$120,000 Is Still on the Table for Bitcoin, On-Chain Data Shows

Bitcoin’s price has mostly traded sideways since rebounding from Friday’s market crash, struggling to break past resistance at $115,892 while finding support near $111,098.

Despite the muted action, two analysts have identified bullish signals that could lead to a price recovery toward the $120,000 level in the near term.

Rising Binance Exchange Flows Support Bitcoin’s Ongoing Bullish Structure

CryptoQuant analyst PelinayPA noted that Bitcoin’s market structure remains intact and continues to show signs of strength despite recent headwinds.

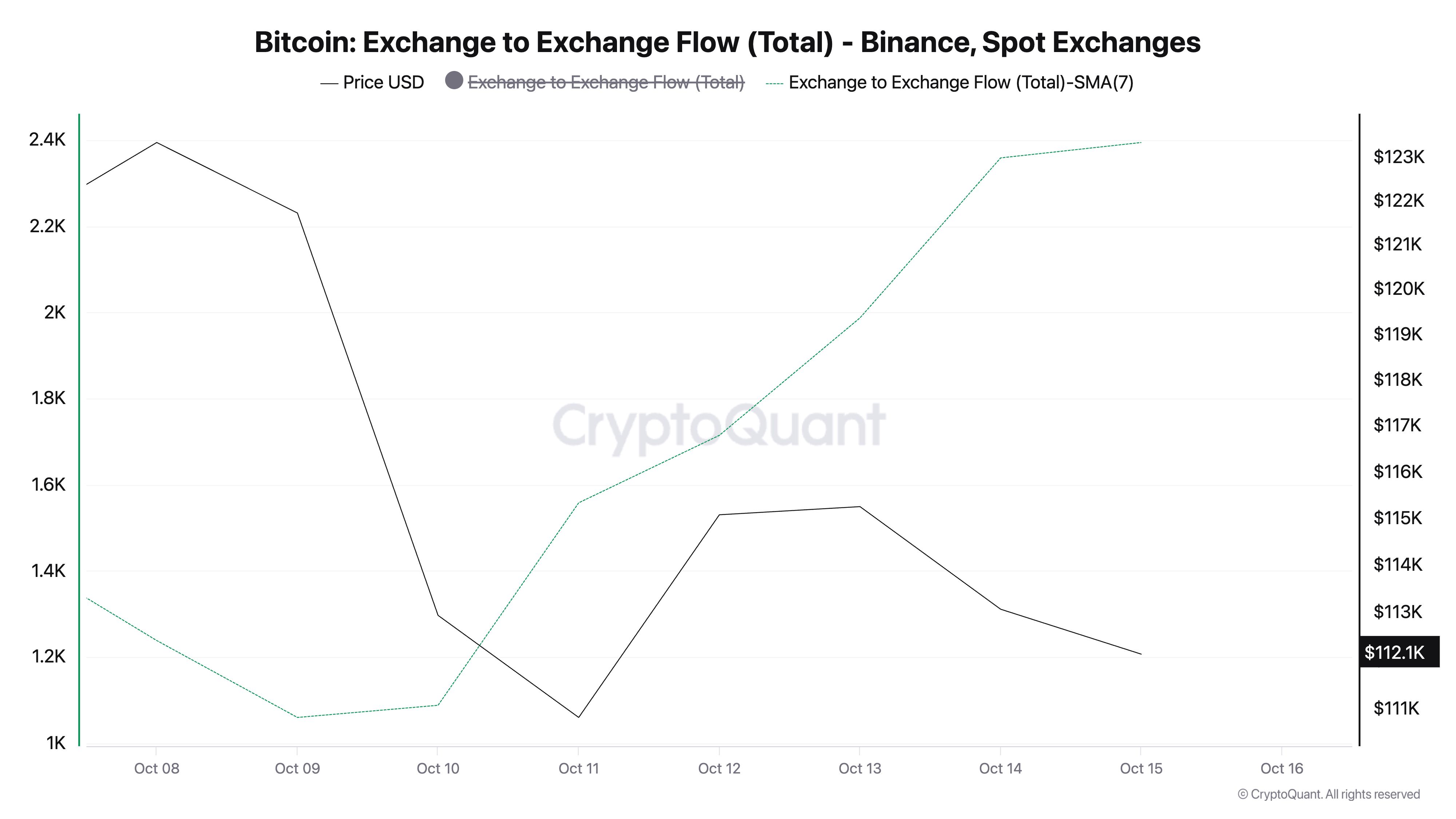

According to the report, one of the major supporting factors is the rise in Binance exchange-to-exchange flows, a metric that tracks the transfer of Bitcoin between major trading venues.

While assessed on a 7-day moving average, CryptoQuant’s data show that it has soared 125% in the past seven days.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Bitcoin Exchange to Exchange Flow. Source: CryptoQuant

Bitcoin Exchange to Exchange Flow. Source: CryptoQuant When exchange-to-exchange flows rise, it indicates heightened activity among large traders, institutions, or market-making entities moving funds between major exchanges.

“Since early October, these flows have risen again, implying renewed activity among large players. However, because these are transfers between exchanges rather than inflows to exchanges, they are interpreted as neutral to slightly positive, suggesting that spot holdings are being redistributed rather than sold,” PelinayPA noted.

The analyst said that this behavior indicates redistribution of liquidity rather than capitulation, a healthy sign for market stability.

“Following the sharp drop on October 11, Bitcoin recovered quickly and has stabilized around $110K. The flow volumes during that sell-off were significantly lower than current levels, indicating that the latest movements reflect a more organic and healthy recovery. Technically, the probability of revisiting the October 11 low is low. The price structure continues to form higher lows, with no visible loss of momentum.”

The analyst added that Bitcoin could test the $115,000 resistance zone if the bullish momentum holds. A confirmed breakout above $115,000–$120,000 may trigger a new wave of upward momentum.

Short-Term Holder Accumulation Points to Renewed Retail Confidence

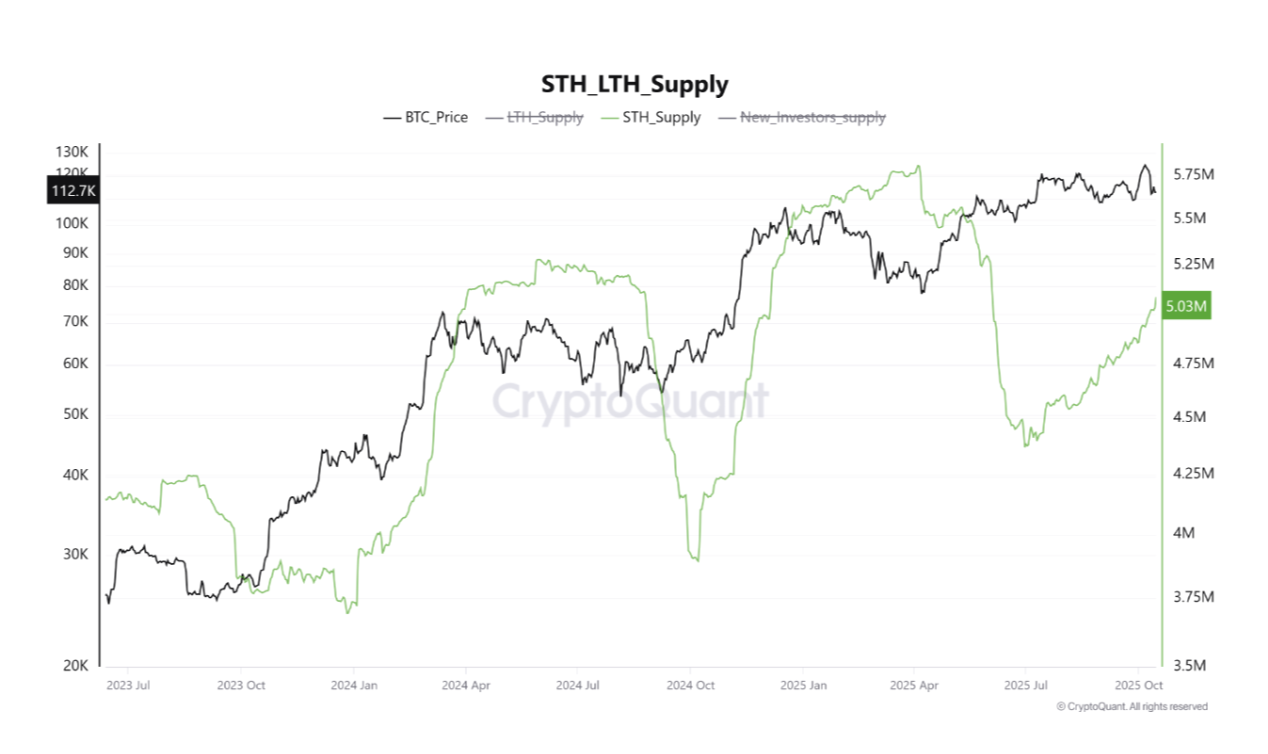

Another pseudonymous CryptoQuant analyst, Crazzyblockk, shared the bullish sentiment in a different report, highlighting a surge in BTC holdings among short-term investors.

According to the analyst, despite Friday’s liquidation event triggering “considerable despair and a widespread reluctance among traders to commit to heavy leverage positions in the futures market,” there is a strong accumulation trend among Short-Term Holders (STHs).

“A critical on-chain metric — the supply held by New Investors (or Short-Term Holders, STHs, typically defined as those holding coins for less than 1 month) — is flashing a profoundly bullish signal: rapid accumulation is underway.”

He added that this renewed buying activity marks an important shift in sentiment following the recent market downturn.

BTC STH Supply. Source: CryptoQuant

BTC STH Supply. Source: CryptoQuant “As confirmed by the underlying metric data, this cohort of new market entrants has rapidly increased their Bitcoin holdings, with STH supply swelling by a substantial volume in a short period. For instance, recent figures show this supply rising from approximately 1.6 million BTC to over 1.87 million BTC in just a matter of days. This represents a significant injection of fresh capital and demand following the price drawdown,” the analyst wrote.

Bitcoin’s Next Move: Break Above $115,000 or Slip Below $111,000?

Both reports suggest that BTC’s on-chain activity is quietly strengthening even as price action remains range-bound. Rising institutional flows and fresh retail accumulation could set the stage for a push above $115,892 in the near term.

A successful breach of this resistance could open the door for a rally toward $120,144.

BTC Price Analysis. Source: TradingView

BTC Price Analysis. Source: TradingView However, if this buying trend stalls, BTC may extend its consolidation or even trend lower below $111,098.