US Senate passes GAIN Act, prioritizing domestic AI and HPC chip sales

The US Senate has advanced sweeping AI legislation under the National Defense Authorization Act, compelling chipmakers to serve US customers first before exporting advanced processors abroad.

On Thursday, senators passed the Guaranteeing Access and Innovation for National Artificial Intelligence Act of 2026, or GAIN Act, as an amendment to National Defense Authorization Act, requiring AI and high-performance chipmakers to prioritize domestic orders before exporting their products.

The GAIN Act also gives Congress the right to deny export licenses for the most high-end AI processors and mandates export licenses for all products containing an “advanced integrated circuit.”

“Over the past several years, US firms have faced regular backlogs in purchasing chips. In late 2024, Nvidia’s Blackwell line was booked out roughly 12 months ahead,” according to policy advocacy group “Americans for Responsible Innovation.”

Applicants must show that all US orders have been filled before the export license will be granted under the NDAA for fiscal year 2026.

However, the GAIN AI Act is an amendment to the NDAA and both must still be approved by the House of Representatives and signed by the president before becoming law.

This leaves the final provisions in the NDAA up to Congressional negotiation, with no guarantee that the GAIN Act will become law in its current form or at all.

Export restrictions on artificial intelligence and high-performance computer chips could negatively impact the crypto mining industry, which is global in scope and is already feeling the economic pain from trade tensions, by making hardware harder to acquire.

Related: Bitdeer doubles down on Bitcoin self-mining as rig demand cools

Tariffs and trade wars hit the mining industry hard

The reciprocal trade tariffs announced by US President Donald Trump in April sent crypto prices crashing and created more challenging conditions for the highly competitive mining industry.

Crypto mining hardware manufacturing relies on international supply chains that are now subject to tariffs, which raises the cost of hardware and reduces miner profitability.

CleanSpark, a US-based mining company, faced $185 million in liabilities in July after the US Customs and Border Protection (CBP) claimed some of the mining hardware ordered by the company originated in China.

IREN, another crypto miner in the US, faced a $100 million bill due to claims that the hardware was subject to increased trade duties.

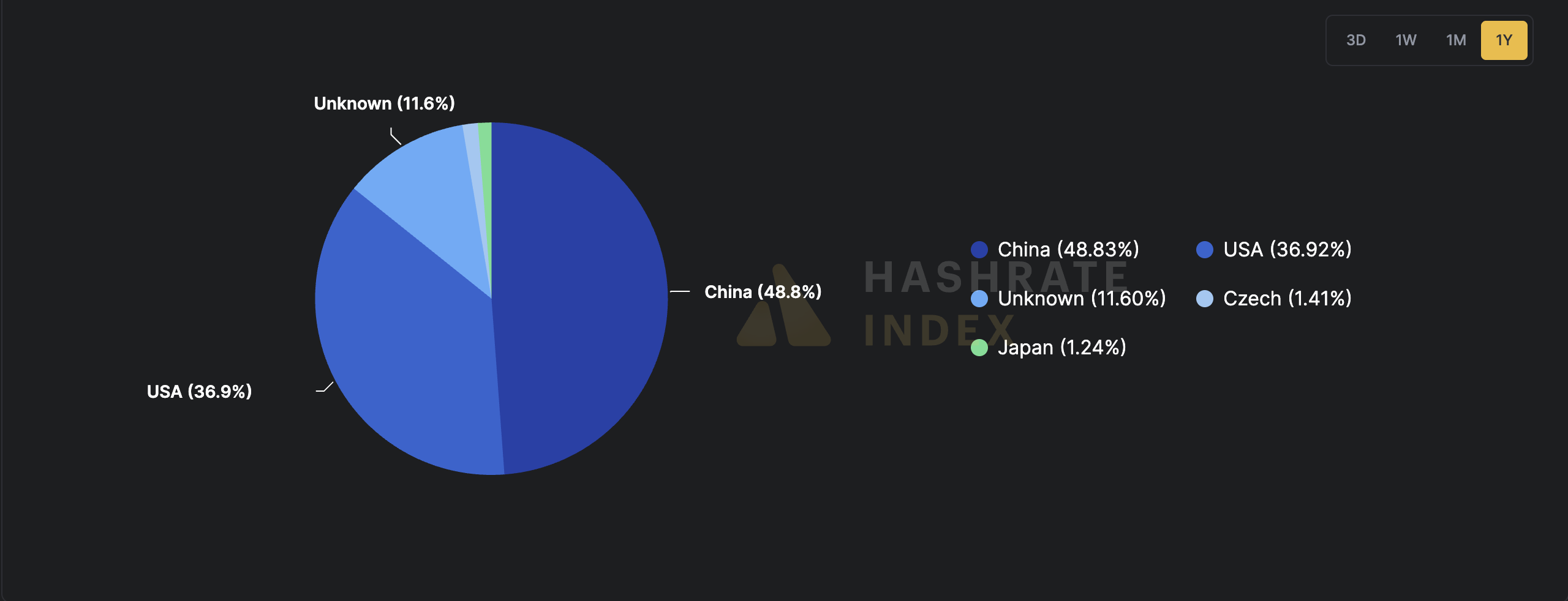

The tariffs could also lower mining hardware prices outside the US, leaving US-based miners at a competitive disadvantage and eroding the United States’ share of global hashrate, the amount of computing power dedicated to securing crypto networks.

Losing hash power would undermine the Trump administration’s stated goal of transforming the US into the crypto capital of the world.

Magazine: Bitcoin mining industry ‘going to be dead in 2 years’: Bit Digital CEO