The crypto market dipped another 1.5% in the past 24 hours, sliding to a total market capitalization of around $3.81 trillion, after Federal Reserve Chair Jerome Powell’s hawkish comments during the latest FOMC press conference.

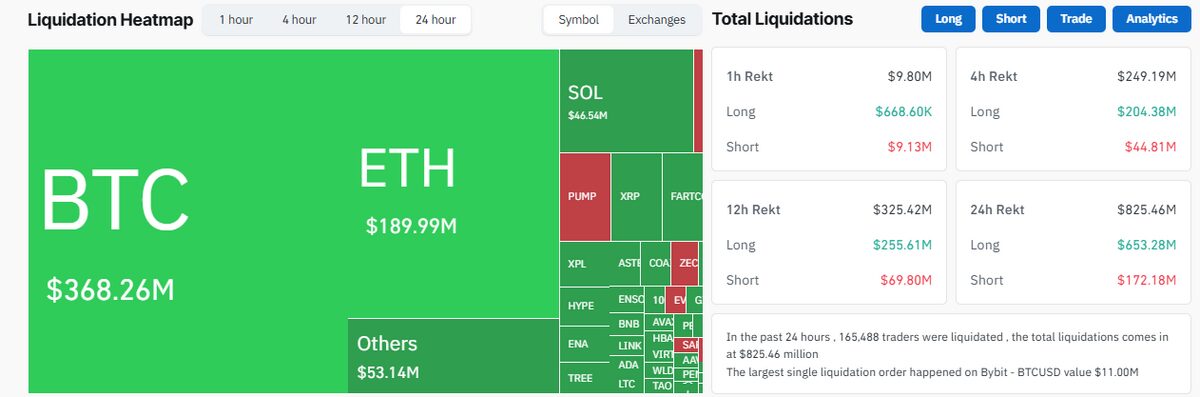

According to CoinGlass, more than $300 million in crypto positions were liquidated within minutes of Powell’s speech, bringing total 24-hour liquidations to roughly $850 million. Long traders bore the brunt, with around $653 million, over 75%, of the losses stemming from bullish bets.

Source: CoinGlass

Source: CoinGlass Fed Cuts Rates, But Outlook Clouds Over

The Fed’s 0.25% rate cut, which was widely anticipated by the market, initially seemed like bullish news for risk assets.

Sponsored

However, sentiment quickly turned sour after Powell said another cut in December was not guaranteed, citing persistent inflation pressures and limited access to fresh economic data due to the ongoing U.S. government shutdown.

In economic terms, Powell’s tone was hawkish, signaling restraint despite the initial policy easing, said on-chain analytics firm Santiment. His comments dampened investor confidence, triggering a selloff across both traditional and digital markets.

Much now depends on whether inflation continues to cool and how the labor market performs, Santiment noted.

“If inflation stays under control and unemployment starts to rise, the Fed could return to cutting rates again, which would likely lift Bitcoin and other risk assets.

But is inflation stays sticky or economic growth rebounds too strongly, Powell may hold rates steady for longer, keeping pressure on markets.”

Following Powell’s remarks, Bitcoin (BTC) dropped nearly 4%, falling to $108,000, while Ethereum (ETH) and other major altcoins mirrored the decline.

Why This Matters

Macro policy remains a dominant force in shaping crypto market sentiment. Monetary tightening, even in a cutting cycle, can still chill speculative assets like Bitcoin.

Discover DailyCoin’s trending crypto scoops:

Solana ETF Smashes Records as Wall Street Opens Door to Altcoins

Trump Eyes $20 Upon US-China Truce, But $35M Unlock Lurks!

People Also Ask:

A Fed rate cut occurs when the U.S. Federal Reserve lowers its benchmark interest rate to stimulate economic growth and borrowing.

Lower rates generally weaken the U.S. dollar and encourage investors to move capital into risk assets like Bitcoin and Ethereum.

Rate cuts often boost liquidity and market confidence, which can increase demand for Bitcoin—though reactions depend on overall market sentiment.

A more hawkish tone—suggesting slower or fewer cuts—can hurt crypto prices as investors expect tighter financial conditions.

Lower rates reduce traditional returns, sometimes driving investors toward higher-yield crypto products such as DeFi staking or lending protocols.