- Bitcoin trades around $110,970 inside a $109K–$112K compression zone, signaling an imminent volatility breakout.

- Spot flows remain balanced with $60.9M inflows, while long-short ratios near 1.8 reflect cautious optimism.

- A breakout above $112,400 could trigger upside toward $114K–$117K, while $109K remains key support.

Bitcoin price today hovers near $110,970, holding a narrow range as traders wait for a decisive move. The market is coiling inside a symmetrical triangle, with compression tightening between $108,700 and $112,400 on the 4-hour chart. Momentum remains muted, but the pattern suggests that volatility could return soon.

Buyers Hold the Line Near $109K

BTC Price Dynamics (Source: TradingView)

BTC Price Dynamics (Source: TradingView) The Bitcoin price continues to respect its triangle base near $108,773, where the 0.236 Fibonacci retracement and lower Bollinger Band align. On the upside, the 20-, 50-, and 100-EMA levels cluster between $111,400 and $112,400, acting as short-term resistance.

A close above $112,092 could open the path toward $114,700, the 0.618 Fibonacci retracement. Beyond that, the next pivot stands near $117,500. If sellers regain control and push below $109,000, the focus could shift to $106,800 and $103,400, key levels from the October swing.

BTC Key Technical Levels (Source: TradingView)

BTC Key Technical Levels (Source: TradingView) RSI on the 30-minute chart sits around 54, showing balanced momentum with a slight bullish bias. The structure of higher lows supports the idea of gradual accumulation beneath resistance.

Spot Data Reflects Calm Before Movement

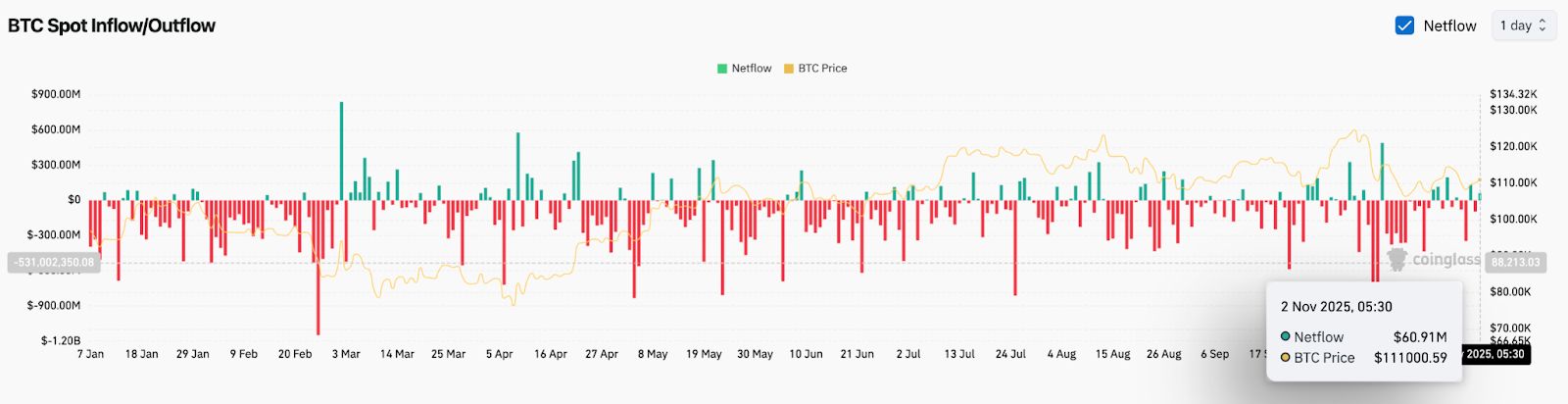

BTC Netflows (Source: Coinglass)

BTC Netflows (Source: Coinglass) Coinglass data shows about $60.9 million in Bitcoin spot inflows on November 2, hinting at light selling but not enough to break structure. Recent sessions show alternating inflow and outflow cycles, signaling equilibrium between buyers and sellers.

The Bitcoin price today has remained steady near $111,000, even with those inflows, which implies demand continues to meet available supply. While not aggressive accumulation, the tone remains neutral to slightly positive across major exchanges.

Futures and Options Indicate Neutral Sentiment

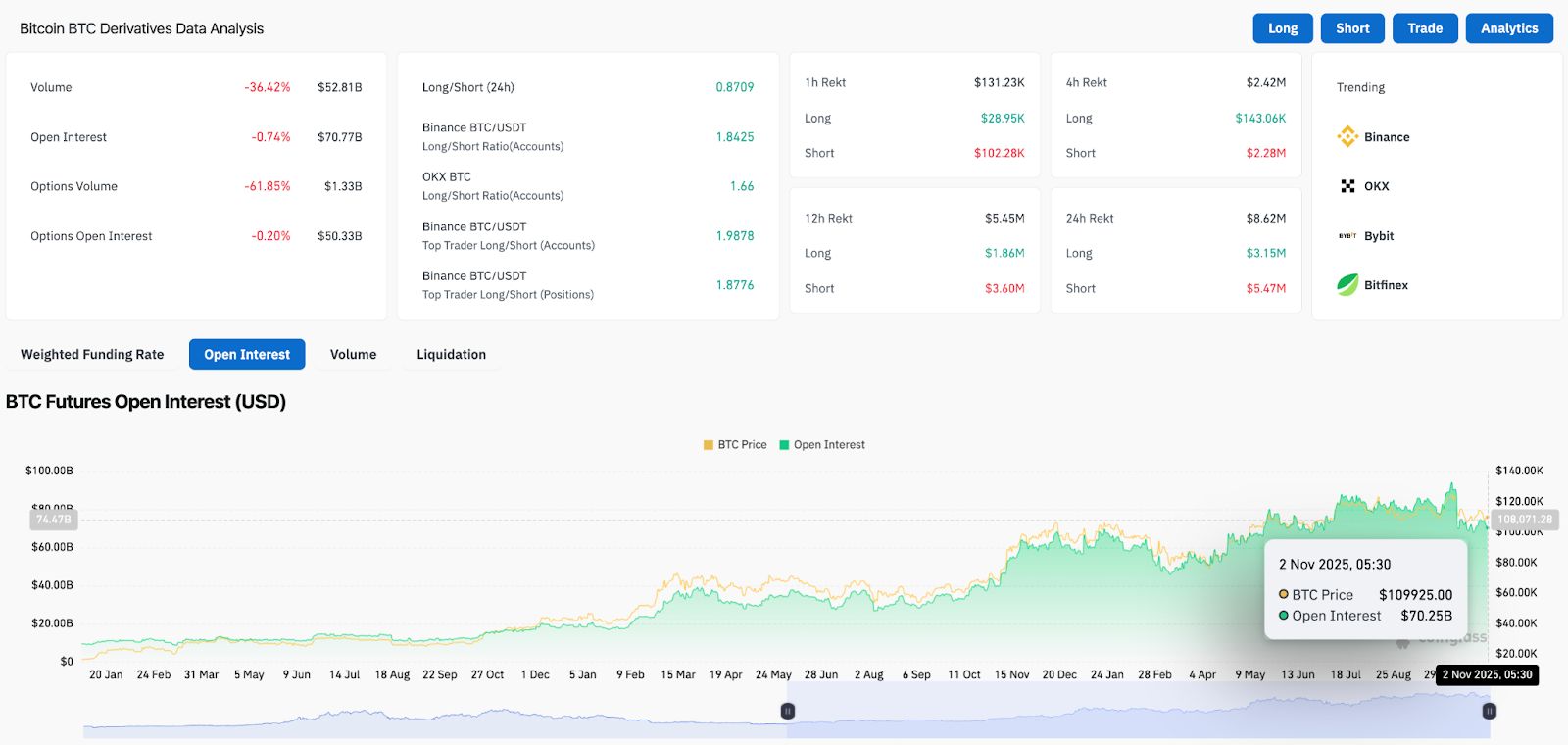

BTC Derivative Analysis (Source: Coinglass)

BTC Derivative Analysis (Source: Coinglass) Bitcoin futures open interest is around $70.7 billion, slipping less than 1% from the prior day. Options volume has dropped by over 60%, showing that traders are reducing leverage and waiting for clearer direction.

Across major platforms, long-short ratios are skewed toward longs. Binance and OKX both show readings near 1.8, suggesting a cautious optimism among participants. Top traders also remain net-long, reinforcing the view that the broader market expects an eventual upside break.

This positioning could amplify a move once price breaks free from the current structure. If the $112K resistance gives way, stop orders and new longs could accelerate momentum toward the $114K–$117K zone.

Outlook: Will Bitcoin Go Up?

The near-term Bitcoin price prediction stays balanced between caution and opportunity. If the price closes above $112,400, the bullish path could extend toward $114,700, followed by $117,500. A sustained breakout from this structure may also invite fresh inflows and unwind short positions.

Failure to maintain above $109,000 would weaken short-term structure and risk a dip toward $106,000. Yet as long as Bitcoin holds above $103,400, long-term momentum remains intact.

The coming sessions may define the next multi-week trend. The market’s compression, neutral sentiment, and stable on-chain data all point to one conclusion—Bitcoin is preparing for its next decisive move, and traders are watching closely for which side gives first.