Former UFC (Ultimate Fighting Championship) champion and legendary fighter Khabib Nurmagomedov is stepping into the blockchain arena.

The sports star recently announced a multi-billion-dollar joint venture with Multibank Group to create a regulated ecosystem linking global finance, sports, and technology.

Sponsored

Under the partnership, Khabib Gyms, the global fitness brand owned by Nurmagomedov, will be tokenized on the Mavryk Blockchain, allowing investors to buy regulated digital shares in the business.

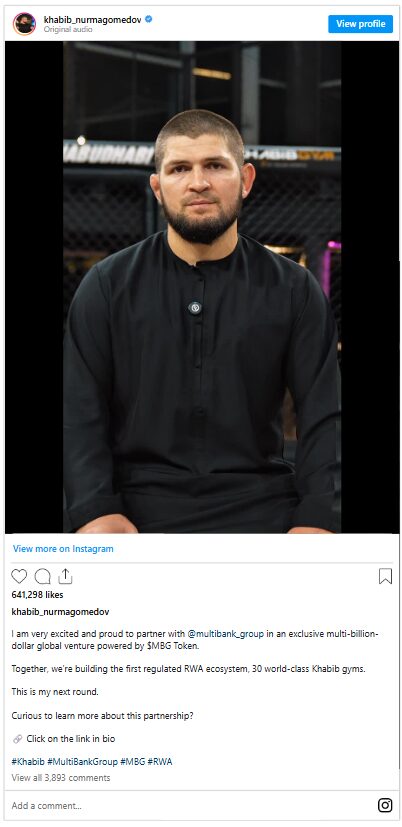

Source: Instagram

Source: Instagram Khabib Nurmagomedov is widely regarded as one of the greatest fighters in mixed martial arts (MMA) history. He became UFC Lightweight Champion in 2018, defeating top fighters like Conor McGregor, and is celebrated globally for his discipline and influence both inside and outside the octagon.

Expanding Access to Tokenized Fitness Assets

The project is supported by Mavryk Network, the layer-1 blockchain powering the tokenization of more than $10 billion in real-world assets (RWAs). Its founder, Alex Davis, says the project signals a turning point for the industry.

“With much of the hype around RWAs, it’s on builders to deliver the right infrastructure for these assets to truly scale to their potential and go mainstream,” Davis noted.

The partnership aims to turn traditional businesses into tokenized, tradeable assets, broadening access to investment opportunities within the global fitness industry.

Once operational, verified investors will be able to buy and trade fractional ownership tokens of Khabib Gyms through MultiBank.io’s RWA platform.

Under the plan, holders of Khabib Gym tokens will receive a portion of the gyms’ annual profits. All transactions will be recorded on-chain through Mavryk’s blockchain, providing transparency and traceability for investors.

Nurmagomedov recently announced plans to open 30 Khabib Gyms worldwide and expand his Eagle FC fight brand. He also revealed developments for Gameplan, a Web3 sports platform.

The project extends an existing collaboration between Mavryk Network blockchain and MultiBank Group, which has already tokenized more than $10 billion in UAE real estate under MAG Lifestyle Development, featuring properties such as The Ritz-Carlton Residences and Keturah Reserve.

MultiBank has also invested in Mavryk’s MVRK token, securing access to the blockchain technology it intends to use for further real-world asset tokenization initiatives worldwide.

Why This Matters

The move signals a growing trend of linking high-profile brands and real-world businesses to regulated blockchain platforms, giving global investors direct access to tokenized assets.

Discover DailyCoin’s trending crypto scoops:

Balancer Loses $128M in DeFi Hack, Exploit Spreads Across Multiple Chains

$2.3B Exodus Hits MEXC Amid Insolvency Fears

People Also Ask:

RWA tokenization means converting physical or traditional financial assets—like real estate, bonds, or commodities—into digital tokens on a blockchain for easier transfer and fractional ownership.

It increases liquidity, transparency, and accessibility, allowing investors to buy fractions of assets and trade them more efficiently in regulated environments.

They bridge traditional finance and blockchain technology, combining regulatory credibility with mainstream visibility to drive adoption of digital asset solutions.

They offer the innovation of blockchain while ensuring compliance with financial laws, providing safer participation for both retail and institutional investors.

Collaborations between established brands, fintech firms, and regulated institutions strengthen trust, expand global reach, and accelerate the integration of digital assets into everyday finance.