Key Notes

- Solana-based DEX Predict and Pump (PnP) integrates DeFiLlama data feeds to enable decentralized, on-chain prediction markets.

- The integration allows users to trade on live DeFi metrics like TVL, revenue, and market cap directly on Solana.

- Solana price remains under pressure below $190 as short-traders dominate derivatives markets despite broader altcoin recovery.

Predict and Pump (PnP), a Solana-native decentralized exchange (DEX), has integrated DeFiLlama data feeds to enable fully on-chain prediction markets. The announcement was made on Saturday via PnP’s official X account, stating that users can now convert real-time DeFi metrics into tradable prediction contracts.

We just integrated @DefiLlama into PNP.

You can now create prediction markets on live DeFi data – tvl, market cap, and outflows.

It means anyone can turn on-chain metrics into tradable markets.

– will Lido cross 50B tvl this year?

– will Pendle hit 2B by december?

– will… pic.twitter.com/jVaOIp3PtD— PNP Exchange | Prediction Market DEX (@predictandpump) October 18, 2025

DeFiLlama provides a wide range of blockchain analytics data, including total value locked (TVL), market capitalization, protocol revenues, and fee volumes across multiple chains. Through this integration, PnP users can create and trade markets directly on live on-chain metrics sourced from DeFiLlama’s data feed.

PnP Disintermediates Prediction Markets with DeFiLlama Integration

Unlike existing centralized prediction platforms, Kalshi and Polymarket, which require permissioned approval for new listings, PnP’s DeFiLlama integration removes intermediaries entirely. It enables an open marketplace where users can speculate on any on-chain metric without custodial oversight or listing restrictions.

The feature will allow anyone to open new markets based on protocol performance, liquidity movements, or token flows. Traders will also earn fees when others participate in the markets they create.

The global prediction markets sector continues to gain traction in October. Earlier in the month, NYSE Parent, Intercontinental Exchange Inc. (ICE), took a $2 billion stake in Polymarket . The deal valued the platform at $9 billion post-money, making 27-year-old founder and CEO Shayne Coplan the youngest self-made billionaire .

On Friday, major derivatives exchange operator CME Group also announced a partnership with FanDuel, aiming at launching a new prediction market platform to rival existing players.

Solana’s official X page amplified the news, sharing PnP’s announcement with its 3.5 million followers.

Solana Price Stalls Below $190 as Derivatives Data Suggests Bull Trap

As institutional Gold markets and US equities closed trading on Friday, major altcoins saw increased inflows, but Solana’s native token (SOL) struggled to sustain momentum. On Saturday, Ethereum (ETH), BNB, and XRP posted roughly 3% gains, while Solana underperformed with the weakest price uptick of 1.3%, among the top 5 ranked layer-1 assets.

Market data from Coinglass shows that SOL underperformance is linked to intense bearish pressure from futures traders.

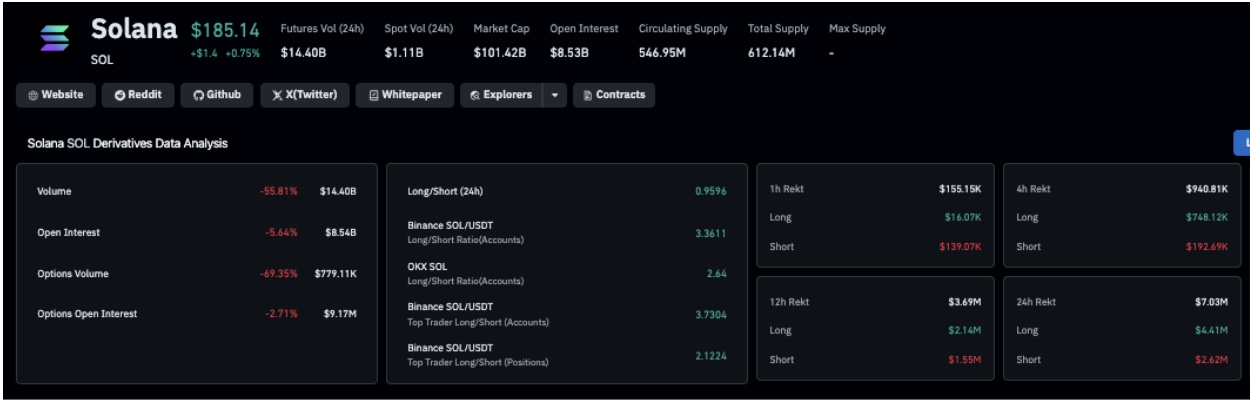

Solana Derivatives Market Analysis | Source: Coinglass

As seen above, SOL futures trading volumes dropped 56.02% to $14.4 billion, while open interest fell 6.37% to $8.51 billion.

The long-to-short ratio also remains negative at 0.96, signaling bearish dominance. Solana traders’ reluctance to back up the 1.3% intraday gains with new futures positions poses a “bull trap,” signal. Failure to hold out for a close above $185 could see SOL price slide towards the next major supply cluster at $18.

Maxi Doge项目最新进展,Solana交易者权衡多重选择

随着Solana价格持续在$190之下徘徊,部分交易者开始关注早期高潜力项目如Maxi Doge (MAXI)。该杠杆平台可为用户提供最高1000倍杠杆并无止损限制,吸引了高风险偏好的交易者。

Maxi Doge进展概览