- Hyperliquid price dips 1.2% amid profit-taking and Aster DEX competition.

- Upcoming HYPE token unlocks worth $11.9B spark short-term supply concerns.

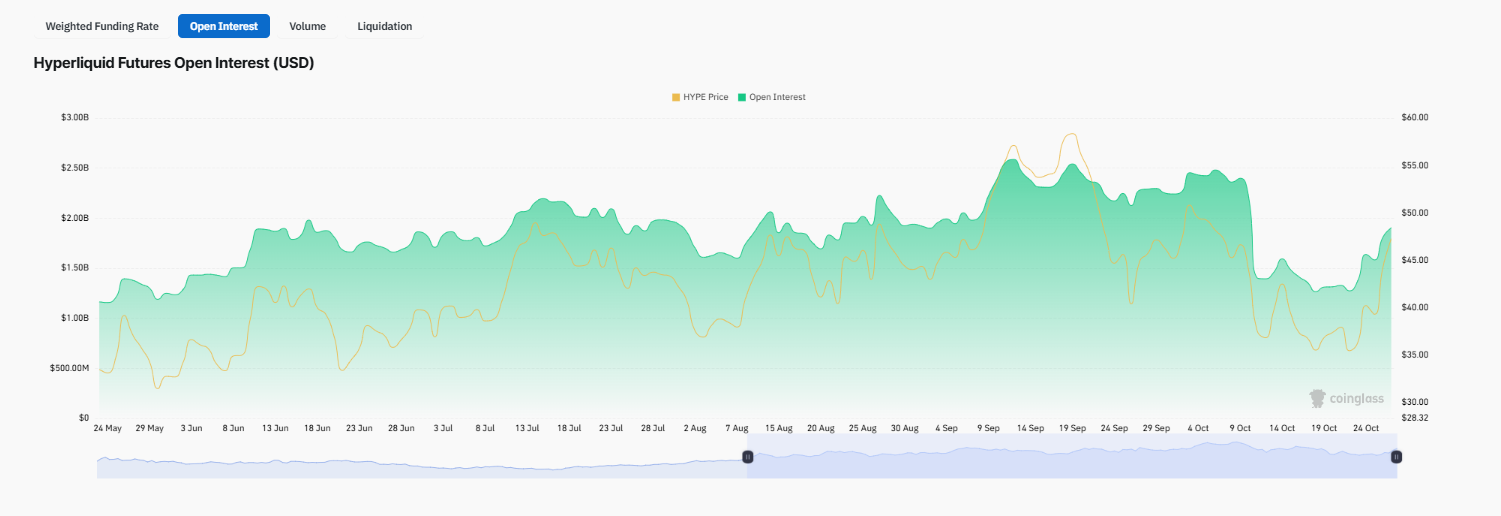

- Rising open interest and whale buying signal bullish momentum.

The Hyperliquid price has seen a brief pullback after a significant surge today, shedding 1.2% to trade around $46.57.

Despite this short-term dip, the HYPE token remains up 19.5% over the past week, highlighting continued investor interest and optimism about the project’s long-term prospects.

The retracement follows a strong rally and reflects a blend of profit-taking, technical rejection, and growing competition in the decentralised derivatives space.

Competition and profit-taking weigh on sentiment

After a robust run last week, Hyperliquid encountered selling pressure near the 38.2% Fibonacci retracement level at $49.36.

The failed breakout prompted traders to lock in gains, leading to a brief correction.

The MACD histogram is flipping negative on the 4-hour chart, signalling weakening short-term momentum, while the RSI eased from overbought territory at 69.89, suggesting that the market needed a cooldown after a 19% weekly surge.

Source: CoinMarketCap

Source: CoinMarketCap Part of the sell-off also reflects the growing rivalry between Hyperliquid and the newly launched Binance-backed Aster DEX.

Since its debut on September 17, Aster has attracted massive trading volumes, processing $20.8 billion on its first day compared to Hyperliquid’s $9.7 billion.

Aster’s rapid adoption and $2 billion in total value locked within a week have shifted liquidity across the decentralised perpetuals landscape, briefly denting Hyperliquid’s dominance.

Still, Hyperliquid maintains a commanding presence in the market.

With a $12.74 billion market cap and a total value locked (TVL) of $4.85 billion, it remains one of the largest decentralised derivatives platforms.

However, traders are watching closely as the project faces near-term headwinds from both external competition and internal supply pressures.

HYPE token unlock fears

The most immediate challenge facing HYPE is a looming token unlock event beginning on November 29.

Around 237.8 million tokens — roughly 24% of the total supply — will begin to unlock over 24 months.

At the current price, this adds nearly $500 million per month in potential sell pressure, partially offset by $65 million in monthly buybacks from the project’s treasury.

This could lead to a monthly imbalance of around $410 million, which could lead to near-term volatility as the market adjusts to the increased supply.

Despite these concerns, the project’s $1 billion treasury filing, connected to the Sonnet Bio and Rorschach merger, could help counterbalance some of the dilution fears.

The treasury’s size and strategic reserves give the team room to manage liquidity and maintain market confidence through buybacks or ecosystem growth initiatives.

On-chain data shows bullish undercurrents

While short-term traders may focus on resistance levels, derivatives, and on-chain data tell a more optimistic story.

Futures open interest (OI) on HYPE has surged from $1.27 billion last Wednesday to $1.97 billion on Monday, the highest level since early October.

Source: Coinglass

Source: Coinglass Rising open interest signals new capital entering the market, typically an indicator of growing bullish conviction.

Data from CryptoQuant also shows that whales — large investors — are increasing their positions, with buy orders dominating both spot and futures markets.

This accumulation trend suggests that institutional and high-net-worth participants expect further gains ahead.

Network data reinforces this bullish sentiment.

According to Artemis Terminal, Hyperliquid’s 24-hour chain fee revenue reached $2 million, surpassing edgeX and BNB Chain.

High network fees often correlate with elevated trading activity and liquidity, signalling robust user engagement even amid short-term market uncertainty.

Key technical levels to watch for the Hyperliquid price

Technically, HYPE has shown resilience after breaking above its descending trendline and the 50-day exponential moving average (EMA) at $43.54.

Over the weekend, it held that level as support before climbing back above $48.57.

If the token closes above the next resistance at $51.15, analysts expect the rally to extend toward the record high of $59.46, last seen on September 18.

However, a failure to hold above the $43.54 EMA could open the door for a deeper correction toward the $41.6 support zone.