Crypto ETF Weekly Report | Last week, US Bitcoin spot ETFs saw a net outflow of $798 million; US Ethereum spot ETFs saw a net inflow of $16.1 million

Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

US Bitcoin Spot ETFs See Net Outflow of $798 Million

Last week, US Bitcoin spot ETFs experienced net outflows for three days, with a total net outflow of $798 million.

Last week, 9 ETFs were in a net inflow state, with outflows mainly coming from IBIT, FBTC, and BITB, which saw outflows of $403 million, $155 million, and $79 million respectively.

Data source: Farside Investors

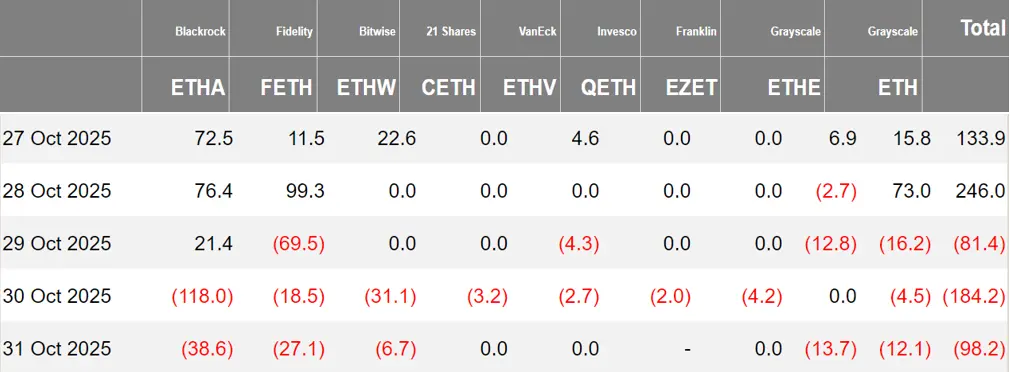

US Ethereum Spot ETFs See Net Inflow of $16.1 Million

Last week, US Ethereum spot ETFs saw net inflows for two days, with a total net inflow of $16.1 million.

The main inflow last week came from Grayscale ETH, with a net inflow of $56 million. Two Ethereum spot ETFs were in a net inflow state.

Data source: Farside Investors

Overview of Crypto ETF Developments Last Week

Bitwise Updates XRP ETF Application, Management Fee Set at 0.34%

Bitwise has updated its XRP ETF application for the fourth time, adding exchange information (New York Stock Exchange) and a management fee rate (0.34%). Eric Balchunas noted that these are usually among the final key steps required in the ETF application process.

Canary XRP Spot ETF Latest Application Removes Delayed Amendment Clause, Expected to List on November 13

According to crypto journalist Eleanor Terrett, Canary Capital has submitted an updated S-1 form for its XRP spot ETF, removing the "delayed amendment clause" that prevented automatic registration effectiveness, and has handed over control of the timeline to the US SEC.

If Nasdaq approves the 8-A form application, Canary's XRP ETF will be officially launched on November 13. Note: Government reopening may affect the timeline. If the application materials are complete and the US SEC is satisfied, the timeline may be advanced; if staff raise more comments, the timeline may be delayed. However, it is worth noting that the US SEC chairman himself also seems to support companies using the automatic effectiveness mechanism. Although he did not directly comment on the ETF launch, Paul Atkins stated yesterday that he was pleased to see companies like MapLight use the 20-day statutory waiting period to go public during the government shutdown, and praised Bitwise and Canary for using the same legal mechanism to launch SOL, HBAR, and LTC ETFs this week.

Fidelity Submits S-1 Update for Its SOL ETF

According to crypto journalist Eleanor Terrett, Fidelity has just submitted an updated S-1 for its SOL ETF, removing the "delayed amendment" that prevented automatic registration effectiveness and giving the SEC control over the timing. This modification follows the example of the already listed Bitwise SOL ETF.

Grayscale Launches Solana ETF with Staking Feature on NYSE Arca

According to The Block, Grayscale has converted its GSOL into an ETF and listed it on NYSE Arca, including SOL staking functionality, and claims to have become the largest Solana ETP manager in the US.

The previous day, Bitwise listed its Solana ETF on the NYSE; Canary listed Litecoin and HBAR ETFs on Nasdaq. During the US government shutdown, the SEC issued guidance: S-1s without delayed clauses can become automatically effective after 20 days; and has approved listing standards for commodity trust shares on three exchanges, which may accelerate the launch of multiple crypto ETFs.

21Shares Submits HYPE Spot ETF Registration Application to SEC

According to SEC documents, 21Shares US LLC has submitted an S-1 registration statement for the "21Shares Hyperliquid ETF".

This ETF aims to track the USD price performance and staking yield of the Hyperliquid network's native token HYPE, reflecting overall returns after deducting related fees. The fund structure is a Delaware statutory trust, with custodians including Coinbase Custody and BitGo Trust.

Canary Has Submitted an Updated S-1 Filing for Its Spot Solana ETF, Fee Set at 0.5%

According to the SEC website, Canary has submitted an updated S-1 application for its spot Solana ETF, with the fee set at 0.5%.

Spot SOL, LTC, and HBAR ETFs Have Begun Trading on Wall Street

Crypto journalist Eleanor Terrett posted on X that the first spot SOL, LTC, and HBAR ETFs have begun trading on Wall Street.

Bitwise to Launch Solana Staking ETF (BSOL)

Cointelegraph posted on X that Bitwise will launch its Solana staking ETF (BSOL), which is the first ETP in the US with 100% spot SOL exposure.

VanEck Submits Sixth S-1/a Amendment for Spot Solana ETF

According to analyst MartyParty, VanEck has submitted the sixth S-1/a amendment for its spot Solana ETF, with changes including: submission status changed to "effective", and the fee rate is 0.3% (which was also 0.3% in previous filings).

Opinions and Analysis on Crypto ETFs

Analyst: DAT Liquidations and ETF Outflows Lead to Crypto Market Weakness, Bitcoin Still Expected to Hit New Highs

Crypto analyst Miles Deutscher pointed out that the current weakness in the crypto market is mainly due to three factors: DAT liquidations putting pressure on Bitcoin and Ethereum, ETF demand exhaustion leading to consecutive net outflows, and the severe psychological and substantial impact of the October 10 event on the market.

Nevertheless, he believes that a strong rebound in Bitcoin prices could completely change market dynamics and is likely to set new highs. Deutscher suggests that investors use the market downturn to focus on researching potential areas such as intelligent agents, robotics, RWA, and prediction markets, while closely monitoring changes in on-chain liquidity to prepare for a market recovery.

Grayscale Executive: US SOL Spot ETFs Expected to Absorb 5% of Total Supply in Next Two Years, Inflows May Reach $5 Billion

According to DL News, Grayscale's Head of Research Zach Pandl predicts that US Solana spot exchange-traded funds (ETFs) could replicate the success of Bitcoin and Ethereum products, absorbing at least 5% of the total supply of Solana tokens in the next one to two years.

Based on current prices, this means that more than $5 billion worth of Solana tokens could be absorbed by companies such as Grayscale and Bitwise. This week, two Solana ETFs were officially listed for trading. Bitwise's BSOL was launched on Tuesday, and Grayscale's GSOL was listed on Wednesday. Unlike Bitcoin ETFs, Solana ETFs support staking functionality, with an annualized yield of about 5.7%.