Bitcoin and Ethereum: Massive Withdrawals from Exchanges… A Sign of Rebound or Caution?

On-chain data reveals a rare phenomenon: billions of dollars in bitcoin and ethereum have been withdrawn from exchange platforms. While prices struggle to recover after a tough October, these massive movements raise questions: are they a harbinger of a trend reversal or just a simple asset reallocation?

In brief

- Billions of dollars in bitcoin and ethereum leave exchanges, signaling a possible accumulation before a market rebound.

- Bitcoin resists better than gold, attracting institutional investors despite an uncertain economic environment.

- Ethereum benefits from technical advances, but its future will depend on decentralized application activity and DeFi demand.

Why are investors massively withdrawing their bitcoin and ethereum from exchanges?

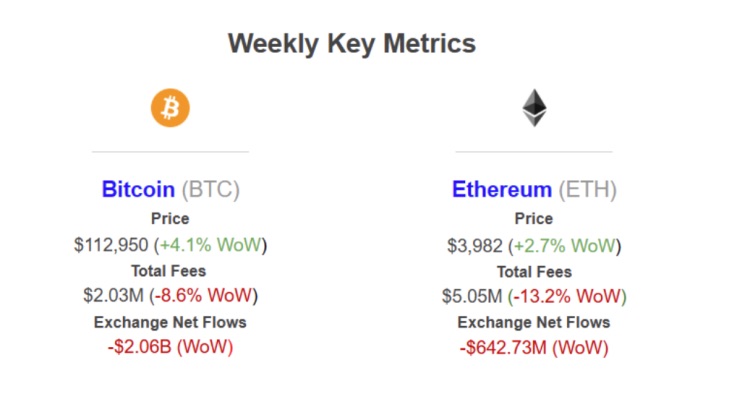

Platforms like Sentora and Glassnode confirm record withdrawals. Indeed, over 2 billion dollars in bitcoin and more than 600 million dollars in ethereum have left exchanges in one week. Several hypotheses explain this phenomenon:

- Some see it as a long-term holding strategy, anticipating a future price increase;

- Others mention increased distrust towards centralized exchanges, recalling the lessons from FTX and SBF’s confessions .

+2 billion $ in bitcoin and +600 million $ in ethereum leave exchanges in one week

+2 billion $ in bitcoin and +600 million $ in ethereum leave exchanges in one week Institutional investors also play a key role. Bitcoin and Ethereum ETFs, although volatile, attract stable capital, encouraging securing assets off platforms. Finally, the decrease in transaction fees on the Bitcoin and Ethereum blockchains suggests a reduction in selling pressure, reinforcing the hypothesis of discreet accumulation.

BTC & ETH: Macroeconomic and Technical Signals to Watch?

The macroeconomic context remains uncertain. Central banks keep rates high, weighing on risky assets. Yet, ethereum and bitcoin resist better than gold, which recently dropped 10% . Technical indicators offer clues: the RSI (Relative Strength Index) for BTC and ETH shows neutrality, while the Fear and Greed Index remains in the fear zone, often a precursor to rebounds.

In addition to billions $ in bitcoin and ethereum leaving exchanges , trading volumes are also decreasing. However, active addresses are increasing, a sign of growing interest in holding. Moreover, heightened monitoring of on-chain flows and whale positions is essential to anticipate movements.

Bitcoin: A Resistance Against Gold and Economic Turmoil

Unlike gold, which suffered massive sales in recent weeks, bitcoin shows remarkable resilience. Recent exchange withdrawals, exceeding 2 billion dollars, confirm a preference for long-term holding. This trend is explained by its growing status as a “digital store of value”, strengthened by ETF adoption and programmed supply scarcity.

Institutional investors, such as MicroStrategy or ETF managers, maintain their positions despite volatility. The comparison with gold is striking: while central banks sell their gold reserves, bitcoin reserves on exchanges are decreasing. This divergence highlights increased confidence in BTC as a hedge against inflation and systemic crises.

Ethereum: A Transition to Maturity or a Passing Trend?

Ethereum follows a similar dynamic to bitcoin, but with specifics. Massive exchange withdrawals coincide with technical advances, like the Dencun upgrades and the rise of layer 2 solutions. These developments reduce fees and improve scalability, attracting more users and developers.

However, Ethereum remains dependent on the activity of decentralized applications (DeFi, NFT). If volumes in DeFi hold steady, withdrawals could reflect accumulation in anticipation of a future rise. Conversely, a prolonged drop in network activity could temper this optimism. The coming months will be crucial to confirm if ETH establishes itself sustainably as a major financial infrastructure.

Massive withdrawals of bitcoin and ethereum from exchanges could mark a turning point. If history repeats itself, these moves often precede phases of increase. Yet, in an uncertain economic context, caution remains warranted. One question remains: do these withdrawals announce a sustained rebound or just a pause before new upheavals?