Understanding Yieldbasis: A Leveraged Liquidity Engine to Eliminate Impermanent Loss

Source: Alea Research

Translation: Zhou, ChainCatcher

Yieldbasis may be one of the most anticipated DeFi projects in the fourth quarter.

This project was created by Curve Finance founder Michael Egorov, aiming to transform constant-product AMM liquidity pools into “arbitrage trades” that are resistant to impermanent loss (IL), starting with bitcoin. YieldBasis does not accept the premise that LPs must inevitably bear IL. Instead, it maintains a constant 2x leveraged position in the BTC/stablecoin pool to track the price of BTC at a 1:1 ratio, while still earning trading fees.

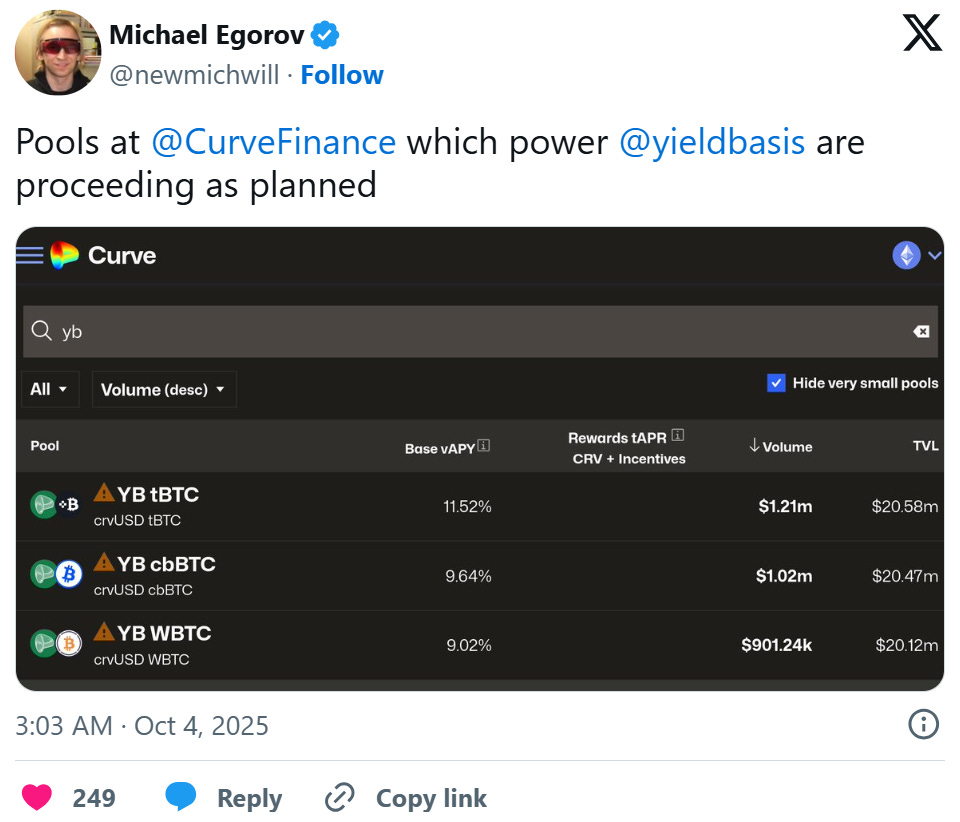

Curve has provided a $60 million crvUSD credit line to launch three BTC pools, using the same dynamic fee-sharing and governance mechanism inspired by Curve’s veCRV model.

This article will explore how YieldBasis eliminates impermanent loss, its leveraged liquidity engine and fee design, as well as the recent Legion sale, which raised nearly $200 million FDV through performance-based allocation.

Eliminating IL with Liquidity Leverage

Impermanent loss has always been a burden for providing liquidity to DEXs. Projects like Uniswap v3 offer concentrated liquidity to mitigate IL, while others subsidize liquidity providers (LPs) through token issuance.

YieldBasis addresses the IL issue by turning dual-asset AMMs into single-asset arbitrage trades, ensuring the pool always holds a 100% BTC net exposure (via 2x leverage), while borrowing stablecoins to fund the other side. This approach is similar to basis trading in TradFi, where users borrow cash to buy futures or spot, profiting from funding spreads and price fluctuations.

Key Concepts:

Deposits and Borrowing: When users deposit BTC, the protocol quickly borrows an equivalent USD value of crvUSD and adds both assets to the Curve BTC/crvUSD pool. The resulting LP tokens are used as collateral to borrow crvUSD and repay the flash loan, leaving a 50% debt/50% equity position (2x leverage).

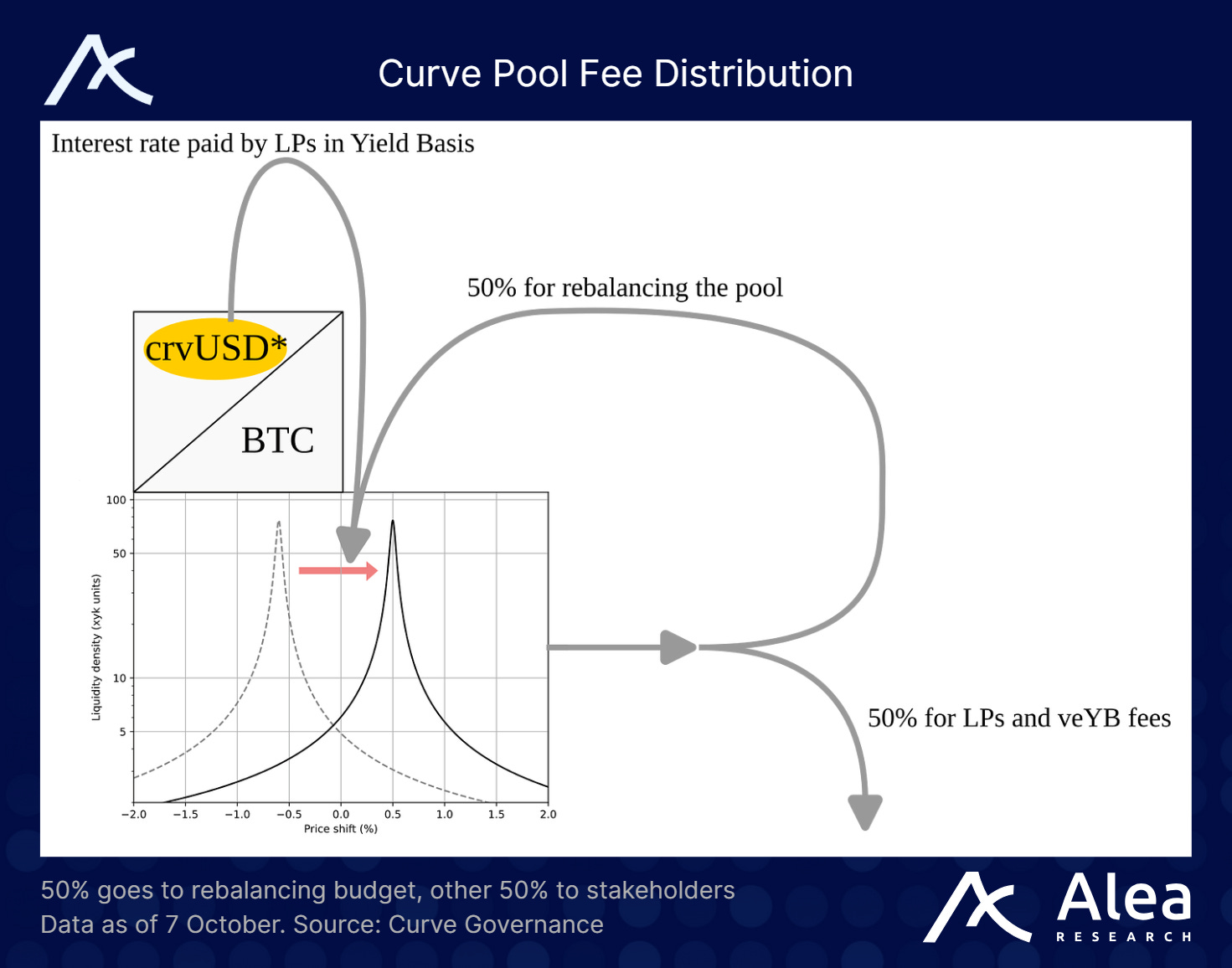

Rebalancing AMM and Virtual Pools: As BTC price fluctuates, the rebalancing AMM and virtual pool expose small price differences, incentivizing arbitrageurs to restore the 2x leverage ratio. When BTC price rises, the system mints more crvUSD and LP; when BTC price falls, the system repays debt and burns LP. Arbitrageurs earn the spread, aligning their incentives with the pool’s health.

Linear Exposure: By maintaining a constant 2x leverage, liquidity providers’ (LPs) positions grow linearly with BTC price, rather than in proportion to its square root. This means LPs’ exposure matches BTC price 1:1, while still earning Curve trading fees.

Curve Flywheel

This design also fully leverages the Curve ecosystem flywheel. YieldBasis borrows crvUSD directly from Curve’s credit line (if approved).

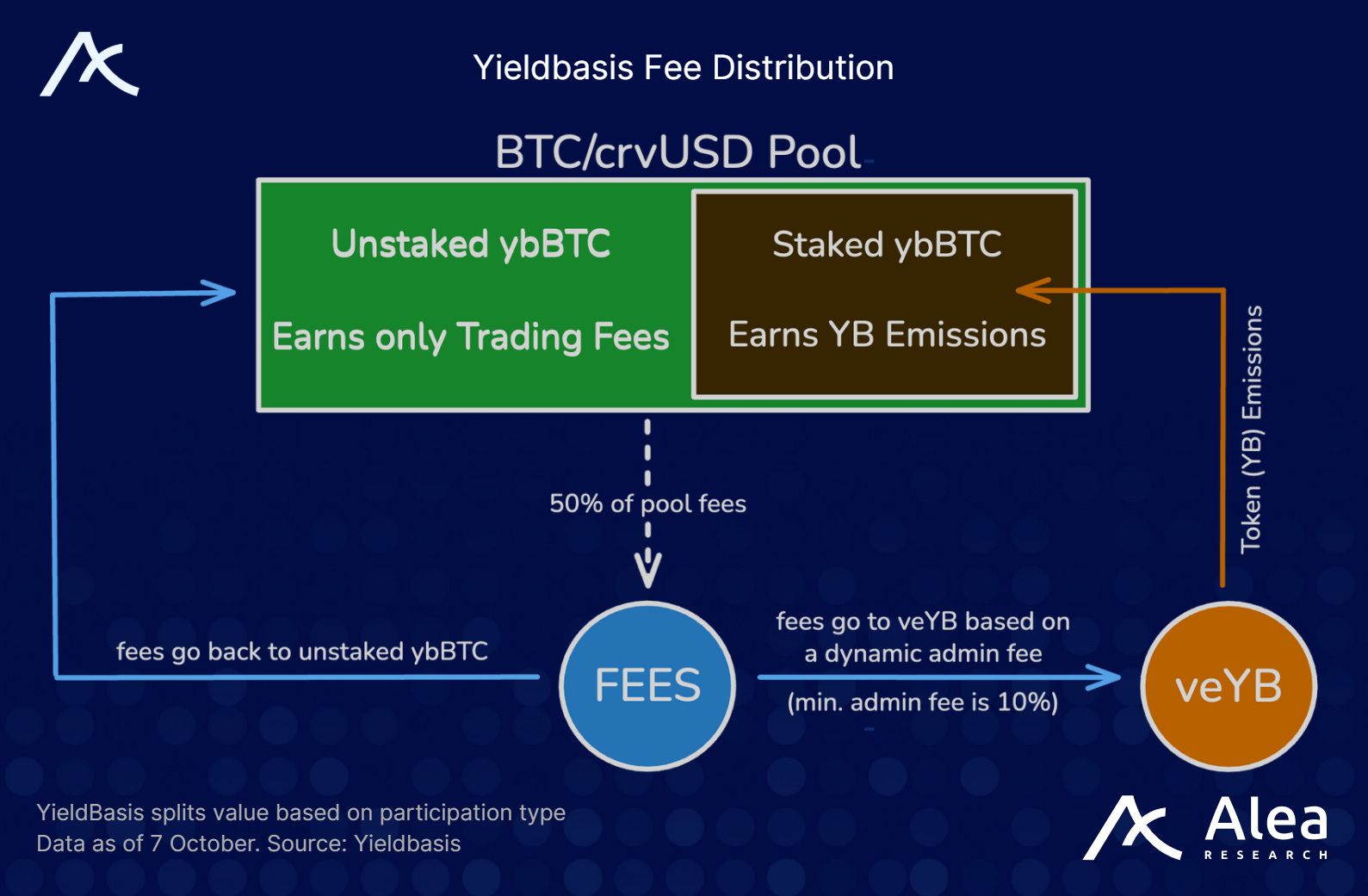

Trading fees from the BTC/crvUSD pool are provided to YieldBasis liquidity providers (LPs) and veYB holders in the form of dynamic management fees. 50% of the fees are used for rebalancing, while the remaining 50% are distributed between unstaked LPs and veYB holders according to the staking share of ybBTC. If many LPs stake to earn YB issuance, management fees increase, resulting in more fees paid to veYB. But if fewer LPs stake, LPs receive more BTC-denominated fees.

This mechanism balances incentives and rebuilds Curve’s gauge system.

$5 Million Legion and Kraken Launch Financing

Yieldbasis recently completed a $5 million financing through Kraken and Legion (accounting for 2.5% of total supply), with an FDV of $200 million. $2.5 million was allocated to Legion’s “contribution-based” public sale, and $2.5 million to Kraken Launch. These tokens are 100% unlocked at TGE.

The public sale was divided into two phases:

Phase 1: Up to 20% of tokens were reserved for users with high reputation scores on Legion (based on on-chain activity, social, and GitHub contributions, etc.).

Phase 2: The remaining quota was simultaneously opened on Kraken and Legion, on a first-come, first-served basis.

Legion’s sale was oversubscribed by 98 times. The final process included filtering out sybils and bots, and adopted a “dual-end weighted” allocation approach:

Allocating more funds to top contributors (those who can increase TVL, bring visibility, contribute to the codebase, etc.);

At the same time, thousands of other companies also received some allocation, combining the advantages of angel round financing with broad distribution.