HBAR Price Stays Flat Despite a 184% Spike in Social Activity

Hedera Hashgraph’s native token, HBAR, has traded sideways since rebounding from last Friday’s market crash.

Interestingly, the muted price reaction comes despite a notable surge in chatter and social activity around the altcoin. This divergence signals that traders may be talking about HBAR but not actually buying it.

HBAR Rides Samsung Integration Rumors, But Data Says Otherwise

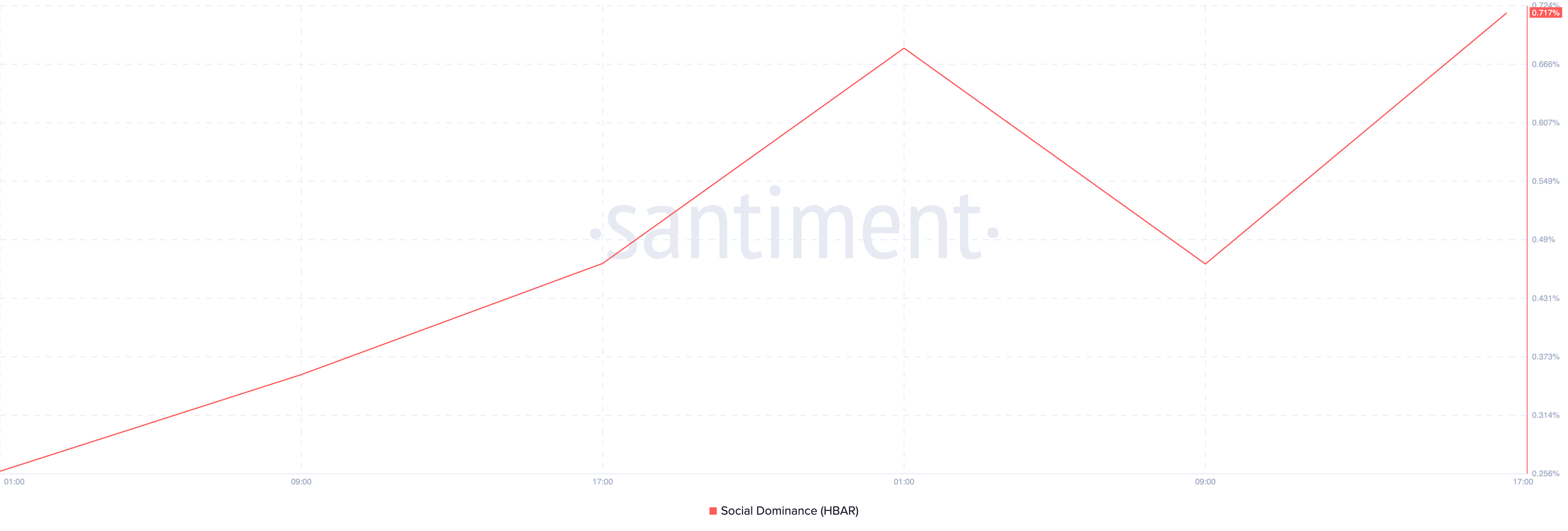

According to Santiment’s data, HBAR’s social dominance has climbed sharply over the past few days, placing it among the most-discussed assets across crypto communities. Between October 12 and 14, this rose by 184%.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

HBAR Social Dominance. Source: Santiment

HBAR Social Dominance. Source: Santiment This sudden spike in attention may be tied to rumors suggesting that Samsung could integrate Hedera’s technology into its upcoming Galaxy devices.

💥RUMOR: SAMSUNG TO INTEGRATE $HBAR HEDERA INTO NEW GALAXY DEVICES. MASSIVE IF TRUE! pic.twitter.com/IecdpramEB

— STEPH IS CRYPTO (@Steph_iscrypto) October 13, 2025

An asset’s social dominance measures how often it is mentioned across social platforms and news outlets relative to the rest of the market.

When an asset’s social dominance climbs with its price, it signals heightened retail market participation, which usually translates into short-term price boosts.

However, when such spikes in social attention occur without a corresponding price increase, as with HBAR, they usually precede a downward move, as hype replaces genuine accumulation.

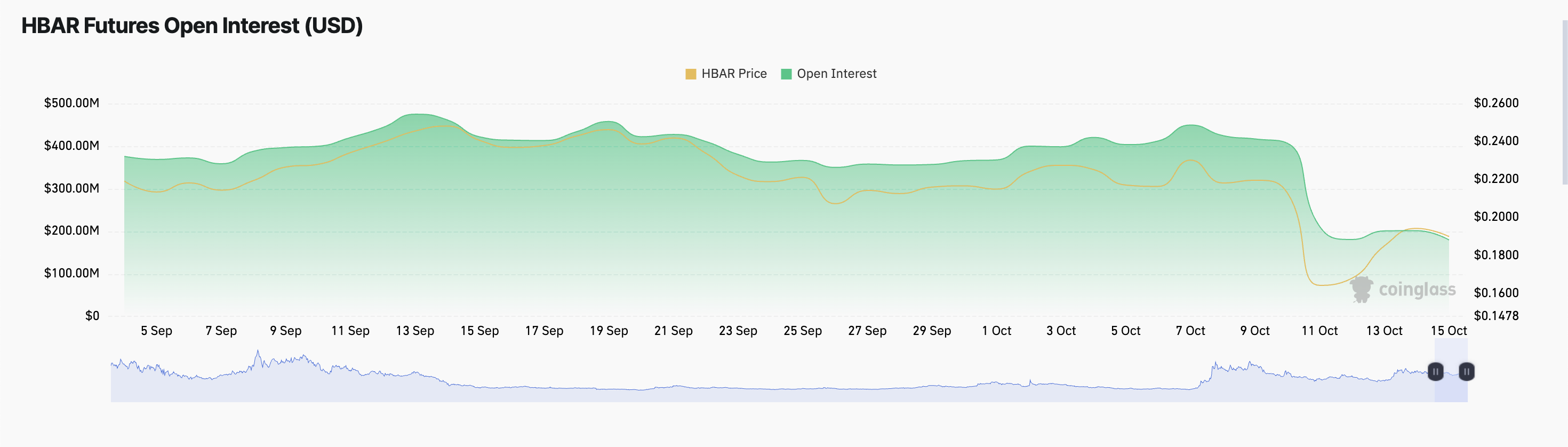

Furthermore, HBAR’s futures open interest has trended downward over the past few days, confirming the waning interest in the altcoin. According to Coinglass data, this is at $180 million at press time, down 55% in the past five days.

HBAR Futures Open Interest. Source: Coinglass

HBAR Futures Open Interest. Source: Coinglass Open interest refers to the total number of active futures or options contracts that have not yet been settled or closed. When it rises, it indicates that new money is entering the market and there’s growing interest in the asset’s future direction.

Conversely, when open interest falls, as is currently the case with HBAR, it signals that traders are closing their positions rather than opening new ones.

This usually reflects a decline in conviction toward the asset, suggesting that market participants are stepping aside rather than betting on further price movements.

Renewed Demand or a Slide Toward $0.1659?

While HBAR may be trending across social platforms, its market participation metrics tell a different story.

Without renewed demand or sustained buying pressure, the token’s sideways structure could soon lead to a short-term decline. In this scenario, HBAR’s price could fall to $0.1659.

HBAR Price Analysis. Source: TradingView

HBAR Price Analysis. Source: TradingView On the other hand, a renewed interest in the token could drive its price above $0.19252 and toward $0.2193.