XRP Faces Breakdown Risk as Large Holders Dump Over $2.6 Billion

XRP price is once again leaning on a critical level — a key area that’s held through multiple declines this month. The token trades near $2.40, down nearly 4% this week and 14% over the past month. The broader trend remains weak, but the $2.28 zone has repeatedly stopped deeper breakdowns.

However, that floor now faces its biggest test yet. A broad selling wave across cohorts is combining with a bearish chart setup. It appears the key $2.28 support might not hold if selling continues to build momentum.

Large Investors and Whales Join the Selling Wave

The selling streak among large wallets began on October 16. Data shows that whale and mid-tier wallets have been trimming holdings consistently since then.

Addresses holding over 1 billion XRP reduced their balances from 26.19 billion to 25.10 billion. They offloaded 1.09 billion XRP, worth about $2.63 billion at current prices.

XRP Whales Continue To Dump: Santiment

XRP Whales Continue To Dump: Santiment Mid-size holders (10 million – 100 million XRP) cut their stash from 8.28 billion to 8.13 billion, shedding about 150 million XRP, worth nearly $360 million. This week-on-week sell pressure exerted by XRP whales has dragged the price lower by almost 4%.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

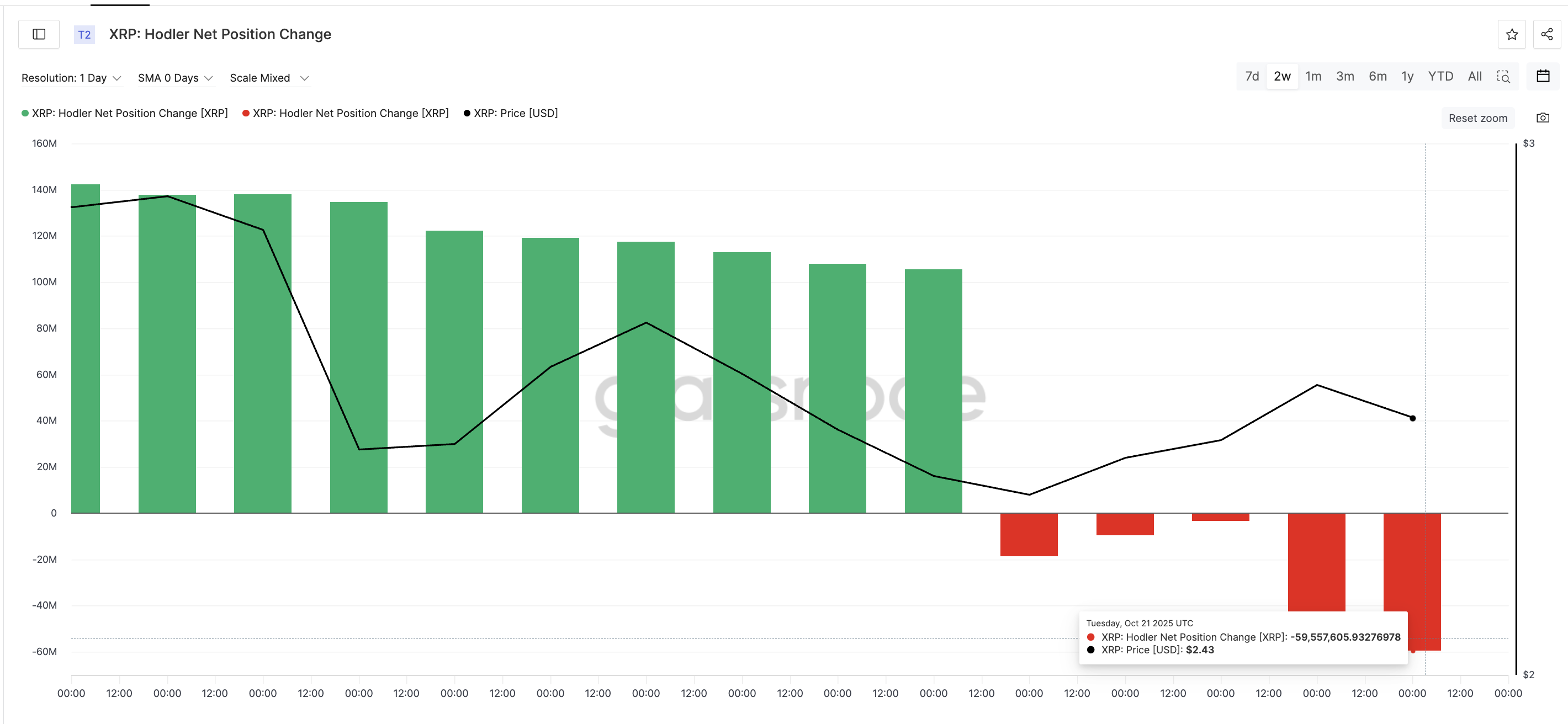

Long-term holders are following a similar path. The Hodler Net Position Change, which measures how much long-term investors add or reduce holdings, has deepened into red territory.

Cashing out increased from –18.5 million XRP on October 17 to –59.5 million XRP by October 21, showing a 220% rise in outflows within four days.

XRP Faces Sell Pressure From Long-Term Holders: Glassnode

XRP Faces Sell Pressure From Long-Term Holders: Glassnode This synchronized reduction among whales and holders adds fuel to the broader sell wave. Until this trend reverses, key XRP support levels could face mounting pressure from both sides of the market.

Selling Pressure Meets Bearish XRP Price Chart — A 5% Slide Could Follow

On the technical front, XRP price continues to trade within a descending triangle, with the strongest horizontal base near $2.28. The formation typically signals that sellers remain dominant until the base gives way.

Between October 13 and 20, XRP formed lower highs, while the Relative Strength Index (RSI), which measures price momentum, made higher highs.

This hidden bearish divergence signals weakening momentum and hints that another leg down may follow. If the XRP price breaks below $2.28 (a 5% correction) with a confirmed daily close, the next targets for the XRP base lie at $2.08 and $1.77 (a 14% to 27% dip).

XRP Price Analysis: TradingView

XRP Price Analysis: TradingView On the upside, a sustained break above $2.82 would invalidate the bearish XRP price structure and open room for a rebound toward $3.10.

For now, XRP price remains caught between an aggressive selling wave and a critical floor at $2.28 — the line separating another breakdown from a potential recovery attempt.