Modest Solana Investment Can Double Portfolio Returns, Study Finds

Bitcoin may dominate institutional attention as the cornerstone of digital assets. However, new research suggests that modest exposure to Solana (SOL) could significantly improve portfolio efficiency.

A study by Capital Markets, drawing on Bitwise data, found that even a small Solana allocation enhances risk-adjusted returns in a traditional 60/40 portfolio of equities and bonds.

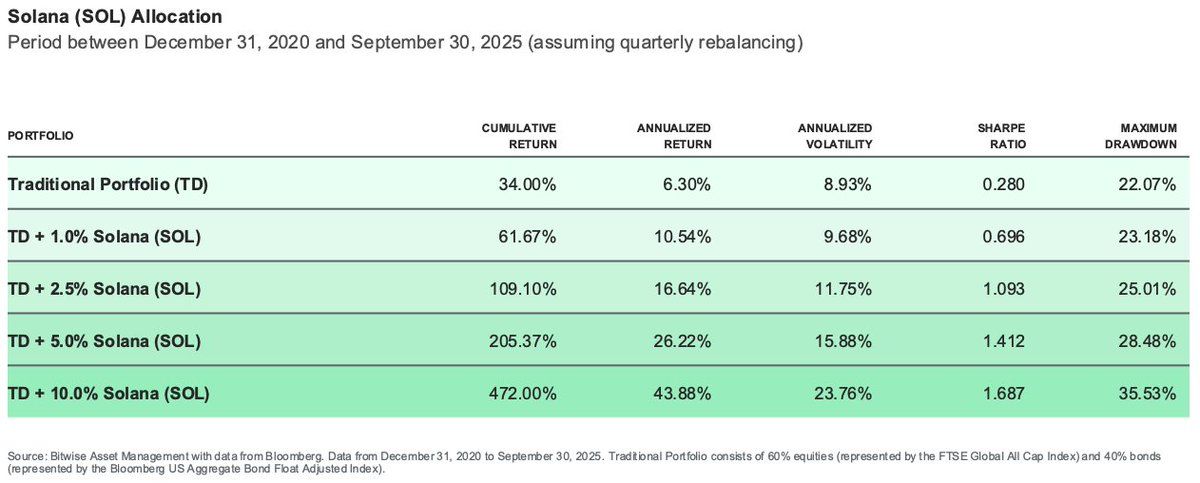

How Solana Allocations Produce Strong Returns

The analysis revealed that adding just 1% SOL exposure lifted annualized returns to 10.54%, with a Sharpe ratio of 0.696.

According to the report, increasing that share to 2.5% boosted returns to 16.64% and produced a Sharpe ratio of 1.093. A 5% weighting, meanwhile, generated 26.22% returns with a Sharpe ratio of 1.412.

Solana Portfolio Allocation. Source: Capital Markets

Solana Portfolio Allocation. Source: Capital Markets Capital Markets also pointed out that a 10% higher-risk allocation will push the portfolio’s annualized returns to 43.88%, with a Sharpe ratio of 1.687.

Capital Markets said these results demonstrate how measured SOL exposure can strengthen long-term portfolio performance. However, diversification altered the outcome.

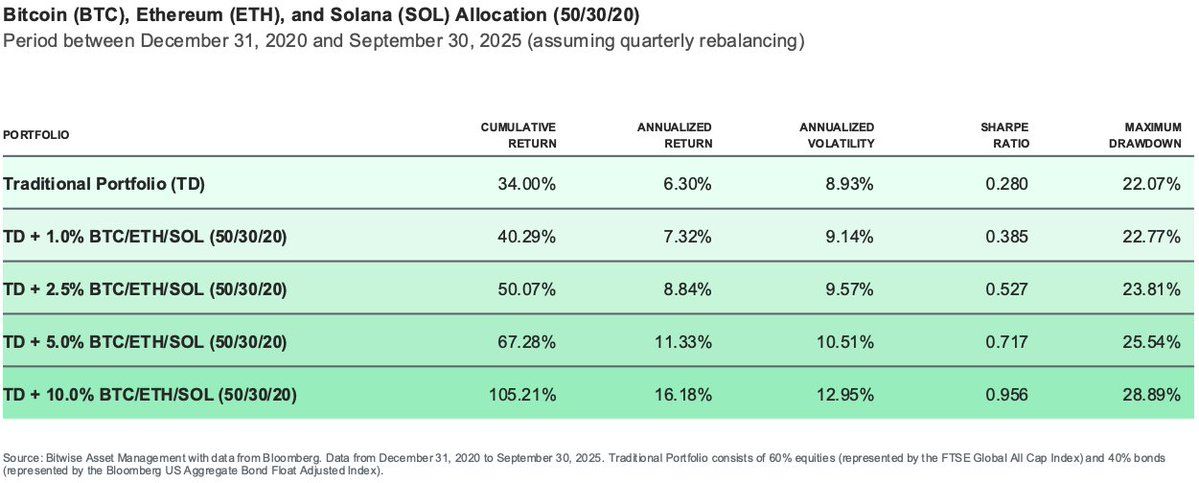

When a 10% crypto allocation was split equally among Bitcoin, Ethereum, and Solana, annualized returns dropped to 19.87%. Notably, this is significantly less than half of Solana’s solo performance.

Meanwhile, a 50:30:20 split between Bitcoin, Ethereum, and Solana yielded 16.18% returns. Smaller allocations of 5% and 2.5% produced steady but moderate improvements of 11.33% and 8.84%, respectively.

Bitcoin, Ethereum, and Solana Allocation. Source: Capital Market

Bitcoin, Ethereum, and Solana Allocation. Source: Capital Market “Maximum drawdowns remained relatively contained across allocations, even as returns increased sharply,” Capital Markets stated.

Considering this, the firm concluded that a concentrated Solana exposure delivered higher gains. However, a diversified portfolio offered smoother, more consistent growth.

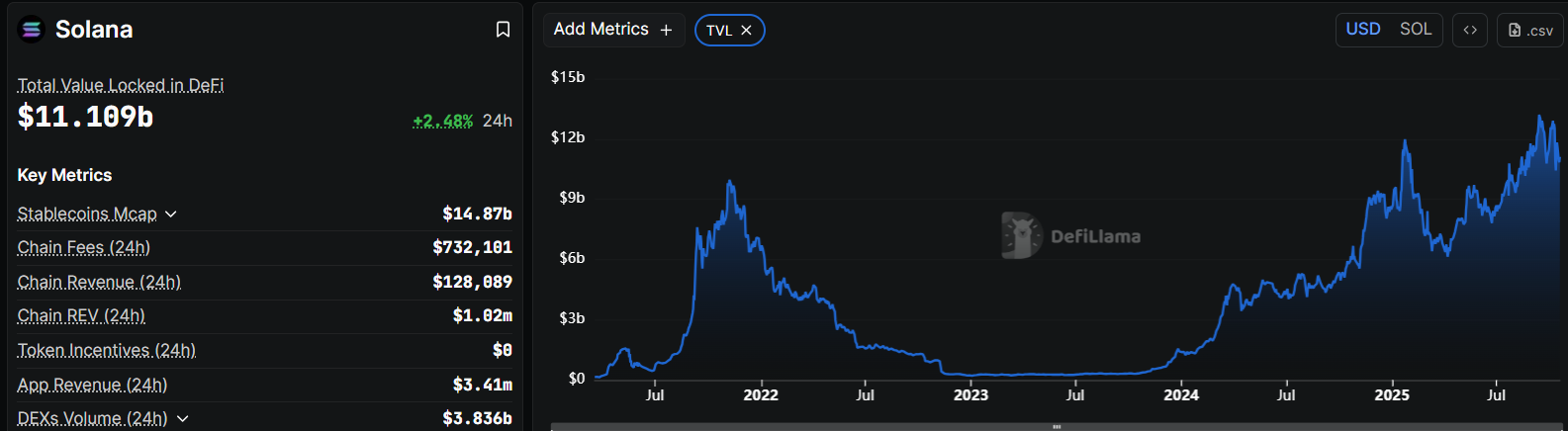

Solana’s on-chain fundamentals help explain its performance edge.

The network, known for low transaction fees and high throughput, processed roughly 96 million daily transactions in the first quarter of 2025 amid the fervor for meme coins.

At the same time, the blockchain network has scored significant institutional adoption and user growth across payments, gaming, and consumer applications. Notably, Solana is the second-largest decentralized finance ecosystem with more than $11 billion in value locked.

Solan DeFi Ecosystem. Source: DeFiLlama

Solan DeFi Ecosystem. Source: DeFiLlama This expanding ecosystem continues to reinforce SOL’s investment appeal. Its efficiency and scalability position it as a credible next-generation blockchain for decentralized applications.

Moreover, with speculation growing around a potential US spot Solana ETF, the asset now dominates discussions about crypto’s evolving role in modern portfolio theory.