Key Notes

- The stablecoin maintains a 103% reserve buffer with holdings in US Treasury bills and FDIC-insured bank deposits under NYDFS supervision.

- RLUSD operates on both Ethereum and XRP Ledger networks with 38,166 holders processing $5.05 billion in monthly transfers.

- Humanitarian organizations including World Central Kitchen now use RLUSD for cross-border aid payments alongside institutional prime brokerage services.

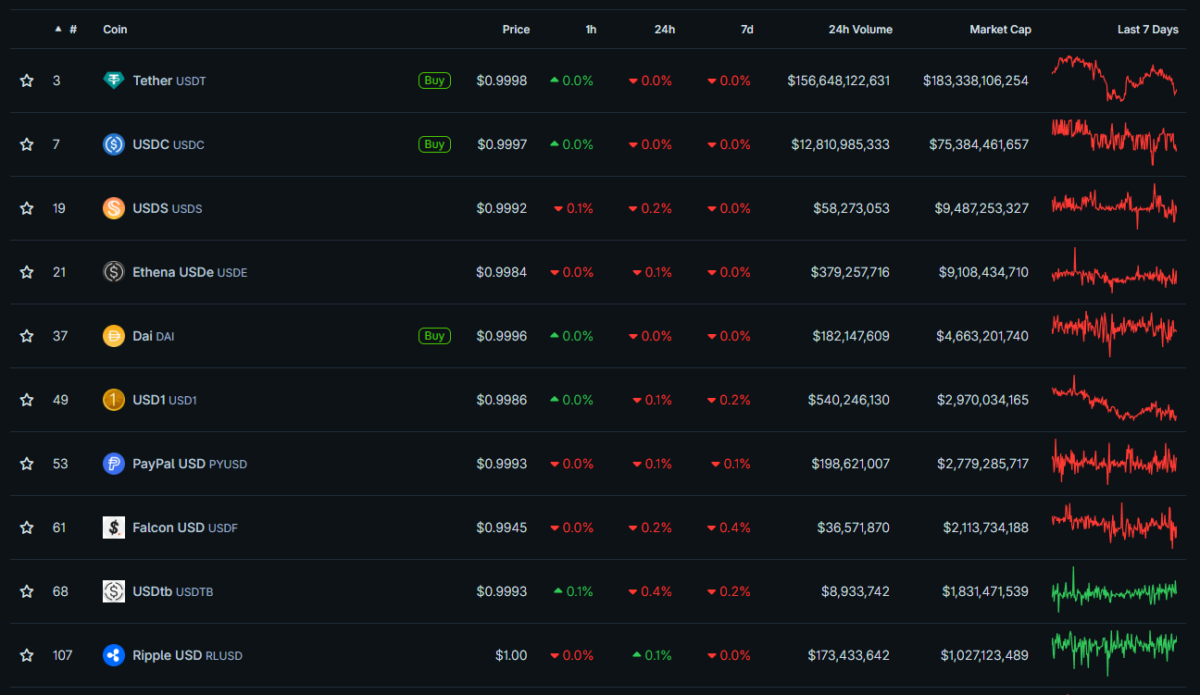

Ripple ‘s USD-pegged stablecoin RLUSD surpassed $1 billion in market capitalization in early November 2025, less than a year after its December 2024 launch. The stablecoin achieved the milestone through institutional adoption and humanitarian partnerships, ranking as the 10th largest USD-pegged stablecoin by market cap. RLUSD recorded 1,278% year-to-date growth.

RLUSD in circulation | Source: RWA.xyz

Live blockchain data shows RLUSD’s total value at $1.02 billion, with $819.7 million on Ethereum ETH $3 491 24h volatility: 3.0% Market cap: $422.05 B Vol. 24h: $48.52 B and $203 million on the XRP XRP $2.28 24h volatility: 2.7% Market cap: $137.29 B Vol. 24h: $6.84 B Ledger, according to CoinGecko . The stablecoin has 38,166 holders and processes $5.05 billion in monthly transfer volume. Daily trading volume reached $174 million, comparable to PayPal USD and Dai.

RLUSD Enters Top 10 Stablecoins

Standard Custody & Trust Company, a wholly-owned Ripple subsidiary, issues RLUSD under New York Department of Financial Services supervision. The stablecoin operates on Ethereum and XRP Ledger networks.

Top 10 USD stablecoins by market cap | Source: CoinGecko

The company maintains reserves of US Treasury bills with maturities of three months or less, government money market funds, and deposits at FDIC-insured banks. Standard Custody reported $908.5 million in circulating RLUSD against $950.9 million in reserve funds on Oct. 30, 2025.

RLUSD maintains a 103% reserve buffer through a 3% initial buffer and daily variation adjustments. The Bank of New York Mellon holds non-cash reserve assets in custody, providing separation from Standard Custody’s proprietary assets. An independent certified public accountant conducts monthly attestations of reserves and circulation.

Institutional and Humanitarian Adoption

Ripple launched Ripple’s US spot prime brokerage on Nov. 3, 2025 , following the $1.25 billion acquisition of Hidden Road in October. The service allows institutional clients to execute over-the-counter spot transactions across multiple digital assets, including XRP and RLUSD.

Non-profit organizations including World Central Kitchen and Water.org announced World Central Kitchen partnerships to use RLUSD for cross-border humanitarian aid payments. The growth follows after Ripple’s $1 billion XRP buyback plan was announced in October 2025 to boost its XRP treasury.