Solana Profit Remains Underwhelming – Will SOL Price Recover Above $200?

Solana’s price continues to face resistance around the $200 mark, a level that has proven difficult to break. After multiple attempts at recovery, the altcoin remains constrained just below this threshold.

Despite broader market optimism, Solana’s inability to secure $200 as support has kept investors cautious and profit-taking active.

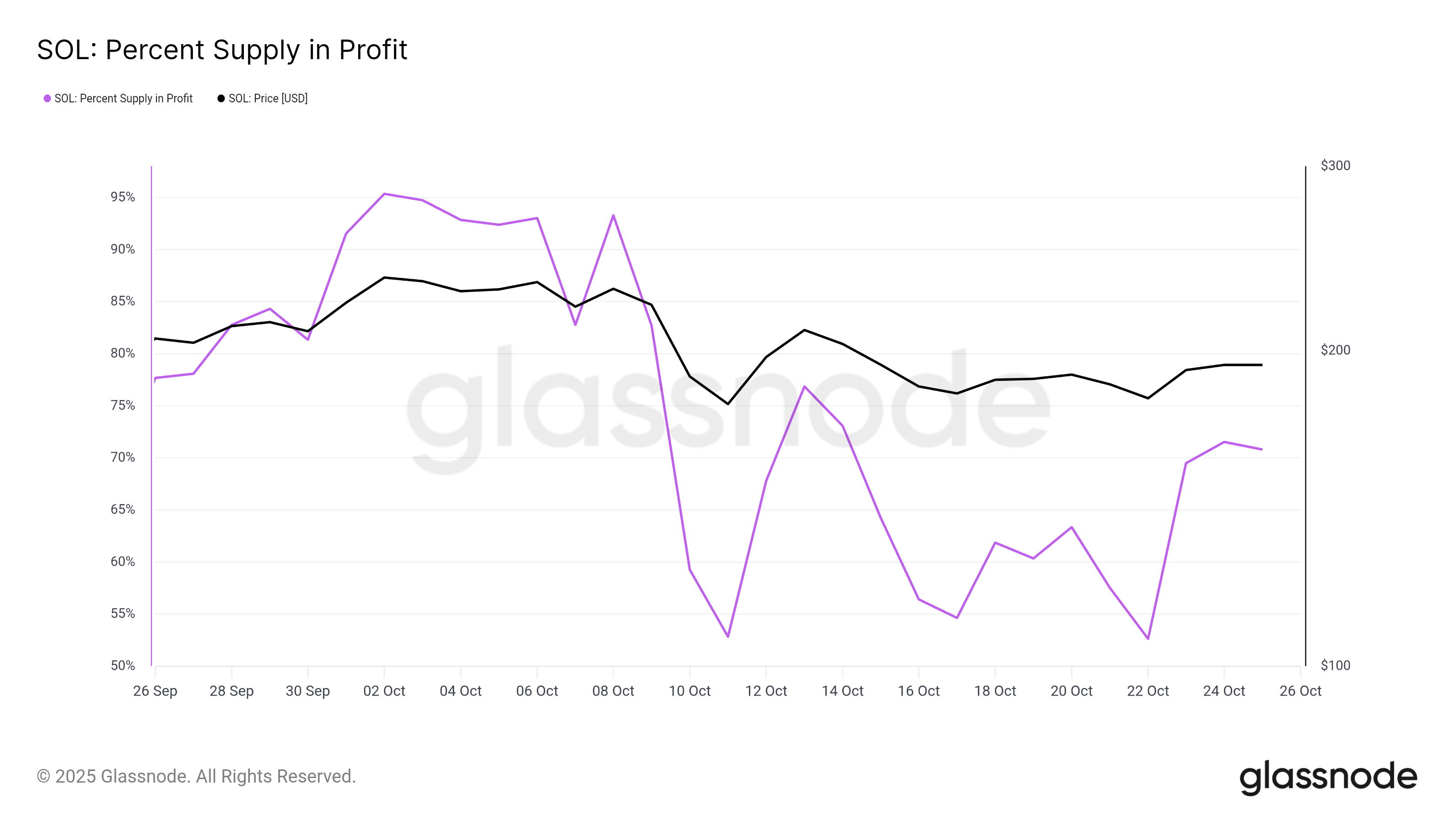

Solana Profits Remain Volatile

Recent data shows that Solana’s supply in profit has been highly volatile. Within just 48 hours, the percentage of SOL supply in profit jumped from 52% to 70% — an 18% increase — while the price itself rose by less than 5%. This disparity suggests that many holders accumulated their tokens around the $200 level.

When Solana’s price dips, these profits vanish quickly, leading to renewed selling pressure. The sharp fluctuations confirm that $200 remains a critical psychological and technical barrier.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Solana Supply In Profit. Source: Glassnode

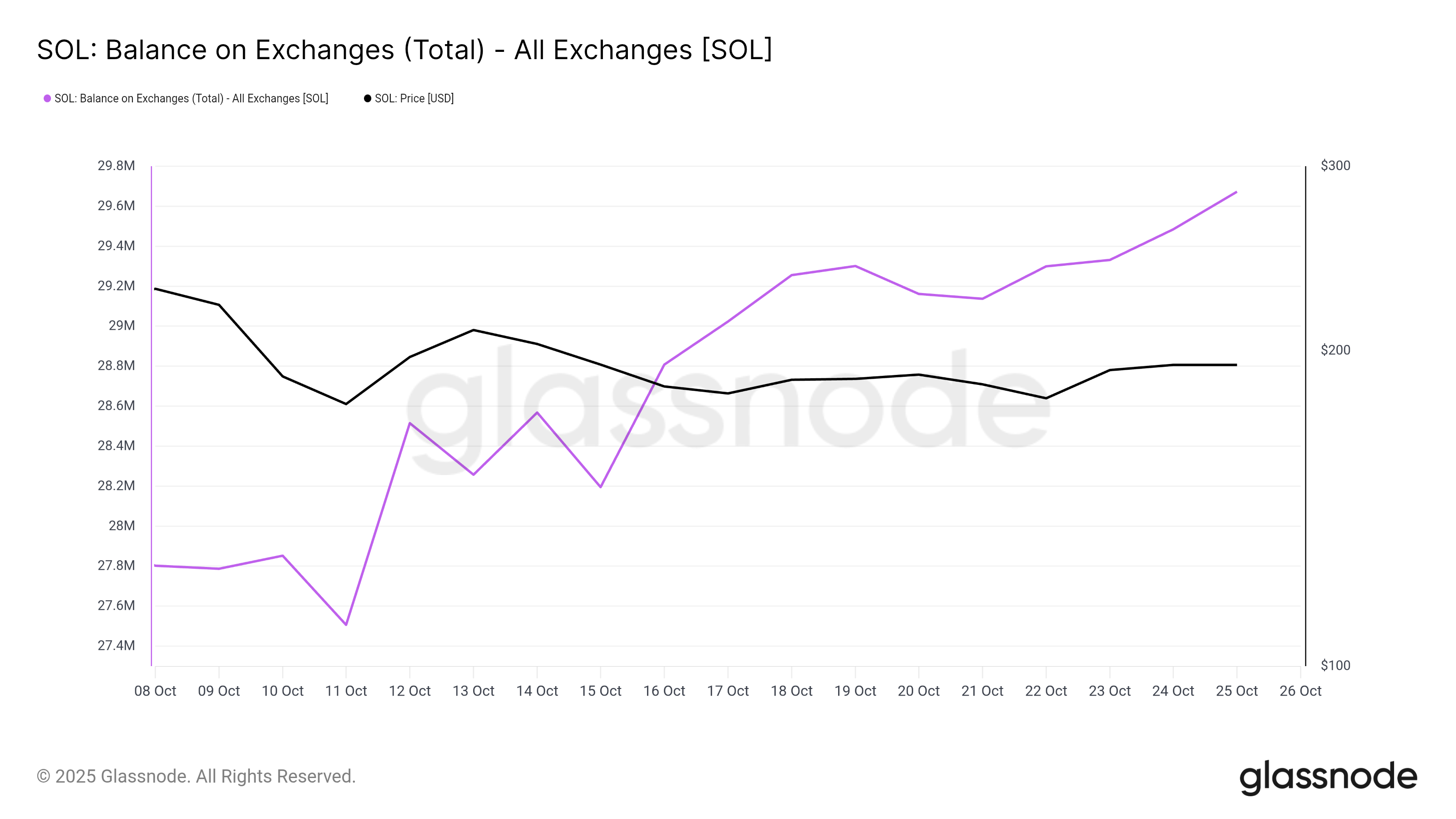

Solana Supply In Profit. Source: Glassnode Exchange data reinforces this cautious outlook. Over the past 10 days, approximately 1.5 million SOL — valued near $300 million — has been moved to exchanges. This trend indicates that many holders are choosing to sell rather than accumulate, reflecting a prevailing bearish sentiment across the market.

The rising exchange balance often precedes short-term corrections, as higher supply on trading platforms increases the risk of sell-offs. Unless inflows slow down or strong buying interest emerges, Solana may continue facing downward pressure.

Solana Exchange Balance. Source: Glassnode

Solana Exchange Balance. Source: Glassnode SOL Price Needs To Find Strength To Rally

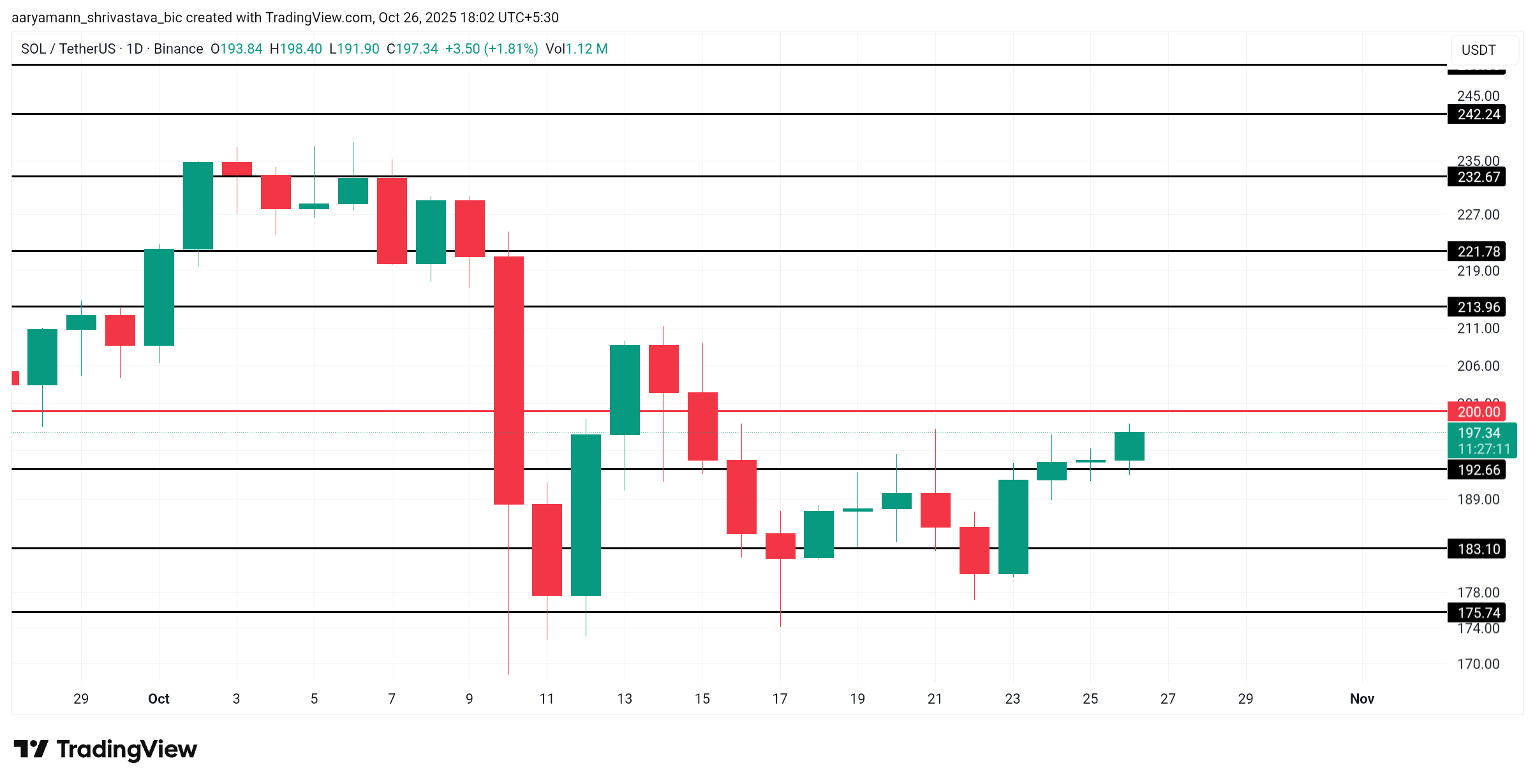

At the time of writing, Solana trades at $197, sitting just below the $200 resistance. This price level has repeatedly acted as a ceiling, preventing a sustained recovery. For a decisive breakout, SOL must secure $200 as a firm support base to confirm bullish strength.

If selling pressure persists, Solana’s price could drop below $192, with potential declines toward $183 or even $175. The continued rise in exchange balances and unstable profit-taking activity support this near-term bearish scenario.

Solana Price Analysis. Source: TradingView

Solana Price Analysis. Source: TradingView However, if Solana manages to climb above $200 and extend gains to $213, it could invalidate the bearish outlook. A clean breakout above $200 would likely attract renewed investor interest, improving sentiment and reducing short-term volatility.