Bull Market Scenario Prediction | Timeline Deduction, ETF Approval and Aftermath

Reviewing GBTC and Gold ETFs to deduce the crypto market.

Written by: Chain Research Society

This article is a collection of the ETF series, including "Predicting the Approval Time of Bitcoin Spot ETF and the Start Time of the Bull Market" and "What Will Happen If Bitcoin Spot ETF Is Approved? Will a Big Bull Market Come?"

The content is quite lengthy, so for your convenience, I have placed the conclusions at the beginning. It is recommended to bookmark and share this so that in the next six months, we can witness the historical process of the approval of the Bitcoin spot ETF together.

I. Predicting the Approval Time of the ETF and the Start Time of the Bull Market

Bull Market Scenario Prediction

Referring to the timeline of the last Grayscale Trust approval, I believe the most likely scenario now is:

- Approval of the Bitcoin spot ETF application in January 2024 (the Federal Reserve stops raising interest rates or there is no expectation of rate hikes in the market);

- The Bitcoin spot ETF comes into effect in April 2024 (before the Bitcoin halving, which helps attract capital);

- The Bitcoin bull market officially starts in July 2024 (after the post-halving adjustment and the market's realization of monetary easing expectations);

- The Federal Reserve enters a rate-cutting cycle in September 2024, implementing monetary easing policies. (Once the expectation of rate cuts is released, risk markets will immediately react, 1-2 months in advance. We can refer to GDP>CPI as a leading indicator.)

Why do I judge that the bull market will officially start around July, and not when the Bitcoin spot ETF takes effect? It is because we usually experience a period of adjustment 2-3 months after the halving, rather than an immediate start. Considering the current macro market's expected rate-cutting cycle, the timing is set for July.

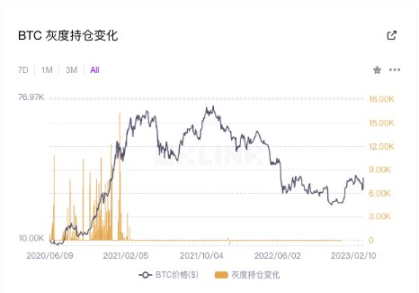

Reviewing the Starting Point of the 2020 Bull Market: The Approval Process of Grayscale GBTC Trust

- November 2019: Grayscale submits GBTC Trust Fund registration application to the SEC;

- January 2020: Grayscale GBTC Trust is approved and registered by the SEC, becoming the first digital asset instrument to meet the standards of the U.S. Securities and Exchange Commission;

- April 2020: Grayscale Bitcoin Trust GBTC officially takes effect, with rapid expansion in scale. Three Arrows Capital also grew rapidly by arbitraging GBTC;

- In 2020, Grayscale alone brought over $10 billions of incremental funds to the crypto market, with the total incremental funds in the market possibly reaching the $100 billions level.

The GBTC secondary market premium rate once exceeded 30%. After February 2021, Grayscale stopped increasing its BTC holdings.

Previously, Grayscale held 654,885 BTC, with an estimated cost of $8.931 billions, and an average cost of only about $13,700 per BTC.

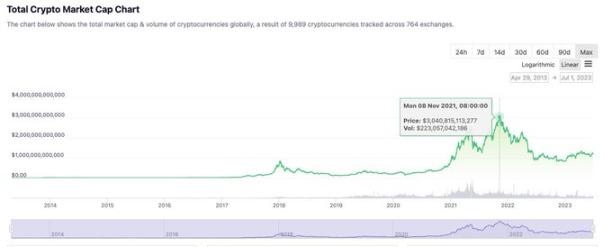

The Possible Starting Point and Incremental Funds of This Bull Market

In 2020, Grayscale brought about $10 billions to the market, resulting in incremental funds at the $100 billions level. The total crypto market cap peaked at $3 trillion in 2021, about 30 times higher than just over $100 billions in 2019.

If the bull market repeats itself, we need to see inflows of over $100 billions. The approval of BlackRock's Bitcoin ETF is a necessary condition for the next bull market. It will take about half a year for the ETF to be truly approved (Grayscale applied in November 2019, took effect in April 2020, and Bitcoin halved in May 2020).

Thus, the incremental funds from ETFs alone will exceed Grayscale's current fund size ($25.5 billions). However, this is not enough. Another necessary condition for a real bull market is sufficient market liquidity. After the Bitcoin spot ETF is approved, it is expected to bring $100 billions in liquidity to the crypto market, and the increase in total market cap will be at least at the $1 trillion level. The total market cap will then surpass that of the world's most valuable company (currently Apple).

In summary, the three necessary conditions for the starting point of the next bull market are:

- SEC approval of a spot BTC ETF

- The next Bitcoin halving

- Monetary easing and excess market liquidity

Finally, a summary of the approval of the Bitcoin spot ETF

- Approval of the Bitcoin spot ETF application in January 2024 (the Federal Reserve stops raising interest rates)

- Comes into effect in April 2024 (before the Bitcoin halving)

- The Bitcoin bull market officially starts in July 2024 (after the post-halving adjustment and the market's realization of monetary easing expectations)

- The Federal Reserve enters a rate-cutting cycle in September 2024, implementing monetary easing policies. (Once the expectation of rate cuts is released, risk markets will immediately react, 1-2 months in advance. We can refer to GDP>CPI as a leading indicator.)

- The approval of the Bitcoin spot ETF will bring $100 billions in liquidity to the market

II. What Will Happen If the ETF Is Approved? Will a Big Bull Market Come?

I referred to the historical process of the approval of the gold ETF in the United States to judge what might happen if the Bitcoin spot ETF is approved, and came to the following conclusions (for reference only):

1. The market will have sustained expectations before the approval of the Bitcoin spot ETF, which can be regarded as bullish

2. After the Bitcoin spot ETF is approved, there will still be a small rally

3. Shortly after the Bitcoin spot ETF starts trading, there will be a significant drop after the peak, possibly even falling below the price before the ETF was approved

Next is a rational analysis: Will a big bull market come just because the Bitcoin spot ETF is approved?

If the Bitcoin spot ETF is approved now, overall I don't think it's necessarily good news. The approval mainly affects market sentiment and pushes up prices with existing funds. Since the world economy has not yet recovered and monetary policy is still extremely tight, it is still difficult for funds to flow in continuously. Of course, it is possible to maintain high-level volatility, but it is hard to last long. One should not expect the crypto market to have an independent rally—this probability is very small. Moreover, it is a pity to have such a major positive news in a bear market; in a bull market, it could rise 100%, but in a bear market, maybe only 30%. Let's see how the US stock market performs in the near future; if US stocks fall, then basically there's no hope. Based on current information, I do not believe that the approval of the Bitcoin spot ETF will directly trigger a big bull market.

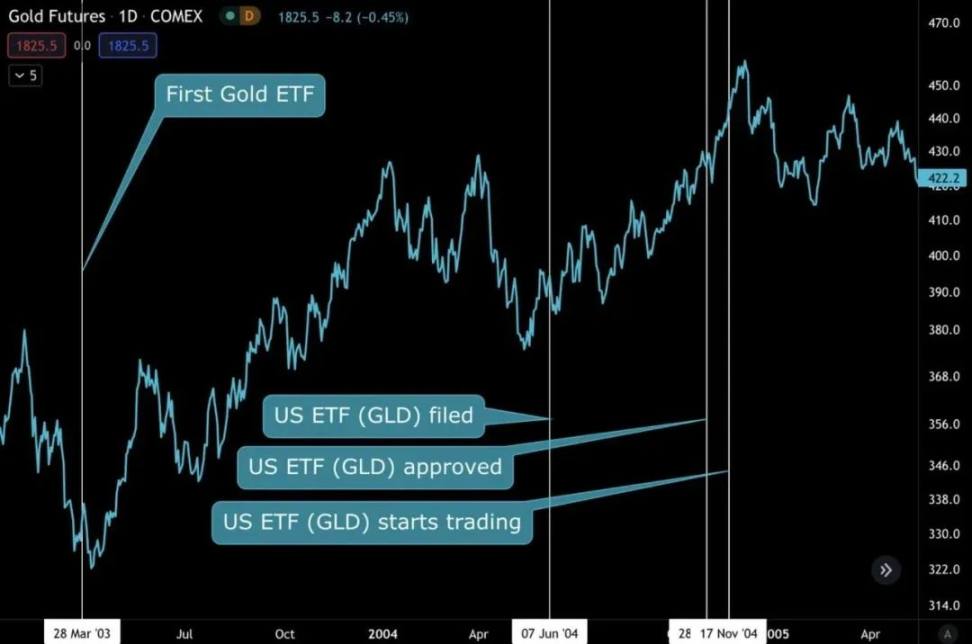

Reviewing the Approval Process of the Gold ETF

- March 2003: Australia launched the world's first gold ETF

- October 2004: The SEC approved the first US gold ETF, GLD

- November 2004: The US gold ETF GLD officially took effect and began trading

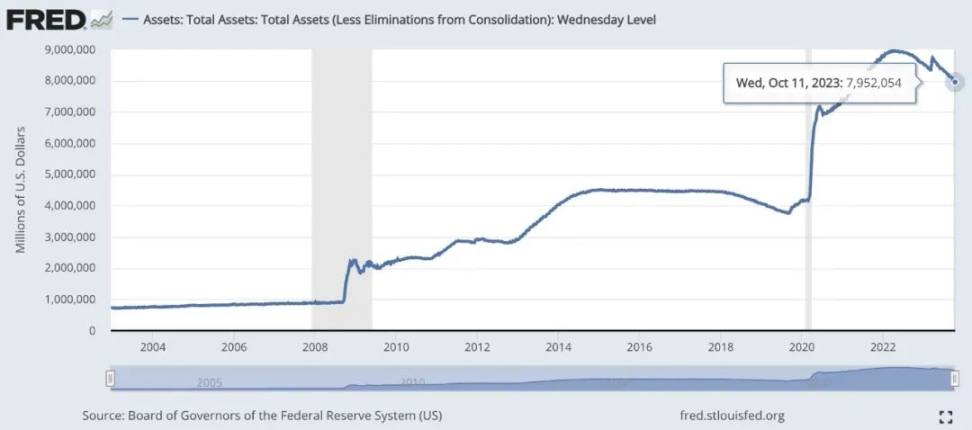

The Economic Environment and Monetary Policy at the Time

Economic environment: In 2004, the US macroeconomic environment was relatively stable. At that time, US GDP was on an upward trend, unemployment was relatively low, and inflation was moderate. Although there were some economic challenges, the US economy was not in crisis.

Monetary policy: In 2004, the Federal Reserve's monetary policy was relatively loose. The Fed gradually raised interest rates (from 1% to 1.75% in 2004), but short-term rates were still relatively low. The loose monetary policy supported gold's performance, as gold is usually seen as a hedge against inflation and currency depreciation.

Gold's Historical Performance Before and After Approval

- Gold saw a significant rise after the first gold ETF was approved, which continued until the US ETF began trading

- The US gold ETF GLD continued to rally slightly after SEC approval

- Shortly after the US gold ETF began trading, the market fell by about 9% in the following two months, dropping below the price at the time of ETF approval

The approval of the gold ETF allowed more traders to invest through ETFs without the need to store metal or use bank custody. In the following years, more funds entered the market, and the 2008 financial crisis pushed gold to $1,000.

The Historical Process of the Bitcoin Spot ETF

- February 2021: The world's first Bitcoin ETF was approved in Canada. BTC surged to a high of 65,000 in the following two months before starting to fall, during which the 519 event occurred

- October 2021: The first US Bitcoin futures ETF was listed. After surging to over 69,000 in just over a month, it began a year-long decline

- July 2023: BlackRock, one of the world's largest asset management companies, began applying for a Bitcoin spot ETF. That month, BTC reached a high of 31,800 before starting to fall

The current status of Bitcoin ETF applications is illustrated using a chart from Odaily@OdailyChina

Current Economic Environment and Monetary Policy

- Economic environment: In 2023, the US macroeconomy is unstable, having experienced a banking crisis at the beginning of the year. Inflation is high, US GDP growth is weak and has not fully shaken off recessionary trends, unemployment is relatively low, and there is an inverted yield curve between long- and short-term bonds. The economy faces challenges, and although the Fed wants a soft landing, it has not yet escaped crisis.

- Monetary policy: In 2023, the Fed's rate hikes and balance sheet reduction have created a tight monetary environment. To control inflation, the Fed has implemented extremely aggressive rate hikes, with rates reaching 5.25%. Rate hikes have not yet stopped but are nearing the end. The market expects rate cuts in September 2024.

The approval of the Bitcoin spot ETF will allow tens of millions of new investors and traders to invest through ETFs, further increasing Bitcoin's legitimacy. More funds will definitely enter this market in the future.

Summary

The previous article mentioned the three necessary conditions for the starting point of the next bull market:

1. SEC approval of a spot BTC ETF

2. The next Bitcoin halving

3. Monetary easing and excess market liquidity