What to Expect From Hedera (HBAR) Price in November

Hedera (HBAR) traders are heading into November with mixed expectations. The token has dropped 32.6% over the past three months, weighed down by broader market caution, but HBAR price history says the next few weeks could look very different.

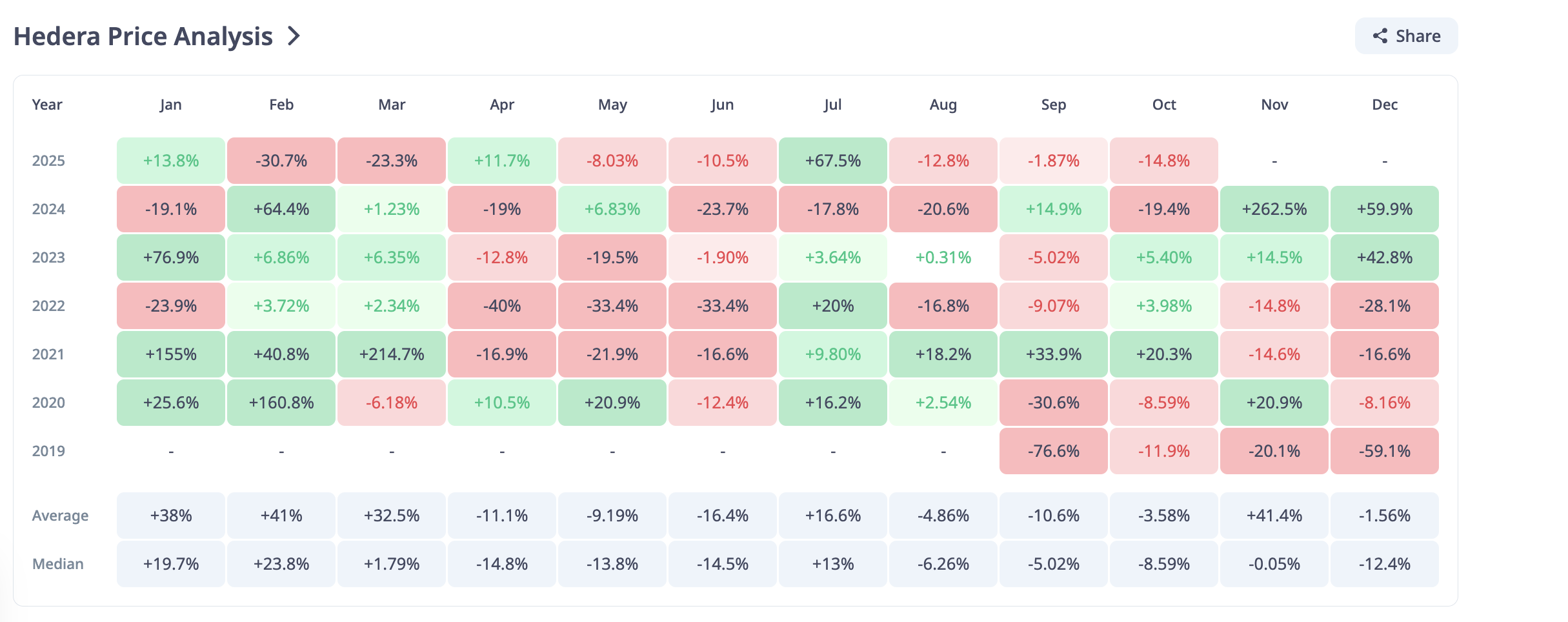

November has been one of Hedera’s best-performing months on record, gaining 14.5% in 2023 and an incredible 262.5% in 2024. With the FOMC meeting wrapping up on October 29 and possible rate cuts in sight, traders are wondering whether another big move could be brewing for November.

Weak Big-Money Backing Despite Strong Historical Record

Over the years, HBAR has shown a strong seasonal bias for November rallies. But this time, it’s missing one critical element — whale support.

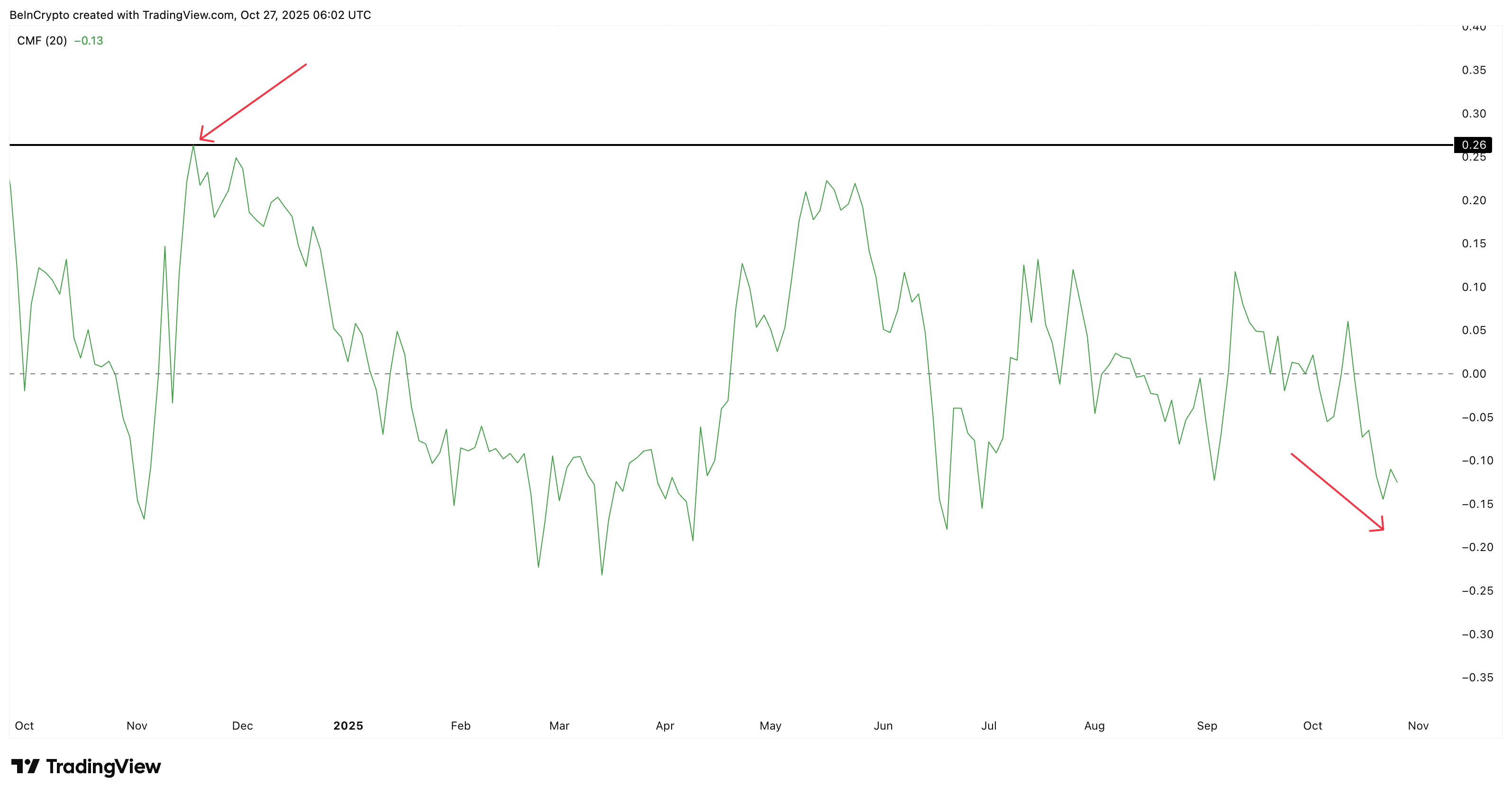

The Chaikin Money Flow (CMF), an indicator that tracks how much capital is entering or exiting the market, sits at –0.13 on the daily chart. A positive CMF shows money flowing in, but negative readings mean investors are pulling funds out.

HBAR Money Flow History: TradingView

HBAR Money Flow History: TradingView Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Last November, CMF hovered near +0.26, a sign of strong institutional buying. The current downtrend shows that large investors are still holding back.

Despite that, HBAR’s long-term data shows an average November gain of 41%, keeping optimism alive if the macro setup turns supportive after the Fed meeting.

Hedera Price History: CryptoRank

Hedera Price History: CryptoRank Short Liquidations Could Trigger a Sharp Move Upward

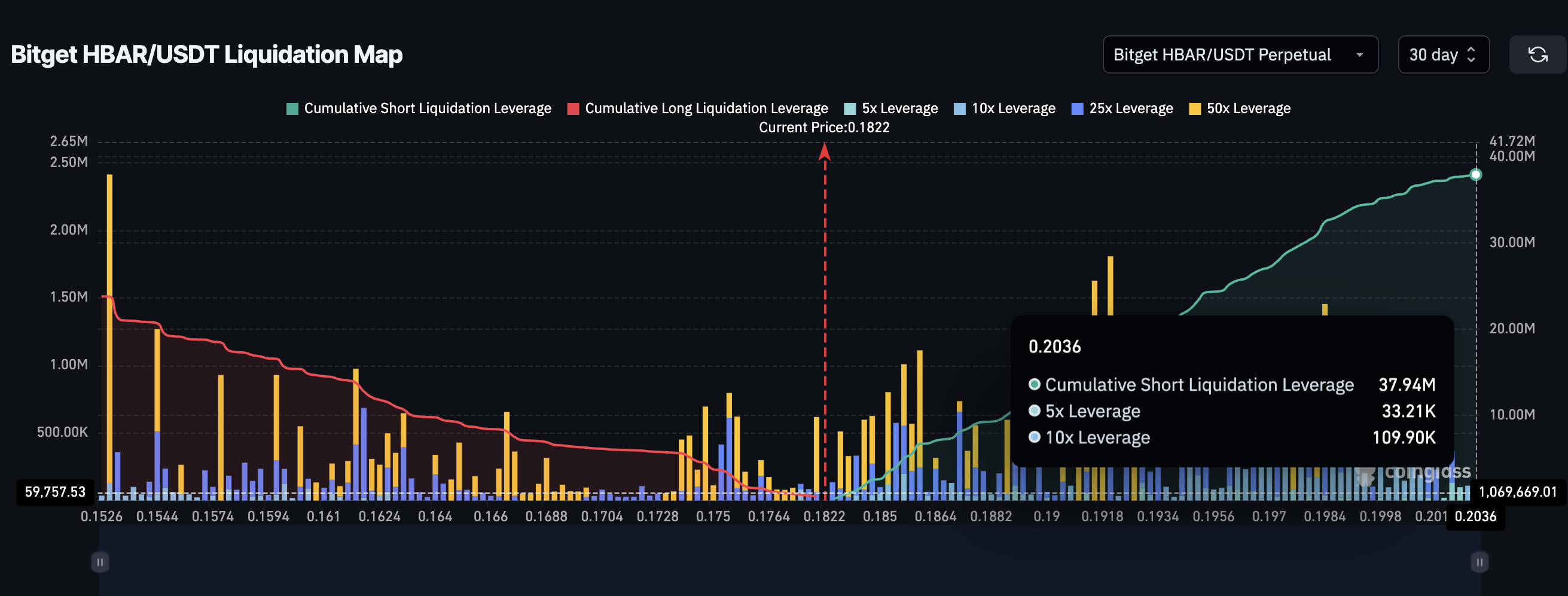

While big money remains quiet, the derivatives market is heating up. According to Bitget’s liquidation map, shorts have built up roughly $37.94 million in open positions, while longs hold $23.78 million. There is a nearly 50% gap in favor of bearish bets.

Most of these short clusters sit between $0.18 and $0.19, right around HBAR’s current range. If prices rise slightly after the FOMC meeting, especially if the Fed confirms a dovish tone or a rate cut, it could trigger a short squeeze, forcing bearish traders to buy back into the market.

HBAR Liquidation Map: Coinglass

HBAR Liquidation Map: Coinglass That kind of derivatives-led rally could set off a quick move toward $0.22 or even $0.26. The latter would mark gains of up to 44% from current levels.

HBAR Price Action and Divergence Hint at Early Indecision

On the two-day chart, HBAR is still moving inside a symmetrical triangle, a neutral pattern that often leads to large breakouts (or breakdowns) once the price escapes the range.

However, between October 12 and October 26, the price made lower highs, while the Relative Strength Index (RSI), a tool measuring buying versus selling pressure, formed higher highs. That’s known as a hidden bearish divergence, which usually signals that the existing downtrend could continue. The 3-month dip of over 32% confirms the downtrend.

Still, the RSI, currently near 43, is hovering in a zone where reversals can easily form, especially if external triggers appear. If HBAR closes above $0.20, the upper boundary of the triangle breaks, and targets of $0.22 and $0.26 (a 44% rise) open up.

HBAR Price Analysis: TradingView

HBAR Price Analysis: TradingView If the token falls below $0.17 (triggered by the bearish divergence), downside targets appear near $0.14 and $0.10. That would invalidate the previous bullish structure and erase most of HBAR’s October-end rebound.

It is also worth noting that the lower trendline of the triangle has only two proper touchpoints. That makes the HBAR price breakdown risk more pronounced, especially if Hedera loses $0.17.

The overall setup for November suggests that derivatives, not whale buying, could decide HBAR’s next move. Historically, strong Novembers have relied on big-money inflows, but with the CMF still negative, that support hasn’t arrived yet.

If short liquidations start piling up after a dovish FOMC signal, a short-term rally above $0.20 could unfold quickly. However, if the Fed disappoints or the divergence deepens, a slide toward $0.14 remains likely before any HBAR price recovery.