Fed Vice Chair Michelle Bowman among other pro-crypto candidates to lead the Federal Reserve

Crypto-supportive Federal Reserve Vice Chair for Supervision Michelle Bowman is one of five candidates to lead the central bank ahead of current Chair Jerome Powell's leave next year.

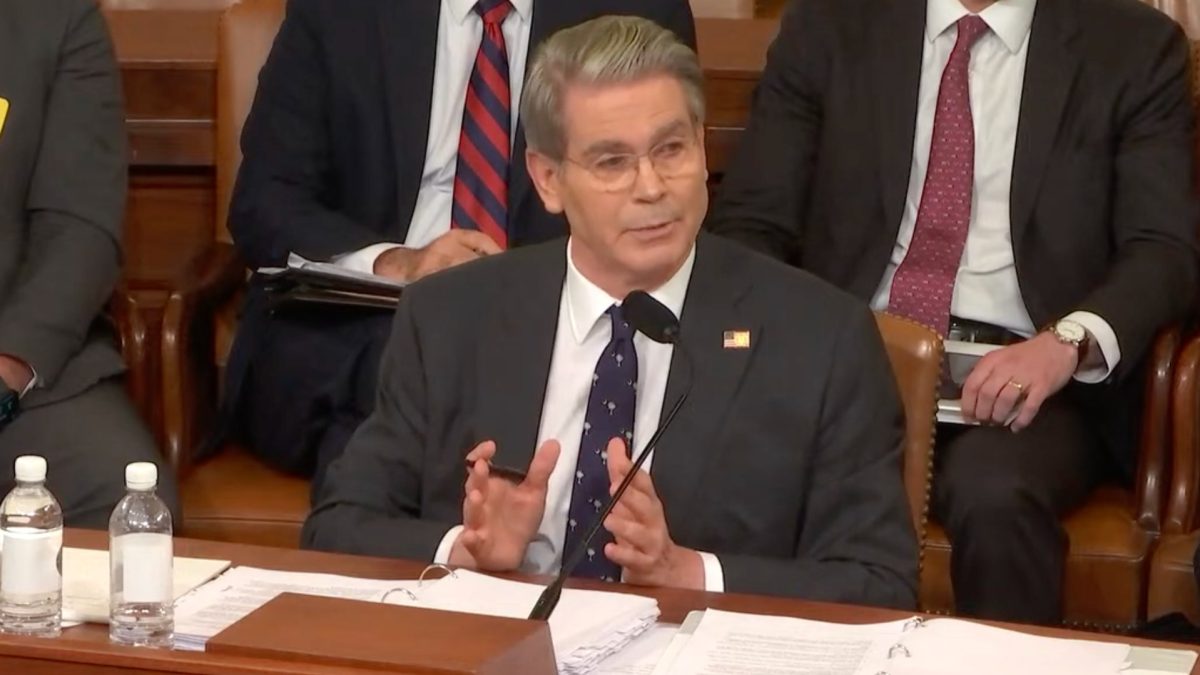

Treasury Secretary Scott Bessent also has on his list former Fed governor Kevin Warsh, National Economic Council Director Kevin Hassett, Fed governor Chris Waller and BlackRock fixed-income chief investment officer Rick Rieder, according to multiple news reports .

Bessent will reportedly interview the candidates alongside two senior Treasury Department officials and two senior White House officials. A pared-down list will then be sent to President Donald Trump. The pick will be nominated to be a Fed governor and then later Fed chair, according to CNBC .

The U.S. Treasury did not immediately respond to a request for comment from The Block.

After being tapped by Trump, the nomination goes to the Senate for consideration.

Shifts at the Fed

Searching for a new Fed governor comes amid tension at the central bank over the past year. Trump has rallied against Chair Powell for not lowering interest rates sooner and has threatened to fire him, which has a high bar since a member can only be removed "for cause" as a way to protect the central bank's independence from politics.

Tensions escalated after Trump also tried to fire Federal Reserve Board Governor Lisa Cook following accusations of mortgage fraud. Cook sued Trump and the Supreme Court later allowed her to stay on as governor.

A new central bank board governor Stephen Miran was confirmed by the Senate last month, replacing Adriana Kugler. Miran is serving the recently vacated seat until Jan. 31, 2026. Kugler announced her resignation in August and said she would be returning to Georgetown University as a professor in the fall.

Powell's term as Fed chair ends in May though he can elect to continue serving on the board of governors until 2028, according to CNBC.

Pro-crypto candidates

Bowman has previously said that the central bank is at a "crossroads" — one that will determine whether it leads or lags in financial innovation. She has also spoken about the need for banks and regulators to be open to new technologies and depart from "an overly cautious mindset."

She has also said that staff should hold a small amount of crypto to get a better understanding of it.

Other candidates have also made positive statements about crypto.

Last week, Waller said the Fed was entering a new era and said that crypto will "no longer be on the fringes" and also said the central bank would be looking into the idea of a "payment account," which he said could be helpful for entities focused on innovations in payments.

BlackRock's Rieder said in 2021 that the asset management firm was " dabbling " in bitcoin. Later in 2024, Rieder told The Wall Street Journal that though bitcoin can be volatile, over time, people will become more comfortable with it.

Lastly, Hassett disclosed in June that he has a stake in Coinbase Global Inc., worth at least $1 million.