ASTER Price Could Use Short Squeeze as a Rebound Catalyst — Is $1.39 Possible?

Aster (ASTER) price has dropped almost 40% over the past 30 days, trading close to $1.10 after weeks of steady selling. The downtrend looks heavy on the surface, but behind the scenes, a mix of retail exits and short-heavy positioning could actually be setting up the next rebound.

If ASTER manages to reclaim $1.39, where a defining short-squeeze play would complete, the structure could flip fast.

Retail Steps Away, But Crowded Shorts May Be Laying the Groundwork

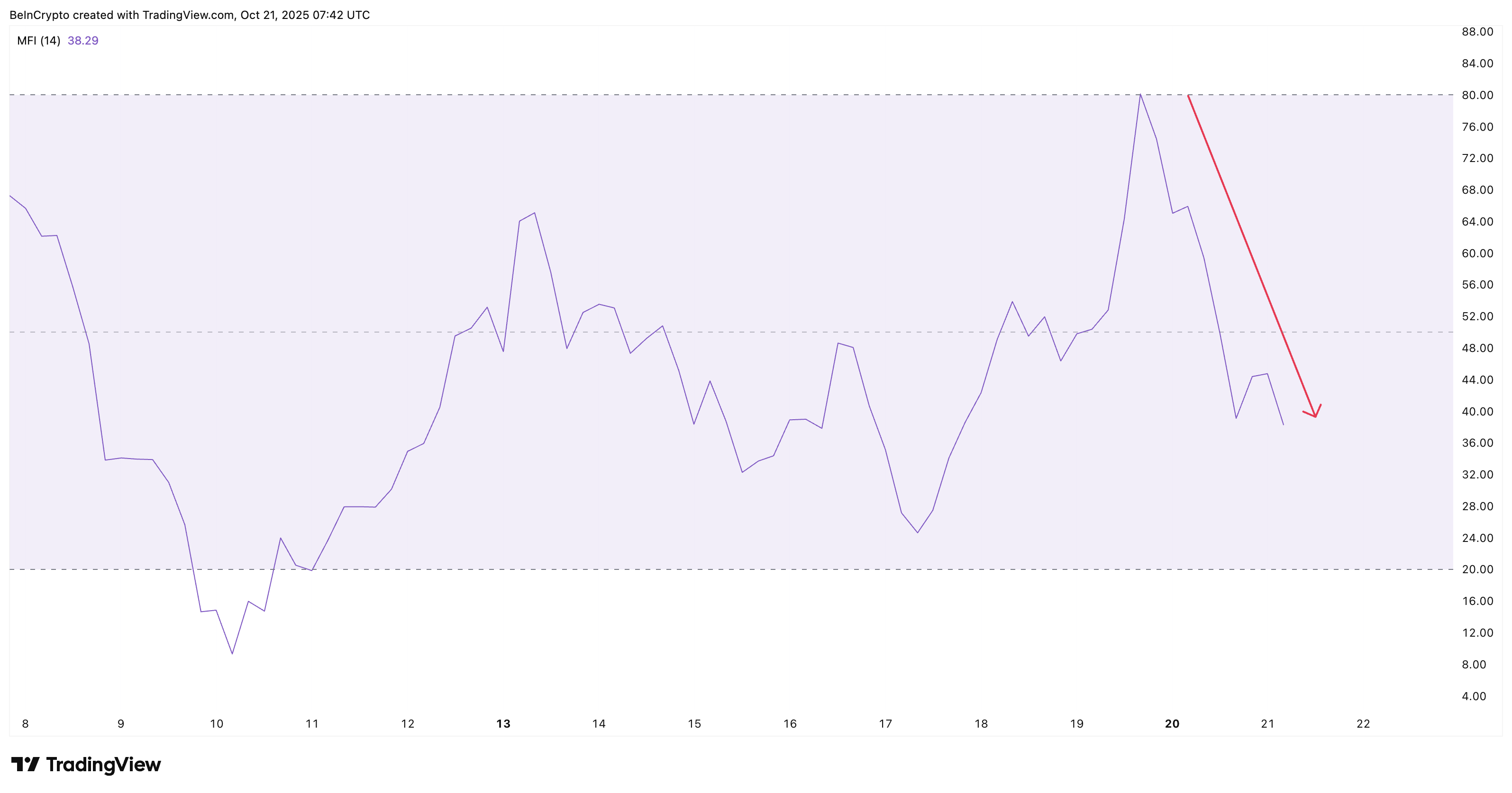

Smaller investors appear to be stepping back. The Money Flow Index, which tracks how much money is entering or leaving the market, has dropped by over 50% since mid-October — falling from nearly 80 to 38.27. That means retail traders are no longer buying as aggressively. It usually signals weakness, but it can also create conditions where big traders accumulate quietly before a move higher.

ASTER Retail Moving Out: TradingView

ASTER Retail Moving Out: TradingView Meanwhile, derivatives data show that most traders are heavily tilted to the short side. That also confirms the bearish bias and the MFI dip.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

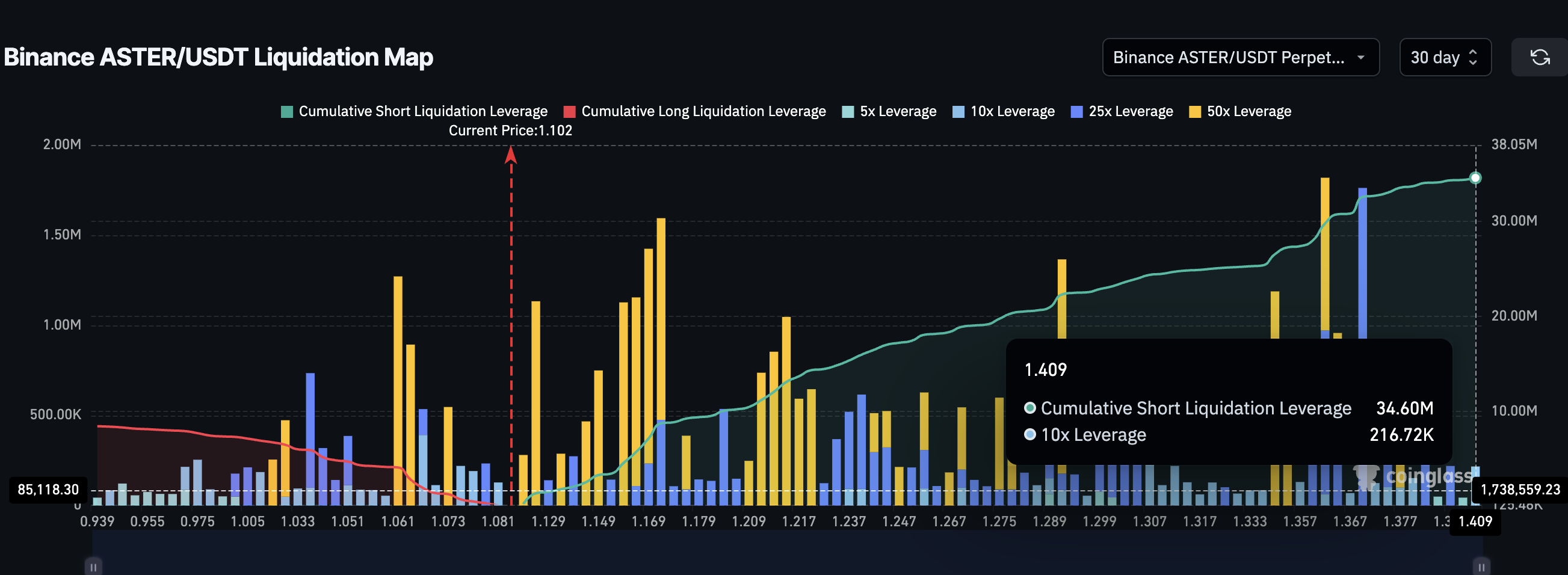

On Binance alone, ASTER’s short liquidations total $34.6 million, compared to $8.46 million in longs. This means almost 80% of leveraged positions are betting on a further drop — a heavily biased setup that often leads to sudden reversals when price pressure shifts.

Massive Short-Bias For Aster: Coinglass

Massive Short-Bias For Aster: Coinglass The liquidation map suggests that if the ASTER price climbs above $1.39 (a 26% upmove from the current level), all these short positions would be forced to close. Such a squeeze could trigger automated buy orders and cascade into a sharper rally.

So, while retail money is moving out and sentiment looks weak, that very imbalance could end up driving the rebound once the right level breaks.

One ASTER Price Level Could Flip the Setup Entirely

The 4-hour price structure on ASTER’s chart gives a possible explanation for the retail pullback. The token is still trading inside a falling channel, a pattern that usually signals weakness. That visual bearishness could be what’s keeping retail traders away.

However, under the surface, the setup might be quietly shifting. The same falling channel also supports the short squeeze possibility discussed earlier. The cluster of short liquidations sits tightly between $1.15 and $1.39, meaning that if ASTER starts climbing within this zone, many traders betting on the downside would get wiped out — accelerating the rebound.

The Relative Strength Index (RSI) — which measures the strength and speed of price movements — adds to this theory. Between October 11 and 21, the RSI made higher lows while ASTER’s price made lower lows. This bullish divergence usually appears when sellers are losing power, even though the price remains weak. That shift in momentum often precedes rebounds, especially when paired with high short exposure.

ASTER Price Analysis: TradingView

ASTER Price Analysis: TradingView If ASTER manages to climb above $1.39, it would not only break the upper trendline of the falling channel — effectively cancelling the bearish setup — but also trigger a full round of short liquidations. That could push prices toward $1.88 and $2.22.

On the other hand, if the ASTER price slips below $1.05, the rebound setup weakens. A close under $0.92 would break the lower channel boundary. And it would expose the token to a deeper fall, invalidating the potential recovery.