Is Tria, the next Legion launch project, worth participating in?

Tria will launch its community round token sale on Legion on November 3 (UTC+8), with an FDV of $100-200 million.

Written by: Stacy Muur

Translated by: Chopper, Foresight News

Tria is a non-custodial neobank application that allows users to spend, trade, and earn across more than 100 chains, with zero gas fees and no mnemonic required. On November 3 (UTC+8), it will launch a “contribution-based sale round” on Nozomi by Legion.

Tria Investment Thesis

The core logic of Tria is simple. By 2030, on-chain transaction volume is expected to approach $100 trillion, but the industry bottleneck is not yield or liquidity—it’s usability.

Monthly stablecoin settlement volume has already surpassed $1.1 trillion, exceeding Visa and Mastercard, but most people still cannot use crypto in daily scenarios. Tria addresses this with a cross-chain abstracted neobank solution: it retains non-custodial features while hiding the technical complexity of crypto.

Tria’s product highlights include:

- Spending: Supports Visa card payments in over 150 countries, up to 6% cashback, zero fees for deposits/withdrawals/payments/forex transactions;

- Earnings: Idle assets can earn up to 15% APY, with automatic bill repayment from yield;

- Trading: A single interface covers 100+ chains, with built-in AI narrative tracking—powered by BestPath AVS.

- After 11 weeks of closed testing: $1.2 million in revenue, $15 million in transaction volume, 20,000 users, 4,400 affiliate members; average revenue per user $105 (about twice that of Phantom). BestPath has been adopted by over 70 protocols (such as Arbitrum, Polygon, Injective, Sentient) and, through integration, covers more than 250,000 users.

Tria enables crypto to be “ready-to-use,” demonstrating innovation in the following areas.

- BestPath AVS (Intent Market): Solvers, relayers, liquidity routers, and fast finality layers compete to match each transaction with the optimal execution path. The system scores on cost, speed, and security, ensuring optimal settlement without cross-chain bridges;

- Unchained (AVS L2→L1): An EVM-compatible, consumer-facing execution environment, which will upgrade to an L1 network in the future—optimized for payments and agent interactions;

- Multi-VM support: Compatible with EVM, SVM, IBC, Move, BTC, providing a single SDK for a “chain-agnostic” user experience.

Tria’s ultimate goal is to build a “chain-agnostic” financial operating system, retaining non-custodial features, simplifying the user process, and achieving mainstream user adoption at scale.

Support from Nozomi

Tria is not just a product launch, but also a typical case of Nozomi’s “fair, compliant, contribution-based” model.

Unlike traditional launches “only for VCs, with inflated valuations,” Nozomi adopts a “Legion Score” mechanism, allocating participation eligibility based on on-chain activity, community contribution, influence, and professionalism.

How is the sale quota allocated?

- Purchase any Tria card with a promo code (enjoy 20% discount) to access the locked quota channel;

- Complete KYC verification on Legion;

- Submit the priority quota form;

- Active card usage can unlock airdrops. (Note: Over $30 million in funds are already watching, and the sale is likely to be oversubscribed.)

My Evaluation Framework

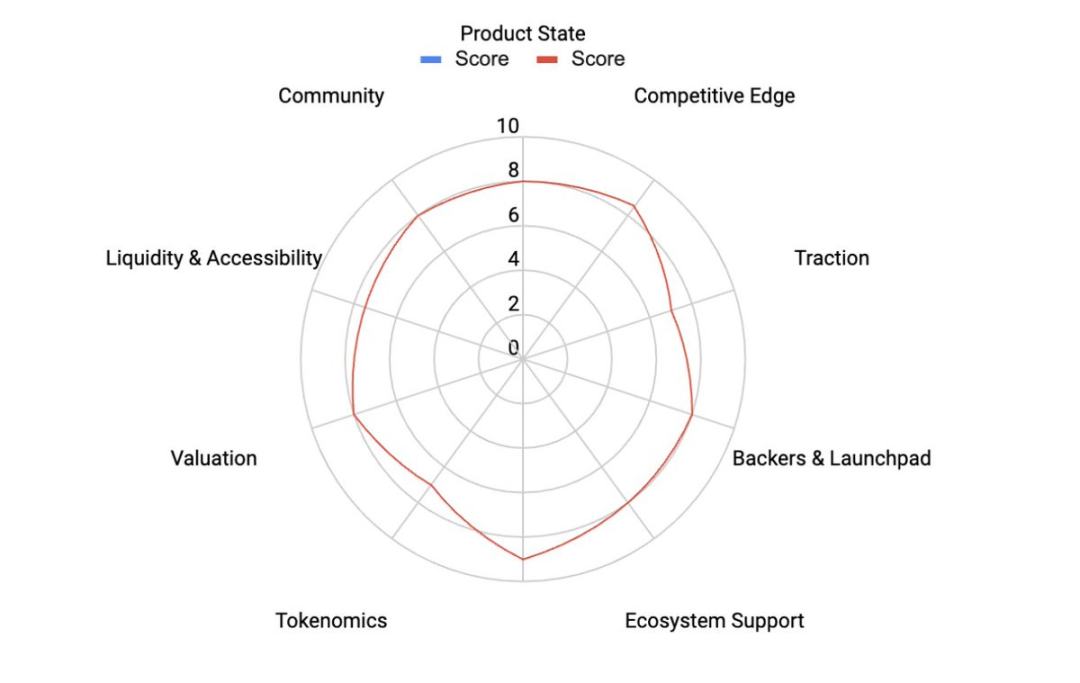

The Muur Score framework focuses on core project dimensions: product, token design, user growth, investors, and market environment, with weighted scores by importance.

For Tria, the evaluation dimensions include:

- Product: chain-agnostic neobank experience, BestPath AVS + Unchained infrastructure, closed test data;

- Tokenomics: functional utility, allocation/unlock mechanisms, issuance valuation;

- Community & Narrative: affiliate promotion network, organic buzz, neobank/intent layer track trends;

- Distribution model: Legion’s contribution-based sale mechanism, card-locked quota channel.

Comprehensive score: 8.21/10. Tria has real revenue, clear differentiation advantages, and a synergistic distribution model, but there are still uncertainties in scaling compliance, liquidity management, and multi-VM routing at the execution level.

Tokenomics

Tria will launch its community sale round on the Legion platform on November 3 (UTC+8). The fully diluted valuation (FDV) for this round is split into two tiers: $100 million (30% unlocked) or $200 million (60% unlocked). The unlock mechanism is a 2-month lock-up period plus 6 months of linear unlocking.

TRIA token utilities include:

- Settlement for BestPath and neobank ecosystem;

- Paying fee discounts (gas/transaction/card fees);

- Staking to become a “Pathfinder”;

- Ecosystem reward distribution, governance voting;

- Structured buyback and burn from protocol revenue.

The token generation event (TGE) is planned for Q4 2025.

Tokenomics Evaluation

- Functional utility: 9/10—indispensable demand on both consumer and infrastructure ends;

- Structural design: 7/10—balanced lock-up and unlock schedule, pending full unlock curve and audit report;

- Valuation level: 8/10—$100-200 million FDV is a value zone compared to similar payment/infrastructure projects.

- Liquidity: Not rated before TGE; trading is expected to open after the Legion sale, with market makers providing deep liquidity.

Risk Warning

Tria’s business outlook faces the following challenges:

- Compliance risk: Card/funding channel compliance filings are required in over 150 countries, which is highly challenging;

- Execution risk: Advancing both consumer banking services and multi-VM infrastructure simultaneously increases business complexity;

- Competition risk: Custodial neobanks may quickly imitate its features, so maintaining user experience and fee advantages is crucial;

- Liquidity risk: Short-term liquidity after launch depends on Legion sale allocation, unlock schedule, and market maker depth.

Valuation Reference

Similar payment/consumer-grade infrastructure projects typically have an FDV of $350 million to $1 billion after launch, with most having weak revenue before going live.

Tria’s $100-200 million FDV pricing benchmarks high-potential TGE infrastructure projects, but it already has real revenue and users, and the token has dual utility for both consumer and infrastructure ends, making its valuation highly cost-effective.

Even capturing only a tiny fraction of Revolut’s scale (for example, 1% of its $4 trillion annual transaction volume) would mean billions of dollars in on-chain transaction volume routed through BestPath/Unchained, with huge growth potential.

Summary

Catalyst: Legion sale on November 3 (UTC+8), with over $30 million in funds watching before launch;

Core mechanisms: BestPath AVS offers the lowest cost and fastest cross-chain execution; Unchained will gradually upgrade from AVS L2 to L1;

Sale rules: Purchase Tria cards to lock quota, card tiers at $20/$90/$225; active usage can earn airdrops; priority form submission required;

Risk warning: Compliance pressure in over 150 countries, post-launch token liquidity, and the complexity of advancing both consumer and infrastructure businesses simultaneously.

My score: 8.21/10. If Tria can maintain its revenue growth momentum during the public testing phase and successfully achieve global compliance, it may become the “Revolut moment” for crypto, while also setting another benchmark for Legion’s contribution-based sale model.