$100 Million Lost in One Hour: Bitcoin Drops Spark Rampaging Liquidations

Retail Bitcoin traders made themselves heard today, causing $700 million in crypto liquidations. The price of BTC fell by around $4,000 as on-chain activity spiked, even though institutions kept buying.

Whether or not BTC keeps dropping or recovers soon, we need to pay attention to these dynamics. Corporate liquidity is very influential in the market, but it’s not the final arbiter of price.

Bitcoin Causes Surprise Liquidations

When Bitcoin hit two successive all-time highs earlier this week, it caused a little consternation in the community. This took place despite a lack of retail activity, with institutional investors powering the growth.

Crucially, these corporations continued making huge purchases while BTC’s value was inflated.

In other words, there have been fears that these inflows could profoundly alter market cycles. Arthur Hayes even proclaimed that the four-year cycle was dead and that global institutional liquidity would determine token prices now.

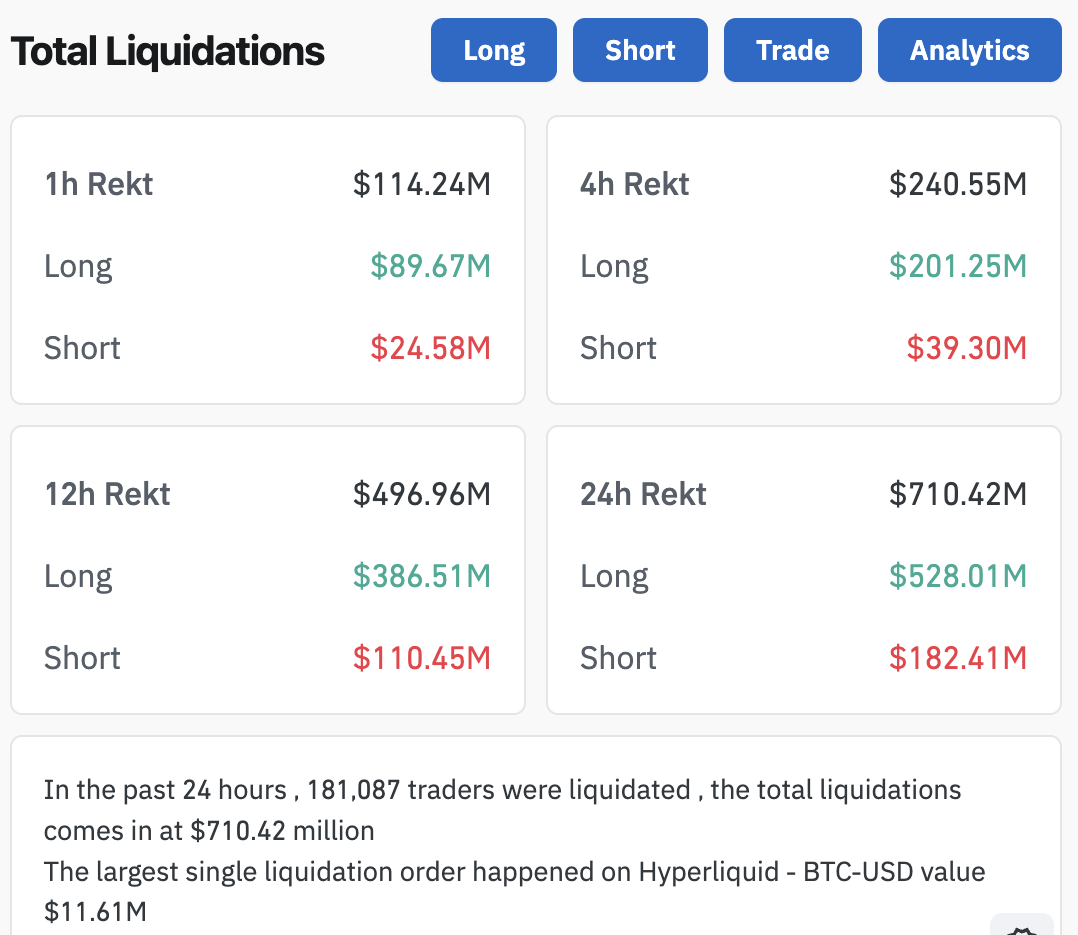

Today, however, these concerns seem less serious. Bitcoin fell around $4,000 in the last 24 hours, spawning a frenzy of crypto liquidations. Over $114 million in total short positions were eradicated in one hour:

Bitcoin Drops Cause Liquidations. Source: CoinGlass

Bitcoin Drops Cause Liquidations. Source: CoinGlass Retail Traders’ Impact

A few key factors suggest that retail Bitcoin traders caused all these liquidations. For one thing, ETF issuers continued buying BTC at elevated rates, and the products are seeing huge inflows. Meanwhile, BTC’s on-chain trading activity has spiked between 4% and 5%, showing that activity is stirring awake.

Analysts have already identified some of the most likely causes for Bitcoin’s retreat to $120,000, which triggered these liquidations. They seem like pretty standard price actions; long-term traders are taking profits, holder accumulation rates sparked low confidence, etc.

Furthermore, there are even signs that BTC could rebound in the near future.

This, too, presents a useful opportunity to gather valuable market data. These new structural forces are very powerful, but they aren’t all-powerful.

Retail activity still spurred a major Bitcoin price dump, causing a cascade of liquidations. What new narratives can help explain this behavior and enable accurate predictions?

Whether Bitcoin keeps going up or down, these questions should be at the forefront of traders’ minds. These institutions are apparently going to keep stockpiling Bitcoin either way.