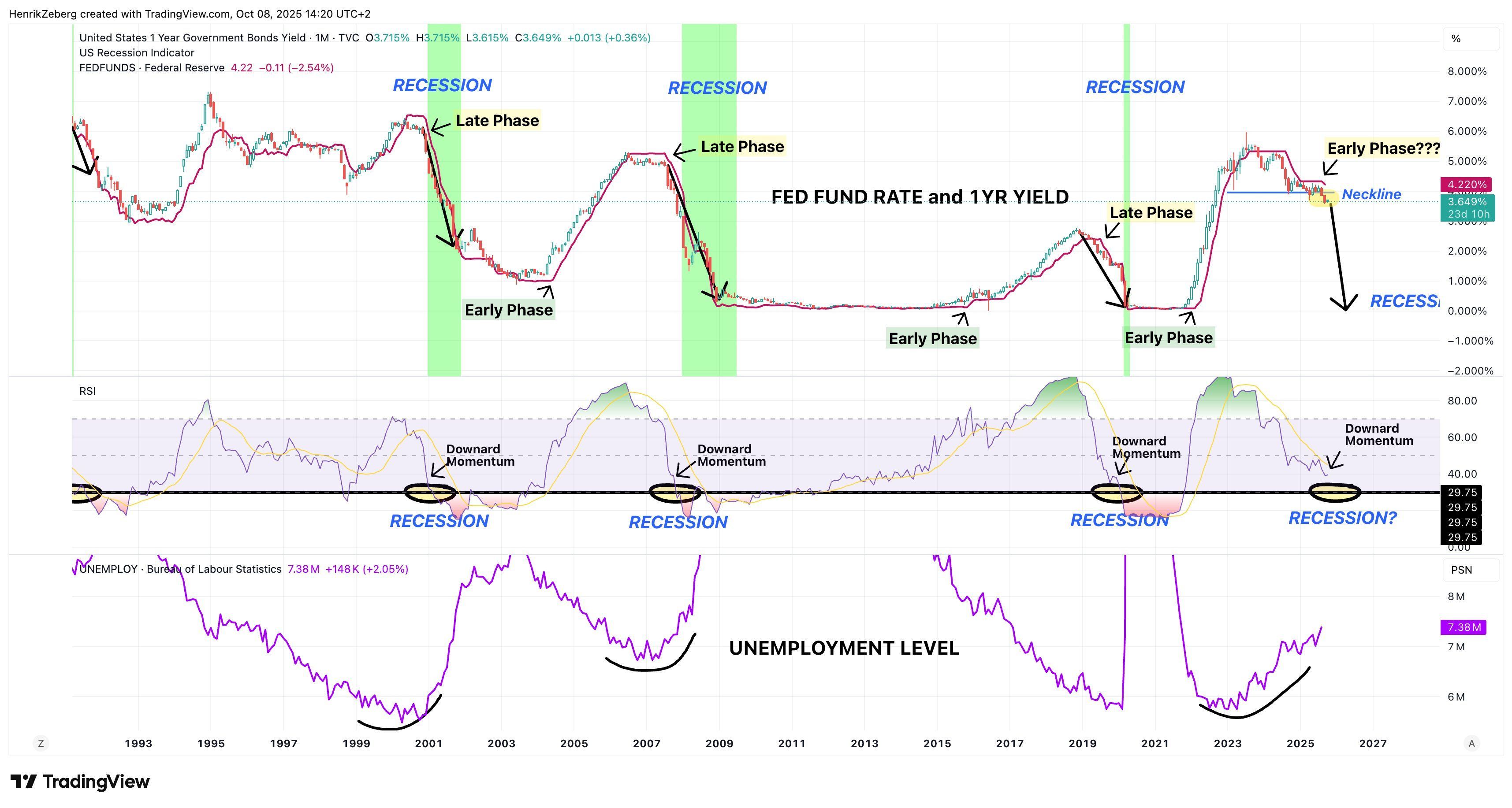

Adding to the warnings, Henrik Zeberg, Head Macro Economist at Swissblock, pointed to two critical signals that have preceded every major US recession: rising unemployment and declining short-term yields.

In an analysis shared on X, Zeberg illustrated how the pattern is reemerging. His chart shows unemployment levels turning higher while 1-year Treasury yields begin to drop — a setup that historically marks the shift to early recession.

“See this is one of my key charts….To say that we definitely have a SLOWDOWN,” he added.

Recession Setup Chart. Source: X/HenrikZeberg

Recession Setup Chart. Source: X/HenrikZeberg 3. US Hiring Intentions Drop to Crisis Levels

Labor market signals also reveal increasing problems. Global Markets Investor pointed out that US employers cut hiring plans to just 117,313 jobs in September—the lowest for that month in 14 years.

“Year-to-date, employers have planned to add 204,939 jobs, the lowest figure since the financial crisis. A pickup in already elevated layoffs is coming,” the post read.

Retail seasonal hiring projections exacerbate the outlook. Challenger, Gray & Christmas forecasts retailers to bring on fewer than 500,000 workers in the fourth quarter. That would mark an 8% decline from last year and the lowest seasonal hiring level since 2009.

This reluctance to hire stems from heightened uncertainty. Automation, persistent inflation, and ongoing macroeconomic tensions weigh heavily on business and consumer outlooks. As hiring weakens, wage growth is threatened, which could soon dampen household spending—especially as the crucial holiday season approaches.

4. US Credit Scores Are Falling

Another major warning this fall is the rapid decline in US credit quality. According to a September report, the average FICO score fell 2 points to 715, the largest annual slide since the Great Recession in 2009. Spiking student and consumer loan delinquencies are squeezing family budgets at a time of notable inflation.

“Gen Z consumers (ages 18–29) experienced the largest average FICO® Score decrease of any age group, down three points year-over-year. This group also showed a higher rate of 50+ point score swings than the national average, reflecting greater financial volatility. A key driver is student loan debt: 34% of younger consumers hold student loans, compared to just 17% of the total population,” the report reads.

5. Government Shutdown Threat Adds Fuel to the Fire

Finally, the threat of a prolonged government shutdown looms as a potential catalyst. Such an event would suspend critical economic data releases, including jobs and inflation reports. This blackout heightens uncertainty for policymakers, businesses, and consumers.

“Each week the Democrat Government Shutdown continues, our economy loses $15 BILLION in GDP. A month-long shutdown means 750,000 federal workers furloughed and 43,000 more Americans OUT OF WORK across the private sector,” market commentator Scott Adams added.

Thus, experts, companies, and households are bracing for turbulence this year. From widespread regional contractions to falling credit scores, the data suggests a recession may be taking hold beneath the surface. Unless hiring and credit trends reverse or policymakers act decisively, recession risks are likely to intensify.

What a US Recession Means for Crypto

But how will such economic conditions impact the crypto market? A looming recession could pressure crypto markets initially, as investors retreat from risk assets amid tightening credit and rising unemployment.

Yet, as BeInCrypto points out, echoes of the 1970s Nixon shock suggest that when confidence in fiat currencies erodes, assets like gold and Bitcoin tend to benefit. If the downturn forces central banks to cut rates or expand liquidity, a weaker dollar could revive demand for decentralized stores of value.

In that scenario, Bitcoin may once again emerge as a modern hedge against monetary debasement, while altcoins could struggle to keep pace in a flight-to-quality phase.