BTC Market Pulse: Week 42

Overview

Over $19B in open interest was wiped out and futures funding collapsed to levels last seen in the 2022 bear market. The rapid unwinding of leverage triggered widespread liquidations and a sharp reset in market positioning.

Momentum indicators such as the RSI and spot CVD confirm the extent of the shift, as buying pressure faded and aggressive selling dominated short-term flows. Futures open interest contracted meaningfully, reflecting risk reduction across derivatives markets, while realized profit-loss metrics point to a period of loss realization and cooling sentiment.

Despite the severity of the event, the broader market structure remains intact. Spot trading volumes remain elevated, ETF inflows continue, and entity-adjusted transfer volumes signal robust on-chain activity. These dynamics suggest that while leveraged participants were forced out, structural capital and institutional demand remain present beneath the surface.

In the options market, open interest expanded as traders repositioned around new volatility regimes, with a modest rise in skew indicating renewed demand for downside protection. On-chain metrics echo this normalization, with profitability ratios easing from euphoric levels but still reflecting a market dominated by profitable holders.

In sum, the deleveraging marks a significant but necessary reset for the Bitcoin market. Excess leverage has been cleared, speculative positioning reduced, and short-term sentiment recalibrated. While liquidity and broader market participation remain intact, momentum has slowed and profit-taking has cooled. The market now enters a consolidation phase, one defined by renewed caution, selective risk-taking, and a more measured rebuilding of confidence across both spot and derivatives markets.

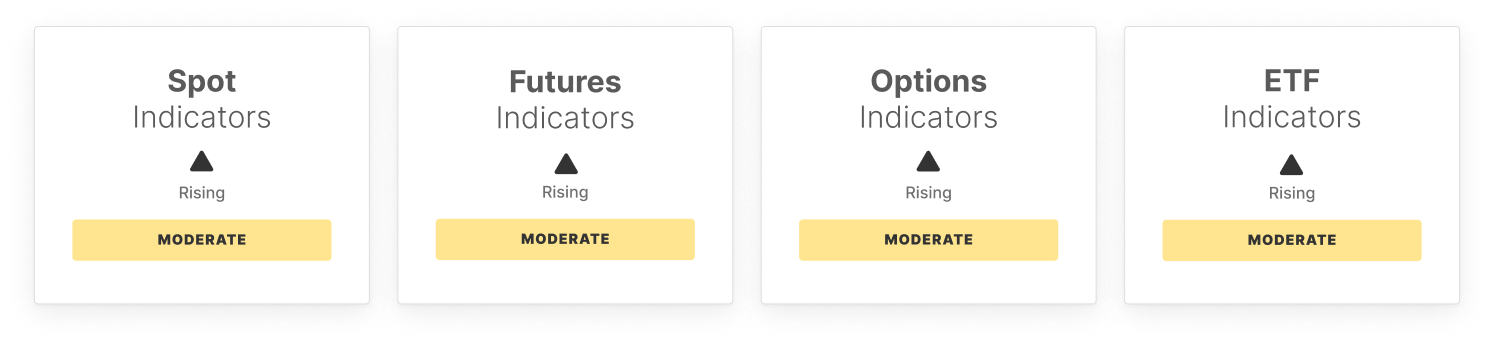

Off-Chain Indicators

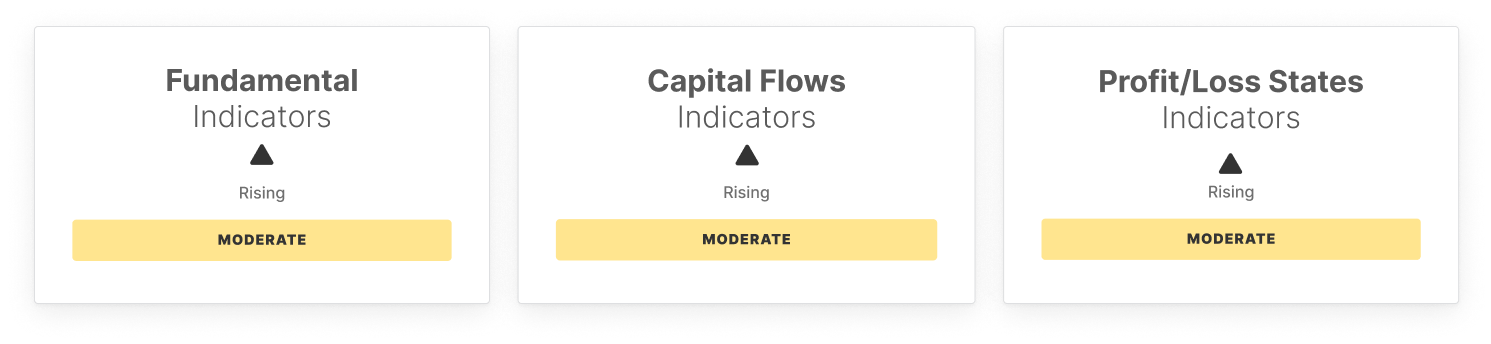

On-Chain Indicators

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe now