Monad Mainnet is about to launch, these dApps are worth keeping an eye on

Original Article Title: Must-Watch dApps After Monad Mainnet Launch

Original Article Author: 100y.eth, Four Pillars

Original Article Translation: Deep Tide TechFlow

Key Points

The highly anticipated Monad mainnet is about to launch. With its EVM-based high-performance tech stack, Monad has garnered attention from investors and retail users alike. While Monad is fully EVM-compatible, it is expected to provide a smoother, more scalable user experience.

With its cutting-edge technology, Monad is capable of supporting novel decentralized applications (dApps) that other EVM networks cannot achieve. Currently, there are many dApps in the Monad ecosystem, but this article will delve into those that are truly native to Monad.

1. Long-Awaited Launch of Monad

1.1 The Popular Secret of Monad

On October 14th, Monad officially announced the launch of its airdrop claim portal, sparking excitement among users. This comes as no surprise, as Monad had already garnered significant attention back in the first quarter of 2023 when it announced its seed round financing. However, it has been two and a half years since the seed round financing, and the mainnet is finally nearing launch.

The popularity of Monad can be attributed to several reasons, including investments from notable venture capitalists and a unique community culture, but the core reason is its technology. At the time, building and achieving parallel EVM was an extremely ambitious goal, which in itself was enough to attract the attention of investors, the community, and users.

Monad is a high-performance, EVM-compatible L1 network with the following technological features:

MonadBFT: An optimized Byzantine Fault Tolerance (BFT) consensus algorithm that can achieve 10,000 transactions per second (tps) and sub-second finality even in an environment with hundreds of consensus nodes. Unlike traditional BFT systems, MonadBFT only requires one round of consensus to reach a "near-final" state.

RaptorCast (RaptorCast): A method that allows the main validator to efficiently transmit large blocks to other validators. The main validator uses erasure coding to split the block proposal into multiple parts, each part first being sent to non-main validator nodes and then further propagated by these nodes. This ensures security while relieving the main validator's workload, as erasure coding can even recover data from partial blocks.

Asynchronous Execution: In most blockchains, consensus and execution are bundled together, leading to inefficiencies. Monad separates the two, so nodes first agree on the order of transactions and then execute them, allowing for an ample processing time.

Parallel Execution: Monad employs optimistic execution, initially processing transactions in parallel and only re-executing those that conflict.

MonadDb (MonadDb): Unlike Ethereum's structure, MonadDb is based on the Merkle Patricia Trie, supports direct access to Trie nodes, handles read/write requests asynchronously, optimizes parallel execution, and supports features such as bypassing the file system and concurrency control.

Through these core optimizations, Monad achieves outstanding scalability, enabling dApps that are not feasible on other EVM networks. Coupled with its full EVM compatibility, Monad provides developers with an excellent development environment, allowing them to build various applications freely without worrying about scalability limitations.

1.2 Monad Ecosystem: Born for Monad

So, as the Monad mainnet is about to launch, what services can users expect to see in its ecosystem? As of October 11, 2025, the Monad ecosystem directory listed a total of 293 dApps, including well-known projects such as 0x, Balancer, Euler, Farcaster, Lombard, Magic Eden, OpenSea, Pancake Swap, Stargate, StakeStone, Uniswap, and Wormhole.

However, Monad differs significantly from existing blockchain networks, so we can expect more unique and innovative services to emerge on the Monad network. This article will delve into some of the highly anticipated dApps in the Monad ecosystem, as well as the Monad Accelerator Program and award-winning projects from hackathons.

Here is a quick overview of some notable dApp categories and their representative projects. Interested readers can scroll down for more information:

· Staking: aPriori, FastLane Labs, Magma, Kintsu

· Spot DEX: Kuru, Clober, Crystal, Capricorn

· Perpetual Contract DEX: Drake, Celeris, Narwhal Finance, Perpl, Monday Trade

· Aggregator: Monorail, Mace

· Lending: Townsquare, Modus, Curvance

· Novel DeFi: Likwid, Timelock, Touch Market

· Prediction Market: Opinion Labs, Buzzing App, Kizzy, Levr.Bet, RareBetSports, Narrative, Hyperthesis

· Trading Terminal/Bot: SEER, ChainPro, KiSignals, mevX, Mona Trading Bot

· Meme Coin Launchpad: CULT, Alloca, nad.fun

· Game: Lumiterra, Omnia, LootGo

· Artificial Intelligence: Fortytwo, Symphony, TypeX, AMMO AI, Rayvo

· NFT: Chog, lil chogstars, Monadverse, Purple Frens, Poply

· RWA: Zona, BlockStreet, Mu Digital

2. Key dApp to Watch in the Monad Ecosystem

2.1 aPriori

Source: aPriori

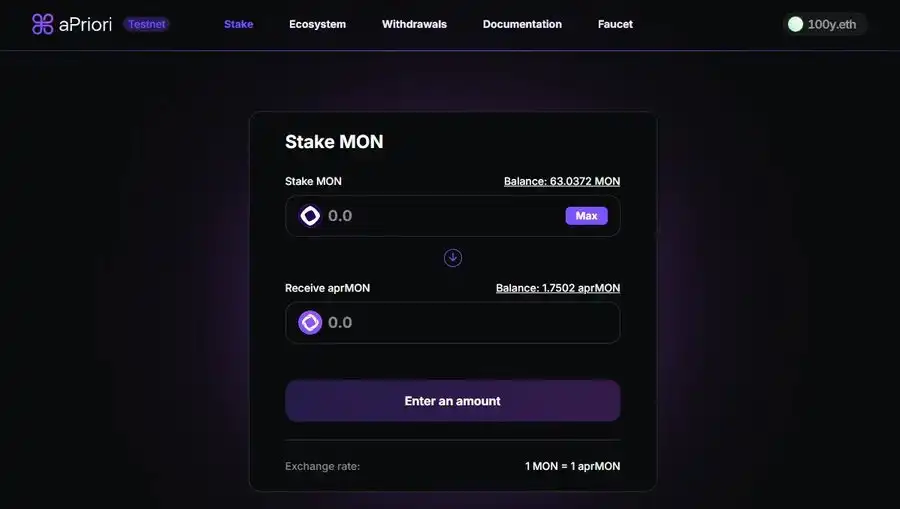

aPriori is the most prominent liquidity staking protocol in the Monad ecosystem. Users can stake MON and receive liquidity staking tokens called aprMON. aprMON not only earns regular PoS staking rewards but also captures network-generated MEV (Miner Extractable Value) and distributes it to users.

Due to Monad's high scalability, the network will process a large number of transactions, naturally creating many MEV opportunities. Unlike the traditional EVM's sequential transaction processing, the Monad EVM uses parallel processing, leading to a different MEV capture mechanism. Leveraging this, aPriori has introduced the concept of probabilistic MEV Auction (MEVA).

In 2023, aPriori received a $2 million seed investment from Hashed and Arrington Capital. In July 2024, it secured an $8 million seed investment from Pantera, Consensys, and Flow Traders. In August 2025, it further raised $20 million from Pantera, HashKey, and IMC Trading. This has made it one of the most well-funded dApps in the Monad ecosystem. Users can stake MON on the testnet to receive aprMON and utilize it across various DeFi protocols.

2.2 FastLane Labs

Source: FastLane Labs

FastLane Labs provides staking and MEV-related infrastructure for the Monad ecosystem, offering services such as:

· shMONAD: The Monad liquidity staking protocol based on FastLane's MFL and Atlas technology, which not only extracts MEV revenue but also ensures that the revenue flows back to ecosystem participants.

· shBundler: A bundler designed as an abstraction standard for ERC-4337 accounts, integrating the bundler's functionality directly into validator nodes.

· shMonad RPC: A high-performance Monad RPC infrastructure that allocates network bandwidth based on the staking amount. Users with more shMON receive higher bandwidth and lower latency to prevent network congestion and front-running attacks.

FastLane Labs not only operates the liquidity staking protocol but also helps users interact with the network more efficiently and fairly by building core infrastructure. The project has received a $6 million strategic investment from Coinbase Ventures, Figment Capital, DBA, Robot Ventures, Hashkey, Chorus One, and Kiln. Users can stake MON on the testnet to receive shMON and use it in various DeFi applications.

2.3 Kuru

Source: Kuru

Kuru is a fully on-chain order book trading platform on Monad designed to be a trading hub. Leveraging the high scalability of Monad EVM, Kuru enables on-chain order book trading. Kuru not only uses a CLOB (central limit order book) but also integrates AMM liquidity to ensure smooth trading even when liquidity is low in certain markets.

Kuru offers two modes: Lite Mode and Pro Mode. In Pro Mode, users can trade different tokens via order book trading and provide liquidity; in Lite Mode, users can easily engage in token trading using the order book liquidity through a simple swapping interface.

In July 2025, Kuru successfully raised $11.6 million from Paradigm, Electric Capital, and Credibly Neutral. Users can now try the simple swapping feature in Lite Mode on the testnet, explore the trading interface in Pro Mode, and even experience providing liquidity to the order book.

2.4 Others

Other notable projects in the Monad ecosystem include (for reference only; protocols not covered in Section 2.4 will be discussed in the next section):

Staking

· Kintsu: A liquidity staking protocol where users can stake MON and receive sMON in return.

· Magma: A liquidity staking protocol where users can stake MON to mint gMON. The protocol offers MEV-enhanced rewards and uses Distributed Validator (DV) technology to allow multiple participants to share the responsibilities of validation nodes.

Spot DEX

· Crystal: An on-chain Central Limit Order Book (CLOB) decentralized exchange where all trades are settled on-chain through smart contracts.

· Capricorn: Capricorn combines an oracle-based private pool with CPMM/CLMM liquidity pools, aiming to marry the efficiency of CLOB with the composability of AMM.

· Monday Trade: A decentralized exchange (DEX) that provides users with a centralized exchange (CEX)-like experience through a hybrid CLOB/AMM architecture, facilitating trading for various tokens.

Perpetual Futures DEX

· Narwhal Finance: A Monad-based perpetual orderbook decentralized exchange that supports using aprMON as collateral and allows trading of synthetic assets such as stocks, indices, and forex.

· Perpl: A CLOB-based perpetual futures decentralized exchange built leveraging Monad's superior scalability. In May 2025, the project raised $92.5 million from Dragonfly, Ergonia, and Brevan Howard.

Aggregator

· Mace: A DEX aggregator native to Monad, which routes trades across multiple DEXs to find the optimal trade path.

Lending

· Townsquare: A lending protocol in the Monad ecosystem, which was a finalist project in Monad Madness.

· Modus: Positioned as an on-chain prime broker protocol, it is the native lending protocol within the Monad ecosystem. Modus not only provides simple lending services but also offers modular features such as vaults and delta-neutral strategies. The project has received investment from Yzi Labs.

· Curvance: Users can use various assets within the Monad ecosystem as collateral to borrow on Curvance.

Next-Gen DeFi

· Timelock: A protocol based on Uniswap V3 liquidity, providing swapping and trading functionality, and supporting non-custodial leveraged trading experience. Future plans include launching additional services such as futures, options, and meme tokens.

· Touch Market: A protocol offering a new type of trading experience where users can set price and time ranges on a chart, and if the price "touches" that level, the user can profit. It offers an intuitive investment interface and stands out with trading functionality of up to 1000x leverage.

Prediction Markets

· Opinion Labs: One of the most popular prediction markets in the Monad ecosystem, which has received a $5 million seed funding round from YZi Labs, Animoca, and Amber.

· Narrative: A prediction market aiming to allow users to trade or invest in assets based on narratives and emerging trends.

· Hyperthesis: Although there is currently limited public information, this project appears to be developing a prediction market within the Monad ecosystem.

Trading Terminal/Bot

· MevX: A multi-chain trading terminal focused on meme and alpha tokens. It offers sniping and copy trading features, and plans to support the Monad mainnet.

· Mona Trading Bot: A trading bot designed specifically for the Monad ecosystem.

Meme Coin Launchpad

· Nad.fun: A meme launchpad and trading platform with a simple interface, similar to pump.fun, that anyone can easily use.

Game

· Lumiterra: A multiplayer open-world survival building game where players can explore the world through activities such as gathering, crafting, battling, and farming.

· Omnia: A game native to Monad that combines adventure and pet-based combat gameplay.

· LootGo: A mobile app where users can earn rewards while walking, providing a gamified experience similar to Pokémon GO.

NFT

· Poply: An NFT marketplace focused on the Monad community.

RWA

· Zona: Supports the issuance and trading of real-world asset-backed or synthetic assets, which can also serve as collateral for lending.

· Block Street: Building on-chain settlement and lending infrastructure for tokenized stocks, providing an RFQ system and risk engine. In October 2025, the project raised $11.5 million from investors such as HackVC and DWF.

Other

· Accountable: A real-time financial verification protocol that allows companies, protocols, and stablecoins to share transparent asset and liability information while maintaining privacy.

3.Monad Official Blog Featured Projects

Monad has introduced multiple projects through five articles on its official blog, and these projects have gained significant attention due to being recommended by the Monad official platform. Here are detailed introductions to these projects:

3.1 Fortytwo

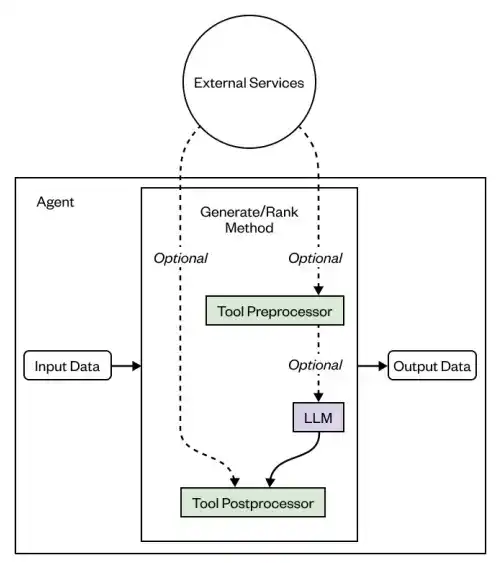

Fortytwo is a decentralized artificial intelligence network built on Monad. It operates by running multiple small language models (SLMs) simultaneously on consumer-grade hardware and combining their outputs through a consensus process to generate the final inference. In short, Fortytwo aims to build a more powerful artificial intelligence system by connecting multiple small models.

The approach of using multiple small SLMs instead of a single large language model (LLM) is not new. This method has been widely adopted in artificial intelligence research. For example, autonomous driving systems are often not built by a single large AI model but by multiple specialized submodules handling specific tasks to form a more complete system.

Source: Fortytwo Whitepaper

The working principle of Fortytwo is relatively simple. When a user sends a query to the network, participating nodes independently generate answers and evaluate each other's responses, with the highest-scoring answer becoming the final consensus result. To ensure fairness, all answers are encrypted before submission and decrypted afterward. Additionally, to prevent Sybil attacks, nodes must stake a certain amount of tokens to participate. Monad is used as a coordination layer for settlement and reward distribution.

In March 2025, Fortytwo successfully raised a $2.3 million seed round from Big Brain Holdings, CMT Digital, EV3, Chorus One, and Mentat Group, and any user with a decent home desktop computer can run a node.

As of the testnet phase, there are already 739 active nodes in the network. For users interested in the Monad AI ecosystem, running a Fortytwo node after the launch of the Monad and Fortytwo mainnets will be a great experience.

3.2 Multisynq

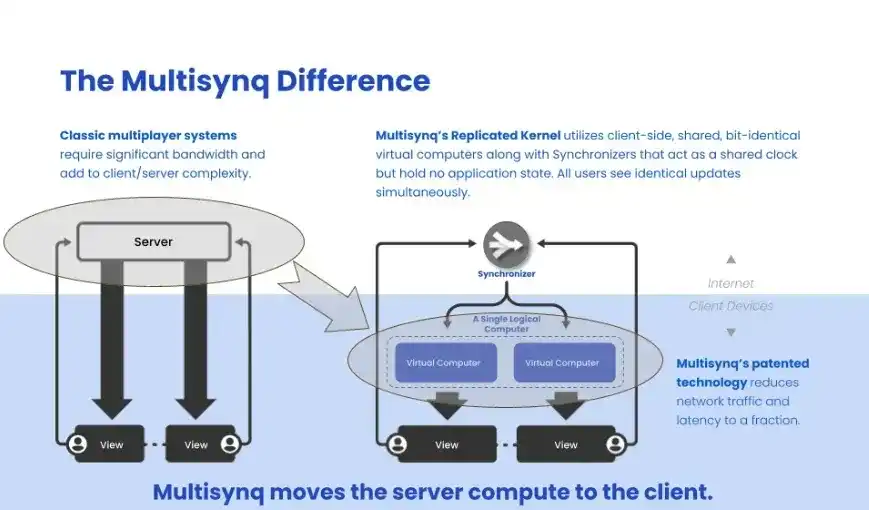

Multisynq aims to build a novel internet protocol for real-time synchronization. Currently, there is no standardized protocol for real-time synchronization, so applications like game servers and video conferencing tools must build their solutions from scratch. In a centralized client-server architecture, the server is responsible for all computations, posing a single point of failure risk.

Source: Multisynq

Multisynq addresses this issue by eliminating the server-centric structure. Instead, each user's device locally executes the application logic, while sync nodes in the Multisynq network are responsible for coordination. Sync nodes do not store data, cannot read the contents of encrypted messages, and are only responsible for managing synchronization.

Multisynq's real-time sync protocol fills a significant gap in the modern internet. When combined with blockchain, it can help build a truly decentralized network. This may one day make running large-scale applications like MMORPGs (Massively Multiplayer Online Role-Playing Games) possible, supporting hundreds of thousands of players or real-time map services based on data from millions of users. Multisynq serves as the sync layer in this decentralized internet and plans to integrate with the Monad blockchain to handle sync states and registries.

In April 2024, Multisynq raised a $2.2 million seed round from Manifold Trading and Republic Capital. In February 2025, it raised $350,000 through a community round hosted by Echo. Users can currently run sync nodes and earn points.

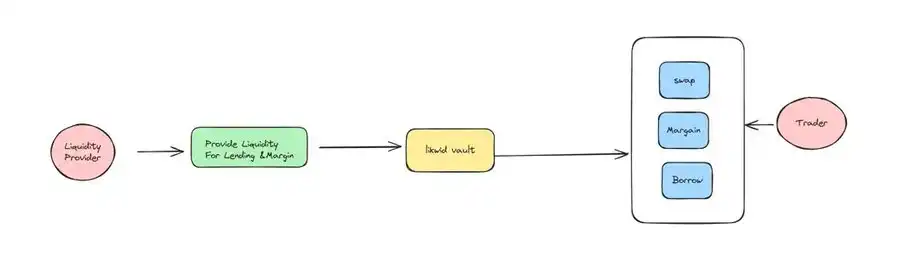

3.3 Likwid

Likwid is a DeFi protocol based on Monad that combines automated market maker (AMM) and lending features in one system, allowing users to provide liquidity, borrow other assets, or open both long and short positions on a single platform. Likwid's most significant feature is that it can achieve these functions without relying on centralized exchanges, oracles, or counterparties.

Traditionally, opening a short position for a new token using a DeFi protocol has been very challenging. Users need to deposit collateral into a lending protocol, borrow the token, and sell it. However, new tokens often lack price oracle data or are not supported by lending protocols. Even if supported, liquidity is usually low.

Source: Likwid

In Likwid, the liquidity pool itself serves as both the market and the lending platform, acting as the counterparty. Liquidity providers not only provide liquidity as in an AMM DEX and earn fees but also serve as lenders and derivative liquidity providers.

For example, in the MON/LIKWID liquidity pool, users can deposit MON as collateral and undertake a short position on LIKWID in a single step. This process involves borrowing and selling the LIKWID token simultaneously.

After the Monad mainnet launch, users will be able to perform token swaps, provide liquidity, engage in borrowing, and take both long and short positions on new tokens on Likwid to capitalize on early ecosystem trading opportunities.

3.4 Clober

Source: Clober

Clober is a fully on-chain decentralized exchange (DEX) with an order book, built on top of Monad. In addition to Monad's scalability, the protocol introduces its unique LOBSTER (Efficient Order Matching Limit Order Book based on Segment Tree) mechanism, achieving efficient and gas-saving order matching.

Building an on-chain order book on an EVM faces many technical challenges. For instance, when a user places a buy order, it must be matched with multiple sell orders sequentially. Handling these operations through a for loop or similar structure consumes a significant amount of gas. LOBSTER addresses this issue through delayed execution: each sell order covers a specific price range, and the system matches based on the buy order size. Sellers then settle the trade.

For large market orders requiring scanning across multiple price levels, on-chain order books typically suffer from low efficiency. LOBSTER employs a tree-based data structure that only searches price levels with actual orders, thereby enhancing performance and gas efficiency.

Through these innovations, Clober has achieved AMM-level efficiency and centralized exchange (CEX)-level precision on-chain. Leveraging Monad's scalability, it has built an advanced structure capable of rivaling centralized exchange performance. Users can trade tokens via order book, place limit orders, and provide liquidity directly on the Clober platform.

3.5 Drake

Source: Drake

Drake is a fully on-chain perpetual contract decentralized exchange (DEX) built on Monad, designed to provide CEX-level performance while retaining DeFi's transparency and composability. Drake's order book, matching engine, risk engine, and treasury all operate on-chain.

Benefiting from Monad's scalability, Drake is able to fully on-chainize each component of the order book. Its parallel execution and low transaction costs enable efficient matching of large orders and state updates, achieving a true on-chain perpetual contract DEX.

Drake also stands out with its hybrid order book model. It primarily utilizes on-chain liquidity but can tap into AMM liquidity when order book liquidity is insufficient, ensuring overall deeper liquidity.

Drake has not undergone venture capital financing and has adopted a community-driven approach, which is becoming a popular trend in new perpetual contract DEXs. Monad users can already test Drake on the testnet.

3.6 Celeris

Source: Celeris

Celeris is a trading platform based on the novel Parallelized Liquidity Order Book (PLOB). In a Centralized Liquidity Order Book (CLOB) system, liquidity is fragmented across individual markets, whereas in PLOB, a shared liquidity pool supports all markets simultaneously, significantly increasing capital efficiency.

Due to PLOB providing deeper liquidity than CLOB, traders experience lower slippage. This model is more advantageous for liquidity providers since the same total value locked (TVL) can be spread across more markets, resulting in higher overall fees.

Implementing PLOB requires real-time management and synchronization of the state of many markets, which is extremely complex on-chain. However, Monad's parallel EVM and MonadDB enable it to process transactions in parallel and efficiently manage multiple markets, providing the perfect environment for PLOB operation.

Users can deposit Monad testnet tokens into Celeris to trade perpetual contracts across multiple markets, as well as explore liquidity provision and lending functionalities.

4. Hackathon Awarded Projects

Monad is known for its strong community and support for early-stage projects in the ecosystem. Through various accelerator programs and hackathons, Monad has provided resources and exposure opportunities for many new teams.

While most teams participating in these projects are still in early stages, the projects that have won awards in official Monad events are definitely worth paying attention to. Let's quickly browse through some of them.

4.1 Monad Founder Residency Program

Source: Monad

The Monad Founder Residency Program is a three-week sprint project aimed at early crypto startups building on the Monad blockchain ecosystem. At the end of the three-week sprint, participating teams will have the opportunity to showcase their projects to global venture capital firms on Demo Day. The program offers growth activities, user retention strategies, mentor guidance, and network support to help startups achieve scalable growth from various angles.

Currently, the program has hosted two editions, with a maximum of ten projects chosen per edition. Here is a brief introduction to the selected projects:

First Edition

Symphony: Helps users optimize trading strategies and explore investment opportunities across different networks through Symphony's AI agent.

Chog NFT: An NFT project based on the Monad mascot character Chog, with strong community support.

Meow Finance: A treasury protocol based on Monad that tokenizes locked treasury assets into NFTs, allowing them to be used elsewhere.

Zona Finance: A platform bringing RWAs onto the chain, focusing on real estate investments and allowing users to use these assets as collateral to borrow stablecoins.

Monorail: A native Monad exchange aggregator that enables users to trade assets via the optimal route.

The Vape Labs: The DePIN project built around smart vaping devices, adopting the health vaping to earn model.

Rayvo: A Web3 smart glasses project, following the wear-and-earn model where users can earn tokens by wearing the glasses and providing POV data usable for AI or on-chain systems.

Fans3 AI: A platform allowing creators to build and operate emotionally intelligent AI characters that can interact with fans and generate revenue.

Phase 2

TypeX Keyboard: A project creating an AI and Web3-friendly smart keyboard, directly linking the typing interface to AI and Web3 services.

Sonzai Labs: A studio combining Web3, AI, and gaming to create immersive experiences, developing mini-games on Telegram.

Buzzing App: An opinion-based prediction market where users can bet on questions like "Will ETH exceed $10,000 by December?"

Agra: A protocol allowing users to use assets across multiple networks as collateral for trading, borrowing, and investing.

SEER: A trading platform that integrates market insights, social trends, and trading tools.

Yap.market: A marketplace connecting content creators (yappers) and projects.

Kizzy: A Monad-based social media prediction platform where users can bet on metrics like YouTube video views or influencer fan growth.

Rug Rumble: A GameFi project based on Monad, where two players bet memecoins and battle in a card game.

CULT: A memecoin trading platform that allows easy launching and trading of new memecoins on Monad and features a reputation system for selective presales.

Mu Digital: A platform that invests in tokenized Real World Assets (RWA) in the Asian region, backed by UOB, Signum Capital, and CMS.

Levr.Bet: An on-chain leverage sports betting platform based on Monad. With the rising popularity of prediction markets, LEVR.BET stands out by offering leverage of up to 5x.

4.2 Monad Madness

Source: Monad

Monad Madness is a global developer and startup roadshow competition aimed at discovering and supporting innovative projects within the Monad ecosystem. The competition boasts a prize pool of up to $1 million and, through partnerships with multiple venture capital firms, offers potential investment opportunities of up to $60 million.

Monad Madness has been held in New York, Bangkok, and Hong Kong to date. Let's take a look at the top three ranked projects in each event.

New York

· EarnOS (1st place)

EarnOS is the first application built on the blockchain payment orchestration protocol OS (OpenSystem). It is a rewards and advertising platform designed to address the inefficiencies of the traditional advertising market. While traditional advertising markets have high click-through and exposure rates, the actual effectiveness is ambiguous, and consumers are merely treated as targets. On EarnOS, brands can directly publish tasks to users, who can immediately receive rewards such as USDC upon task completion. Users can register on the EarnOS platform and participate in various activities to earn points.

· ChainPro (2nd place)

ChainPro is an on-chain trading terminal formerly known as SauceGG. It allows users to trade various assets across multiple networks on one platform. With its excellent UI/UX and zero fees, ChainPro makes memecoin trading more convenient. It plans to support the Monad mainnet, making asset trading, including meme tokens from the Monad ecosystem, even more seamless.

· LEVR.BET (3rd Place)

Refer to Monad Founder Residency Program Phase 2.

Bangkok

· RareBetSports (1st Place)

RareBetSports is a Web3-based sports betting prediction market and also a Monad native decentralized application (dApp). Its uniqueness lies in allowing users to create lineups of 2 to 7 players and predict each player's performance, adding a strong strategic element.

· Kizzy (2nd Place)

Refer to Monad Founder Residency Program Phase 2.

· SparkBall (3rd Place)

SparkBall is a PC-based 4v4 sports and combat hybrid game where players need to score goals during battles against opponents.

Hong Kong

· AMMO AI (1st Place)

AMMO AI is a project building a large-scale multi-agent system on Web3. It has created a reinforcement learning environment where multiple agents can autonomously interact and learn. The project has received investments from AMBER and Samsung Next.

· GM Network (2nd Place)

GM Network is developing a mobile-based AI super app providing agent-driven chat services.

· TypeX (3rd Place)

Refer to Monad Founder Residency Program Phase 2.

4.3 Monad evm/accathon

Source: Monad

The Monad evm/accathon is a hybrid hackathon held during ETH Denver, including both offline and online tracks. The event focuses on innovative solutions leveraging Monad's high-performance EVM architecture. There were five projects that won awards at evm/accathon:

· KiSignals (1st Place)

KiSignals, developed by the KiFi team, is an alpha-call aggregator on Telegram that allows users to trade tokens based on social data. KiFi is a mobile trading and SocialFi platform based on Monad, and users can currently sign up for the beta waitlist.

· StageFun (2nd Place)

StageFun, developed by the Blocklive team, is an event crowdfunding platform.

· OwnPay (3rd Place)

OwnPay is a payment service that enables instant on-chain transactions between devices.

4.4 Monad Mach 2: NFT

Source: Monad

Monad Mach 2 is an accelerator project designed for NFT builders in the Monad ecosystem, providing one-on-one guidance, workshops, and masterclasses. A total of 80 NFT projects were selected, and the full list can be found in the official Monad Eco X post. Here are some notable projects:

· Monad Nomads NFT: One of the early OG NFT projects in the Monad ecosystem, starting in February 2023. Eligibility for the whitelist is obtained through various community activities.

· Monadverse: An NFT series centered around Monanimals characters, released in chapters. It collaborates with over 40 other projects to conduct events and is one of the core NFT projects in the Monad ecosystem.

· Skrumpeys: An NFT collection with a cute pet theme, featuring 500 Skrumpets NFTs. The team has also teased a rare DN NFT collection, with only 135 to be released in the future.

· Lil Chogstars, Chog: A popular PFP project within the Monad ecosystem, all inspired by the Chog character.

Breath of Estova: A 2D MMORPG built on Monad, allowing players to use NFTs from other projects as in-game skins.

Purple Frens: An NFT series issued by the Monad-based token issuance platform Alloca. It has raised $2.5 million from CMS and Cogitent. Holders are expected to enjoy benefits such as revenue sharing, presale access, and platform perks.

4.5 Monad Momentum

Source: Monad

Monad Momentum is an incentive program designed to accelerate early ecosystem growth. Unlike traditional funding systems, it employs a matching incentive model. This means that when selected projects invest their own resources, the program will match additional support.

In the past, many L1 and L2 ecosystems have operated through grant programs or ecosystem funds but have failed to establish a meaningful dApp ecosystem. However, Monad has drawn valuable lessons from its previous projects such as the Founder Residency Program, EVM/Accathon, and Monad Madness. Building on these experiences, Monad aims to reward projects that make tangible contributions to the ecosystem and cultivate a sustainable, high-quality dApp environment post-mainnet launch.

The selection criteria for Monad Momentum are very strict:

1. Projects must have already run on the Monad testnet or be ready for deployment on the mainnet.

2. Projects must have completed or scheduled a security audit.

3. Projects must demonstrate the sustainability of their operations.

4. The project must have a meaningful user metric.

The full list of projects selected for Monad Momentum has not been announced yet, but since MON rewards will be distributed to users of these dApps after the mainnet launch, it is worth paying close attention to updates from Monad Momentum.

Final Thoughts

From Bitcoin and Ethereum to the subsequent myriad of L1 and L2 networks, some have succeeded while others have not. So, what determines success? While technology and user or developer experience are important, the most crucial factor is to build a vibrant and sustainable dApp ecosystem. Monad is no exception.

Ethereum made smart contracts possible. Solana supports high-performance applications that Ethereum cannot handle. Monad's biggest advantage lies in its "high-performance EVM," and its success depends on whether it can launch enough demanding and performance-intensive EVM applications to attract users.

Looking at the current Monad ecosystem, we can derive several key insights:

Projects leveraging Monad's performance: Many existing dApps in the ecosystem, such as order book DEXes and memecoin launchpads, fully leverage Monad's parallel execution capabilities and MonadDb feature. Interestingly, while other ecosystems are mainly dominated by AMM-based DEXes, Monad's scalability enables more CLOB-based DEXes to emerge. Beyond the trading sector, industries such as social, gaming, and streaming could also thrive. Hopefully, after the mainnet launch, we will see killer apps emerge in these areas.

Lack of stablecoin and RWA projects: The stablecoin and Real World Asset (RWA) space has become a core part of the crypto industry and is one of the few areas that has achieved product-market fit. While high scalability is not crucial for these areas, they are vital for the infrastructure of any blockchain ecosystem. Currently, Monad lacks strong participants in this category. Given its advantage in the trading sector, Monad should also develop a robust stablecoin and RWA ecosystem. The acquisition of Portal by the Monad Foundation in July was an exciting step in this direction.

Competition among liquidity staking protocols: Even before the mainnet launch, several mainstream liquidity staking protocols such as aPriori, FastLane Labs, Magma, and Kintsu are already gearing up to go live. While their respective unique differentiators are intriguing, too many liquidity staking options may fragment liquidity and impact user experience. It will be worth watching how this competitive landscape evolves post mainnet launch.

The long-awaited journey of Monad has just begun. For all those embarking on the Monad adventure for the first time, this guide is intended to help you confidently explore the Monad ecosystem.