Will MegaETH, with a pre-market value of 5 billions and using an English auction, deliver excess returns?

Polymarket predicts an 89% probability that MEGA will trade at a price exceeding $2 billions FDV within 24 hours after launch, and a 50% probability of exceeding $4 billions FDV.

Written by: Kunal Doshi, Shaunda Devens

Translated by: AididiaoJP, Foresight News

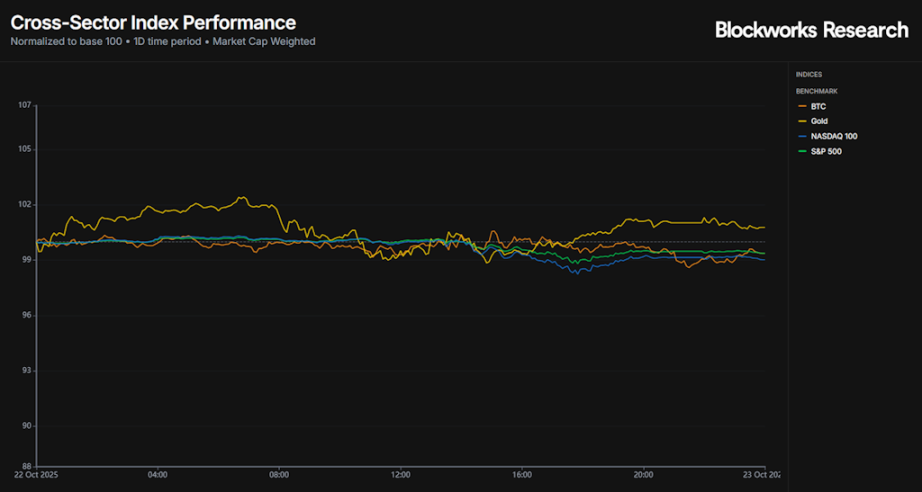

Bitcoin and major indices continue to decline, while among altcoins, only 24% of the top 100 tokens have outperformed Bitcoin in the past 90 days. However, there are still some outstanding tokens, and we believe MegaETH's future development potential is worth paying attention to.

MegaETH is expected to bring considerable returns to early participants.

This is a new round of participation opportunity for the MegaETH community, following the Echo community round (priced similarly to venture investors including Dragonfly and Vitalik) and the Fluffle NFT round, which implied a fully diluted valuation of about $532 millions. This comes after MegaETH recently repurchased about 4.75% of equity and token-related warrants from early pre-seed investors.

MEGA's event will begin at 9:00 AM Eastern Time (UTC+8) on October 27, 2025, and will last for 72 hours. Key details of the upcoming event include:

- Date: October 27 to 30, 2025 (72 hours)

- Payment method: USDT on Ethereum mainnet

- Supply: 10 billions MEGA tokens (5% allocation, totaling 500 millions tokens)

- Format: English auction (fully diluted valuation range approximately $1 million to $999 millions)

- Bidding limits: Minimum $2,650 / Maximum $186,282

- Lock-up terms: Mandatory one-year lock-up plus 10% discount for US investors; optional lock-up for non-US investors

While the initial implied fully diluted valuation could be as low as $1 million, recent fundraising strongly suggests it will reach the highest valuation of about $1 billions. Meanwhile:

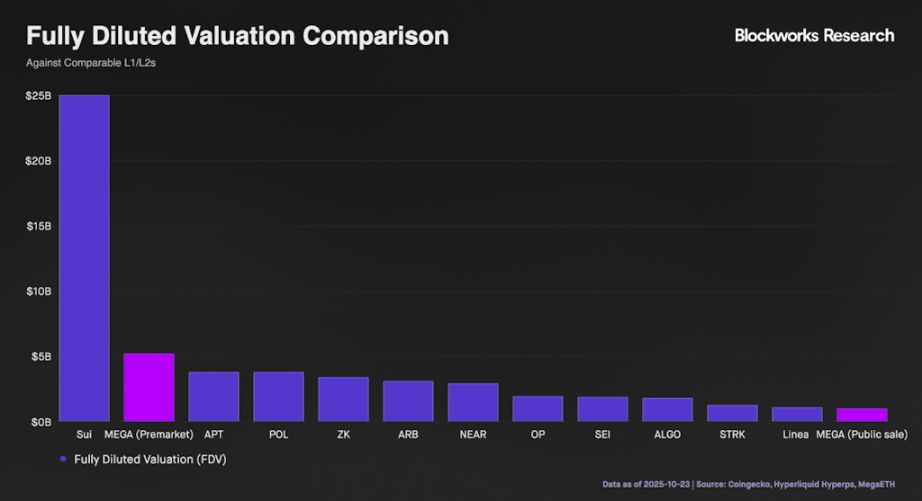

The MEGA-USD perpetual contract market on Hyperliquid currently prices MEGA at a $5 billions fully diluted valuation, with a 24-hour trading volume of $17 millions.

Despite the low trading volume ($147,000), Polymarket predicts an 89% probability that MEGA will trade at a fully diluted valuation exceeding $2 billions within 24 hours after launch, and a 50% probability of exceeding $4 billions.

But why would MegaETH intentionally launch at a price below its potential valuation ceiling?

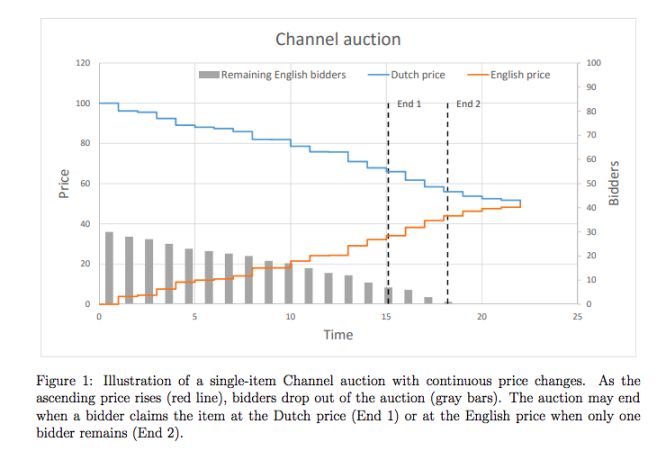

Historically, public events conducted via English auctions have a common problem: the price lands exactly at the valuation level acceptable to the last marginal buyer. When the token becomes liquid after the event, buying pressure disappears, often triggering a price crash. Dutch auctions (where the price starts high and decreases) have a similar issue; marginal buyers purchase at their highest acceptable price. Many times, subsequent price movements cause the project to fail from the outset.

Therefore, some recent projects have deliberately chosen to undervalue their public event price (for example, Plasma at a $500 millions fully diluted valuation) under the following philosophies:

- The best way to build a community is to reward them early and give them some conviction.

- In the long run, the market is a weighing machine, and the price will adjust to approach fair value.

- If a token's fair value is $5 billions, then a revaluation upward from $1 billions is better than a revaluation downward from $20 billions to $5 billions.

Conducting small-scale community rounds at attractive valuations seems to be an effective listing strategy, almost becoming a "community tax" similar to an airdrop, necessary for building positive public sentiment. Overall, I believe MegaETH's future development is worth watching.