BlackRock Hits $13.4T AUM — Larry Fink Says Digital Wallets Hold the Next $4 Trillion Opportunity

BlackRock’s assets under management surged to $13.46 trillion in the third quarter of 2025, up from $11.48 trillion a year earlier, reflecting how rapidly traditional finance is merging with digital-asset strategies.

Larry Fink, CEO of BlackRock, noted that roughly $4.1 trillion is now held in digital wallets worldwide — much of it outside the United States.

BlackRock Bets on Crypto Boom

Fink argued that if products like ETFs could be tokenized and digitized, it would allow new crypto-market investors to transition toward traditional long-term investment products, creating “the next wave of opportunity” for BlackRock.

The comment coincided with the world’s largest asset manager reporting record assets under management of $13.46 trillion for the quarter, underscoring how fast traditional finance converges with digital assets.

Fink’s outlook places tokenized markets near the center of BlackRock’s growth thesis. He said that crypto now plays a role similar to gold — an alternative store of value — and pointed to expanding institutional demand through regulated channels. Company data show digital-asset exposure in its funds has roughly tripled since 2024. Analysts say the trend reflects surging demand for Bitcoin ETFs and growing industry interest in tokenization initiatives. BlackRock’s Aladdin technology supports these initiatives.

Source: Reuters

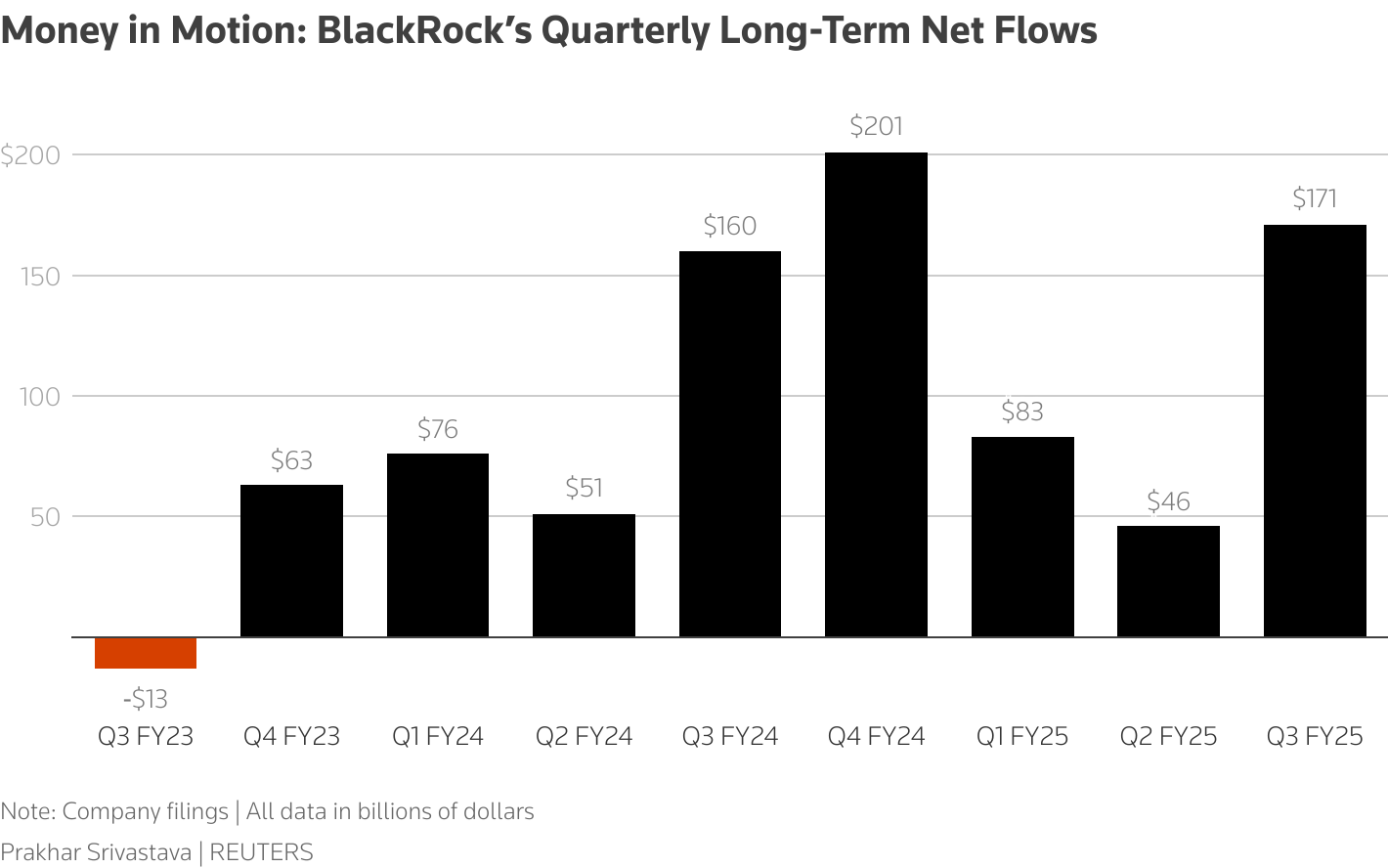

Source: Reuters BlackRock’s assets climbed from $11.48 trillion a year earlier, with long-term net inflows of $171 billion. Revenue rose to $6.5 billion on an 8% rise in organic base fees, while total expenses increased to $4.6 billion. Private-market inflows reached $13.2 billion, and retail inflows rose to $9.7 billion. GIP, Preqin, and HPS Acquisitions bolstered data and infrastructure capabilities supporting its digital-asset pipeline.

Technology revenue jumped 28% to $515 million, led by Aladdin — a system increasingly used for managing tokenized portfolios and integrating blockchain analytics. Fink described BlackRock’s model as a “unified public-private platform,” linking traditional ETFs, private credit, and digital assets under one architecture.

Bitcoin ETFs Anchor Institutional Shift

The firm’s iShares Bitcoin Trust (IBIT) has become its top-earning ETF, generating $244.5 million annually from a 0.25% fee. IBIT’s assets have reached nearly $100 billion in under 450 days — faster than any ETF in history. Across US markets, Bitcoin ETFs are on pace to attract $30 billion this quarter, reflecting Wall Street’s tightening control over crypto liquidity.

Fink’s optimism coincides with a broader institutional shift. JP Morgan’s head of markets confirmed the bank will buy and trade Bitcoin — a pivotal signal legitimizing digital assets within mainstream finance. Morgan Stanley dropped restrictions on which wealth clients can access crypto funds, extending exposure across all account types. This “wirehouse distribution” trend unlocks new ETF demand across retail and institutional channels.

#BlackRock is eating the world! The world's largest asset manager recorded net inflows of $205bn in Q3 2025 as the company expanded its footprint in private credit and alternative assets. BlackRock’s total assets under management hit a record of $13.5 TRILLION as markets surged. pic.twitter.com/QFkR5G8aqw

— Holger Zschaepitz (@Schuldensuehner) October 14, 2025

Meanwhile, BlackRock’s own balance-sheet exposure has grown. Thomas Fahrer reported that the company purchased 522 Bitcoin, bringing total holdings to about 805,000 BTC — valued near $100 billion. Analysts interpret the move as a balance-sheet signal of conviction in digital reserves. Market observer Holger Zschaepitz noted that its growing crypto franchise partly drove total inflows of $205 billion in Q3.

The $4.5 trillion figure often cited by industry analysts illustrates the scale of digital wealth outside the banking system. For traditional asset managers, that capital represents both competition and opportunity. With its expanding ETF empire, tokenization initiatives, and institutional credibility, BlackRock appears positioned to intermediate the next wave of on-chain finance — one that could make digital wallets as central to investing as custodial accounts are today.