News>

Bitget Daily Digest (Nov 06) | Monad Plans to Launch Mainnet and Native Token MON on November 24; U.S. Government Shutdown May Delay Crypto Market Structure Legislation Until 2026

Bitget2025/11/06 03:07

By: Bitget

Today's Outlook

- Axioma Token (AXT) will unlock approximately 18.33 million tokens on November 7, 2025, at 00:00, valued at about $22.68 million;

- Openverse Network (BTG) will unlock approximately 3.87 million tokens on November 7, 2025, at 00:00, valued at about $66.11 million;

- Omni Network (OMNI) will unlock approximately 11.4 million tokens on November 7, 2025, at 00:00, valued at about $33.09 million.

Macro & Hot Topics

- Japan becomes the 11th country to support Bitcoin mining with official resources;

- Multiple whales have scooped up nearly 400,000 ETH over the past 3 days, with total purchases exceeding $1.36 billion;

- U.S. government shutdown may delay crypto market structure legislation until 2026;

- The EU will introduce a new digital currency regulatory framework by year-end, granting ESMA greater cross-border oversight powers, creating a "European SEC" and boosting crypto financial competitiveness;

- U.S. spot Bitcoin ETFs saw a net outflow of $135.94 million yesterday;

- JPMorgan CEO Jamie Dimon: We are heading into an economic recession with credit implications, though the exact timing is unclear.

Market Trends

- BTC and ETH rebound modestly after sharp pullbacks, with market sentiment shifting to extreme fear; liquidations totaled about $46.06 million in the past 4 hours, primarily longs;

- U.S. stocks closed higher on Wednesday, with the Dow up 0.48%, Nasdaq up 0.65%, and S&P 500 up 0.37%; AI sector rebounds, boosted by better-than-expected jobs data;

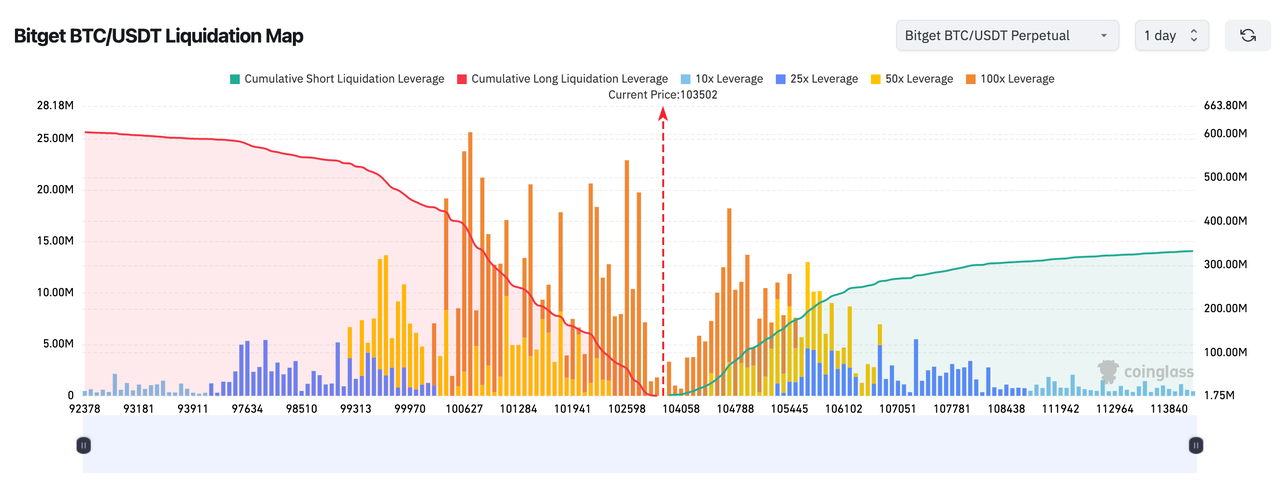

3.Bitget BTC/USDT liquidation heatmap shows high-leverage long liquidations clustered around the current price of 103,502; a breakdown could trigger further cascading, so watch for sharp volatility in the short term;

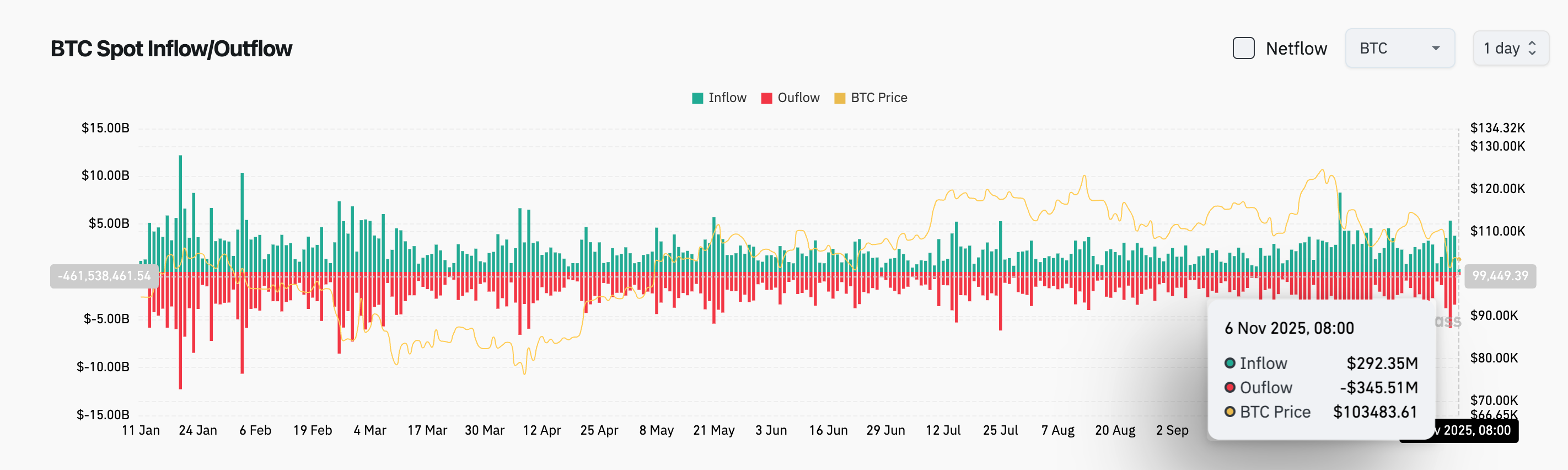

4.In the past 24 hours, BTC spot inflows were $293 million, outflows $346 million, resulting in a net outflow of $53 million;

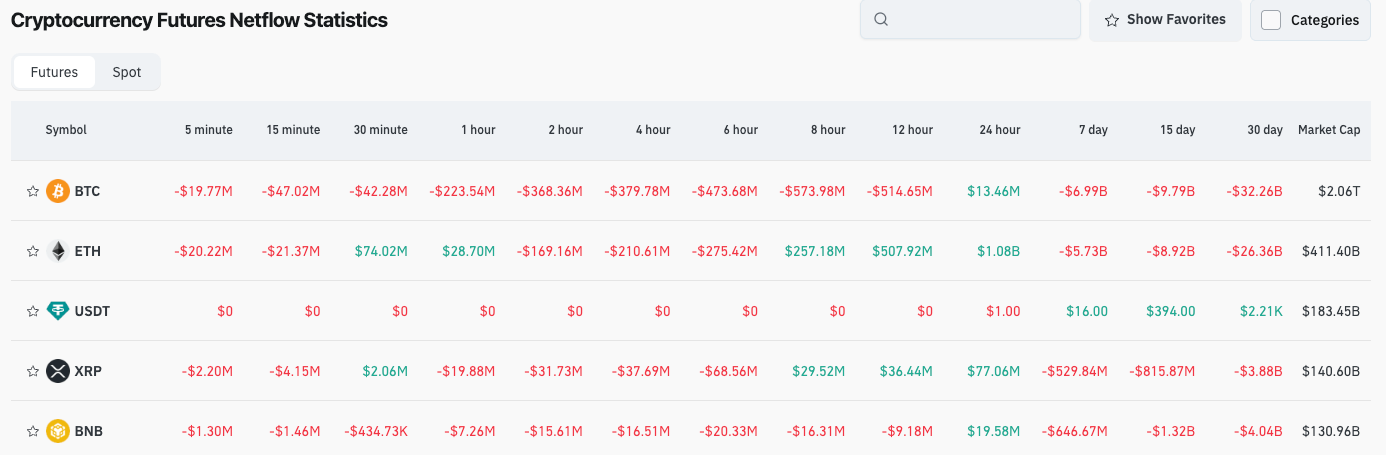

5.Over the past 24 hours, contracts for BTC, ETH, USDT, XRP, BNB, and others led in net outflows, potentially presenting trading opportunities.

News Updates

- Franklin Templeton launches Hong Kong's first AI-driven tokenized fund;

- Bloomberg: Ripple President Monica Long says the company has "no IPO plans or timeline at this time";

- A user lost aBasUSDC after signing a malicious permit, with cumulative losses exceeding $300,000;

- Gemini is preparing to enter the prediction markets, with related contracts pending CFTC approval, expanding its financial product lineup.

Project Developments

- MOVA launches native token and MOVA Liquid derivatives protocol;

- MegaETH announces public sale allocation strategy, with community identified for about 25% USD allocation;

- Folks Finance will launch native token FOLKS on November 6, with an initial release of 25.4% supply;

- Monad plans to release its L1 mainnet and native token MON on November 24;

- Ripple stablecoin RLUSD market cap surpasses $1 billion;

- Tuttle applies for "Crypto Blast" single-stock ETF, aiming to combine put spreads with crypto ETFs;

- Wall Street Journal: OpenAI CFO says OpenAI is not preparing for an IPO;

- Kamino announces an additional $10 million in PT-eUSX deposit capacity;

- Chainlink partners with Dinari to bring S&P crypto stock indices on-chain;

- Folks Finance will open FOLKS airdrop claims today.

Disclaimer: This report is generated by AI, with human verification solely for informational accuracy, and does not constitute any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

Lock now!

You may also like

Crypto prices

MoreBecome a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now