The Manipulation Logic and Survival Strategies Behind the "Largest Liquidation in History"

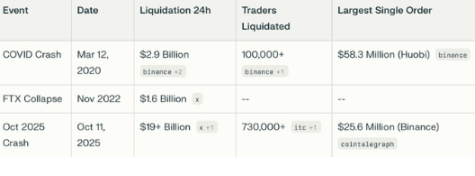

Last Friday, the crypto market experienced its most violent crash since 2020.

In just two hours, over $19 billions in long positions were liquidated,

Bitcoin plummeted more than 20% in an instant, sending the market into panic.

But was this really just an "accident"?

Or was it yet another meticulously orchestrated "hunt" by institutional players?

❶ The Trigger for the Liquidation Wave: Not Trump, but Pre-positioning

The market generally believes that the direct cause of the crash was Trump's announcement

of "imposing a 100% tariff on Chinese imports".

But the truly smart money started moving 24 hours before the news broke:

Multiple whale wallets began transferring BTC to exchanges;

Old addresses started rare short positions;

Order book data showed that selling pressure had already risen significantly the night before the news.

All these signs point to one conclusion:

This crash was "anticipated in advance".

❷ Institutional Playbook Repeats: Copying the 2020 "Pandemic Crash" Model

History doesn't simply repeat itself, but it often rhymes.

This structure is almost identical to the pre-crash setup of March 2020 during COVID-19:

The market was overly optimistic

Leverage had accumulated excessively

An external macro event triggered a chain reaction

Finally, a wave of "precise harvesting" wiped out excessive leverage

After the last crash, institutions accumulated heavily at the bottom, kicking off the epic 2021 bull market.

And this time—everything is unfolding at the same pace.

❸ Behind the Data: Panic is a Disguise, Accumulation is the Truth

On-chain data shows:

Whales are re-accumulating BTC;

The amount of stablecoins flowing into exchanges is rising;

After liquidation, funds are flowing into long-term holding addresses (HODL wallets).

Panic is just on the surface; rebuilding positions is the essence.

On the surface, the market is bleeding, but behind the scenes, it is a golden moment for capital redistribution.

❹ Two Fates for Retail Investors: Liquidated or Educated

In the past few days,

high-leverage players without risk control have been completely wiped out by the market;

emotional short-term speculators were forced to sell at the bottom.

This is not a coincidence, but the market's selection mechanism.

The weak are liquidated, the strong are forged.

Every crash is an "entrance exam" for core bull market players.

❺ What to Do Next: Protect Capital, Wait for Reconstruction

After such a level of liquidation,

the market usually enters a 2-3 week period of structural rebuilding.

During this period:

Leverage will remain low (OI declines);

Funding rates return to neutral;

Spot inflows strengthen;

Volatility drops, and on-chain "slow accumulation" signals begin to appear.

True recovery comes from spot buying, not a leveraged rebound.

If the market reconstructs smoothly, you will see the first signals of the next rally.

Conclusion:

This $19 billions liquidation

is not the end of the crypto market, but a cyclical "purification".

When leverage returns to zero, emotions cool, and capital regathers—

this is the starting point of a new cycle.

Remember this:

"A market crash is not the end of wealth, but the starting point for new capital allocation."

If you are still here, remain rational, and are willing to wait for structural rebuilding,

then you are already ahead of 90% of people.

The next surge will start from here.