Tom Lee Predicts S&P 500 Could Jump 250 Points in November as Year-End Rally Builds

Fundstrat’s Tom Lee predicts the S&P 500 could surge 250 points in November, driven by fund managers racing to meet benchmarks. Over 80% of managers are behind their targets in 2025, setting up a potential performance chase through year-end.

This prediction comes at a pivotal moment for equity markets. Historically, November favors stocks, and despite valuation worries, macroeconomic trends boost optimism.

Fund Managers Drive November Rally Expectations

Lee’s bullish outlook, shared during an interview with CNBC, centers on a “performance chase.” Most fund managers are trailing benchmarks in 2025, so late-year buying often increases as they attempt to close gaps. This pattern has historically lifted returns during strong seasonal periods.

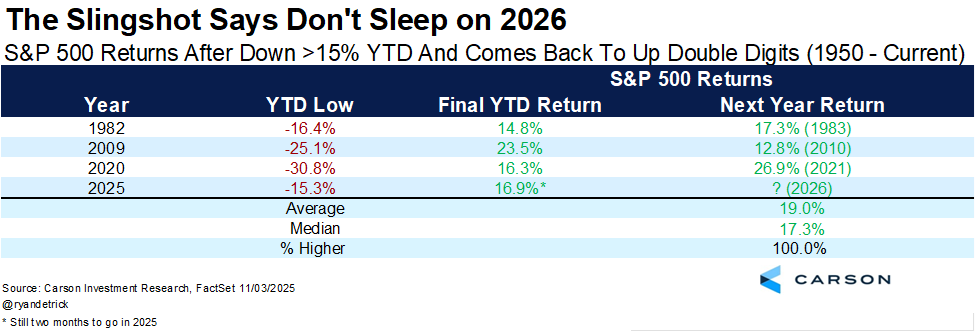

The S&P 500 has already staged a swift turnaround in 2025. After dropping over 15% year-to-date in April, the index is now set to finish up by double digits.

This recovery places 2025 among rare years, such as 1982, 2009, and 2020, which also saw similar reversals. Ryan Detrick noted that each of those years was followed by another with double-digit gains.

S&P 500 slingshot years comparison shows 2025 recovery pattern. Source: Ryan Detrick

S&P 500 slingshot years comparison shows 2025 recovery pattern. Source: Ryan Detrick Following a six-month rally of 22.8%, history shows that the S&P 500 often continues to rise. Median three-month gains after such rallies hit 3.4%, while 12-month gains average nearly 10%. This momentum supports Lee’s view of continued upside into 2026.

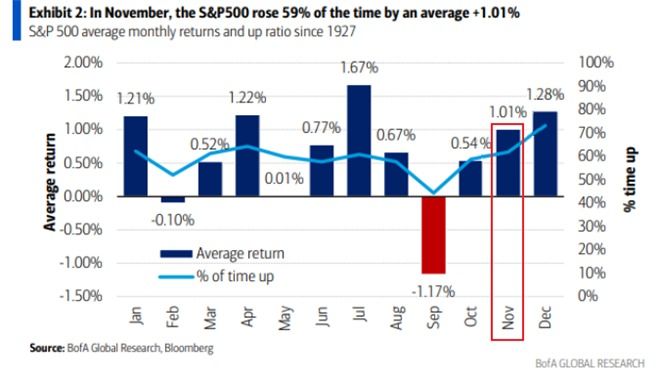

November is historically one of the best months for equities. Since 1927, the S&P 500 has ended higher in 59% of Novembers, the third-strongest record with an average return of 1.01%.

The Nasdaq 100 and Russell 2000 have posted even better average gains of 2.47% and 2.64% in this period.

November ranks as the third-strongest month for S&P 500 since 1927. Source: The Kobeissi Letter

November ranks as the third-strongest month for S&P 500 since 1927. Source: The Kobeissi Letter When the S&P 500 is up more than 15% year-to-date entering November, the index has averaged a 2.7% return.

In the first year of a US presidential cycle, November has also been strong, with the S&P 500 rising 67% of the time for an average of 0.67%. These patterns strengthen Lee’s expectations for more gains.

AI and Corporate Margins Offset Macro Headwinds

Lee highlights that corporate profits and margins are rising due to gains from artificial intelligence across many sectors. Even with concerns about tariffs and the Federal Reserve, these fundamentals support his upbeat outlook. AI is now a significant driver of earnings, enabling companies to remain profitable during economic uncertainty.

Inflation trends further improve the positive case. Core inflation is dropping faster than expected, and shelter costs have steadied. This eases pressure on monetary policy, giving the Federal Reserve more flexibility and lowering the odds of sharp rate hikes that could end the rally.

Meanwhile, cryptocurrency markets are showing resilience that could complement stock gains. Bitcoin and Ethereum are consolidating, but high app revenues and increasing stablecoin volumes signal strong fundamentals. These trends suggest a possible year-end crypto rally that could lift investor confidence across risk assets.

Valuation Concerns Persist Amid Optimism

Not all analysts share Lee’s enthusiasm. The S&P 500 now trades at 40 times free cash flow, only 25% below the dot-com peak of 50 times.

This level is nearly double the current bull market average, raising red flags for some who see stretched valuations similar to the late 1990s.

S&P 500 trades at 40x free cash flow, approaching dot-com era highs. Source: Ross Hendricks

S&P 500 trades at 40x free cash flow, approaching dot-com era highs. Source: Ross Hendricks CAPE ratios remain elevated, prompting caution among value-focused investors. Lee, however, counters that strong fundamentals and AI-fueled earnings growth justify higher multiples. He argues that traditional measures may not fully capture the impact of AI on profitability.

This debate reveals the tension between momentum-driven optimism and valuation caution. While Lee remains confident in near-term catalysts, skeptics warn that high multiples leave little room if conditions worsen or earnings fall short.

As November progresses, the key question is whether fund managers’ urgency and seasonal momentum will drive the S&P 500 to 7,000.

The outcome will likely hinge on corporate earnings, future inflation data, and Federal Reserve policy decisions in the coming weeks.