Bitcoin ETFs Bleed $490 Million as BlackRock Faces Fraud Scandal

Major crypto ETFs (Bitcoin and Ethereum) posted $672 million in combined outflows on Thursday, October 30. BlackRock’s IBIT ETF lost $291 million, and ETHA shed $118 million.

Meanwhile, a $500 million telecom-financing fraud tied to BlackRock’s private-credit arm has rocked institutional markets, raising new concerns about risk management and due diligence.

Institutional ETF Redemptions Show Risk Aversion

Institutional clients of major asset managers pulled $490 million from Bitcoin ETFs on October 30, according to data from Farside Investors.

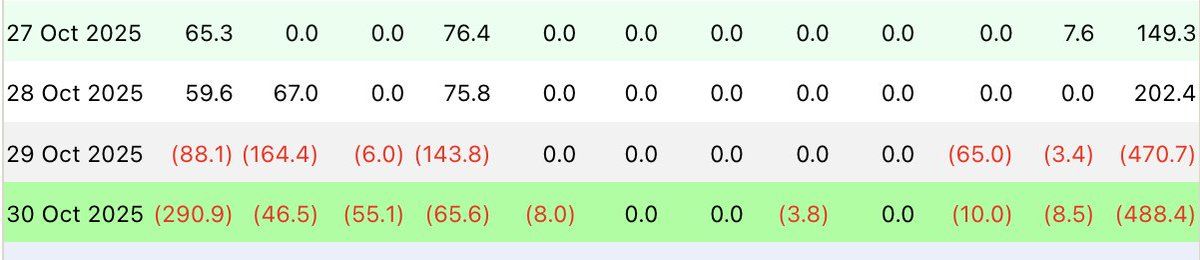

BlackRock’s IBIT led the exodus with $290.9 million in redemptions. Fidelity, Bitwise, ARK, Invesco, VanEck, and Grayscale also recorded heavy outflows. Ethereum ETFs saw $184 million in losses, with BlackRock’s ETHA responsible for $118 million.

Bitcoin ETF outflows totaled $488.4 million on October 30, 2025. Source: Farside Investors

Bitcoin ETF outflows totaled $488.4 million on October 30, 2025. Source: Farside Investors The magnitude of these withdrawals signals a broader retreat from risk as macroeconomic uncertainty grows. Analysts see the outflows as profit-taking and portfolio trimming rather than panic selling.

Institutions are still trimming risk, $BTC and $ETH spot ETFs saw heavy outflows, led by BlackRock’s $IBIT (-$291M) and $ETHA (-$118M), totaling $488M and $184M.But $SOL ETFs quietly pulled in $37M. Looks like some capital’s rotating toward higher-beta plays again.

— Kyledoops (@kyledoops) October 31, 2025

Notably, this coincides with a closer scrutiny of BlackRock following revelations of large-scale fraud in its private credit division. The timing has increased anxiety among investors.

BlackRock Fraud Scandal Reveals Private Credit Risks

BlackRock’s difficulties go beyond ETF outflows. Bloomberg reports that its private-credit arm, HPS Investment Partners, lost over $500 million in a telecom-financing scheme involving fake accounts receivable.

Court filings in the New York Supreme Court allege that borrowers Broadband Telecom and Bridgevoice used forged contracts and invoices from companies like T-Mobile and Telstra as collateral for sizable loans. The court documents also outline years of systematic forgery and misrepresentation.

The fraud was uncovered in August 2025, resulting in bankruptcies and lawsuits. BNP Paribas, BlackRock’s partner in making these loans, is also named in the litigation.

The scandal emerged just 90 days after BlackRock acquired HPS for $12 billion. The purchase, finalized on July 1, 2025, aimed to expand BlackRock’s reach in private credit. Instead, the discovery has raised questions about the company’s due diligence and risk oversight during the process.

BlackRock’s private-credit arm was defrauded of over $500 million by an Indian named Bankim Brahmbhatt.Brahmbhatt ran a telecom-financing firm named Carriox Capital and fabricated customer contracts and invoices from major telecom companies such as T-Mobile, Telstra, and…

— AF Post (@AFpost) October 30, 2025

Notwithstanding, BlackRock remains the clear leader in the ETF space despite this turbulence. According to US Crypto News analysis, IBIT attracted $28.1 billion in net inflows since the start of 2025, outpacing all competitors combined.

Removing IBIT, the sector would have seen net outflows of $1.2 billion this year. Such concentration raises concerns about systemic risks if BlackRock were forced to cut exposure or faced major redemptions, potentially draining liquidity across the crypto ETFs market.

Short Liquidations and Market Volatility on the Horizon

As institutional money exits Bitcoin ETFs, leveraged traders now face more risk. Whale Insider noted on X that more than $3 billion in Bitcoin short positions could be liquidated if the price reaches $112,600.

JUST IN: Over $3,000,000,000 worth of $BTC short positions to be liquidated when price hits $112,600.

— Whale Insider (@WhaleInsider) October 31, 2025

With Bitcoin trading near $109,287 as of this writing, it is just 2.48% away from this threshold. Therefore, even a modest rally might trigger a short squeeze and rapid market turnaround.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCrypto This potential for sharp price moves complicates the bearish outlook suggested by ETF outflows. Liquidation data from Coinglass shows many short positions gathered just above current levels. Any upward move could spark a cascade of covering.

The interplay between institutional redemptions and leveraged bets creates a precarious scenario where sentiment may flip quickly.