- LINK and AVAX stall beneath the 99-period MA, while HBAR sits closest to a bullish reclaim.

- Panic bars faded into lower turnover across pairs, signaling post-liquidation balance and range compression.

- LINK needs >$17.80 then $18.30; AVAX needs >$22.30 then $22.90; HBAR needs >$0.173 toward $0.178.

Markets opened with a fast shock and then slipped into compression across three large-cap pairs. Chainlink, Avalanche , and Hedera each traced the same pattern: dump, rebound, and drift. Yet the structure now signals different near-term paths for each chart.

Chainlink (LINK): Rebound Fades Into Compression

LINK printed a sharp intraday dump, then recovered and moved into a narrow band. The 7- and 25-period moving averages are flattening under the 99-period trendline. Therefore, overhead trend pressure remains active while volatility contracts.

Source: Binance

Volume spiked on the sell bar and eased during the rebound. That profile fits a digestion phase after forced selling unwound. A clean higher-low base above 17.10 would strengthen the repair case.

Key near-term supports sit at 17.10 and 16.90. Initial resistance aligns at 17.60–17.80 and then 18.10–18.30. A breakout with rising volume would confirm the next impulse and unlock higher bands.

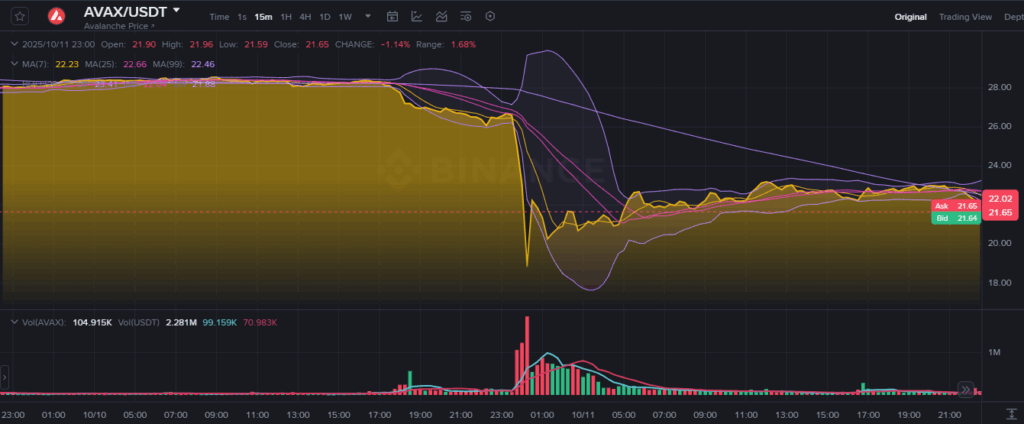

Avalanche (AVAX): V-Rebound, But Moving Averages Still Cap

AVAX dropped vertically near 23:00 and then traced a V-shaped recovery. Price now grinds sideways as Bollinger Bands tighten. All three moving averages sit overhead and slope down, which keeps bias heavy.

Source: Binance

Post-shock turnover peaked during the bounce and faded gradually. That fade is typical after a liquidation event resolves. However, a reclaim of the 25-period average would mark the first repair step.

Important supports cluster at 20.60 and 20.20, with the capitulation wick as tail risk. Resistance stands near 22.30 at the 7/25 average cluster, then 22.90–23.30 at the 99-period zone. A band expansion with firm volume should pick direction out of this squeeze.

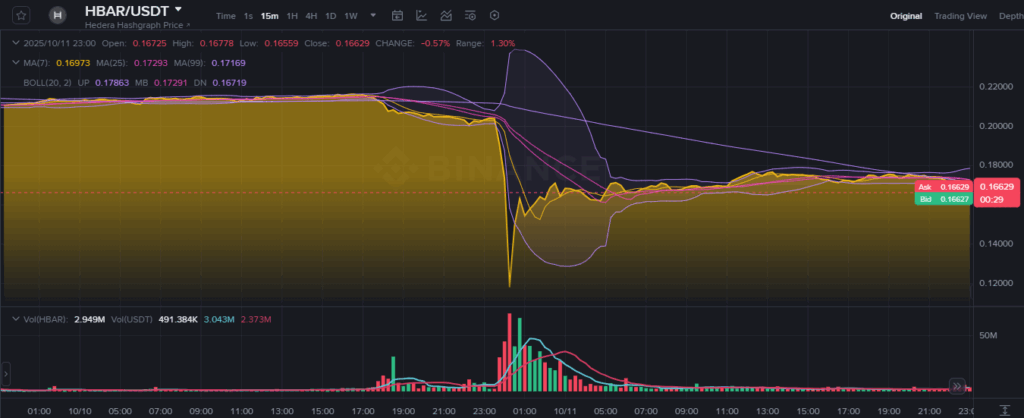

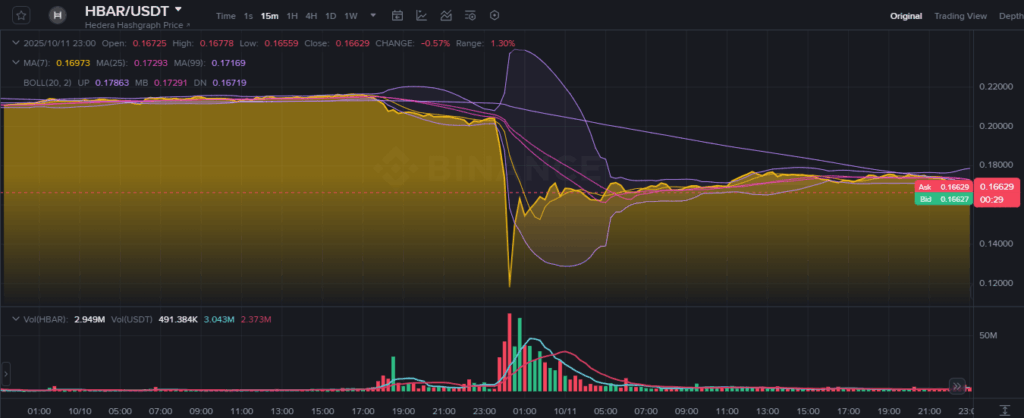

Hedera (HBAR): Momentum Builds as Structure Tightens

HBAR posted an even sharper wick during the same window and then stabilized. Bollinger Bands ballooned and contracted toward the mid-band, signaling balance. The 99-period average trends down above price but sits within reach.

Source: Binance

Volume surged through the flush and normalized quickly afterward. That arc suggests forced flows cooled while responsive bids stepped in. Holding the mid-band and then reclaiming the 25-period average would set a clearer upturn.

Support sits at 0.161–0.164 before the wick zone. Resistance appears at 0.170–0.173 around the moving-average cluster and then 0.178 at the upper band. A stable close above 0.173 would signal momentum shifting toward HBAR.

Outlook: Shock, Then Choice

All three charts show the same template: a flash dump, a strong rebound, and tightening ranges. The next decisive signal is whether price reclaims the 25- and 99-period stacks on rising volume. Without that reclaim, expect two-sided trade inside narrowing bands and frequent fakeouts.

Chainlink needs a steady base to break higher bands. Avalanche requires a reclaim of layered averages to escape supply. Meanwhile, Hedera displays the most constructive sequence and now carries the momentum handoff.