Arthur Hayes’ Portfolio Drops Over 30% — Should Markets Be Worried?

BitMEX co-founder Arthur Hayes’ cryptocurrency portfolio value decreased by more than 30% in November 2025. The sharp drop arises as Hayes actively sold major holdings across several tokens.

The activity contradicts his bullish public views on the market, opening new questions about whether his trades signal deeper concerns about the state of the current cycle.

Arthur Hayes’ Crypto Portfolio Drops Over 30%

According to Arkham Intelligence, Hayes’ portfolio has contracted from $63 million to approximately $42.2 million. On-chain analytics platform Lookonchain tracked a recent flurry of sales linked to him.

Yesterday, Hayes sold 520 ETH for $1.66 million, 2.62 million ENA tokens for $733,000, and 132,730 ETHFI tokens for $124,000.

Shortly after, he offloaded another 260 ETH valued at around $820,000, 2.4 million ENA worth $651,000, around 640,000 LDO for $480,000, 1,630 AAVE worth $289,000, and lastly 28,670 UNI valued at $209,000. The total sales neared $5 million in just one day, indicating a notable decrease in altcoin exposure.

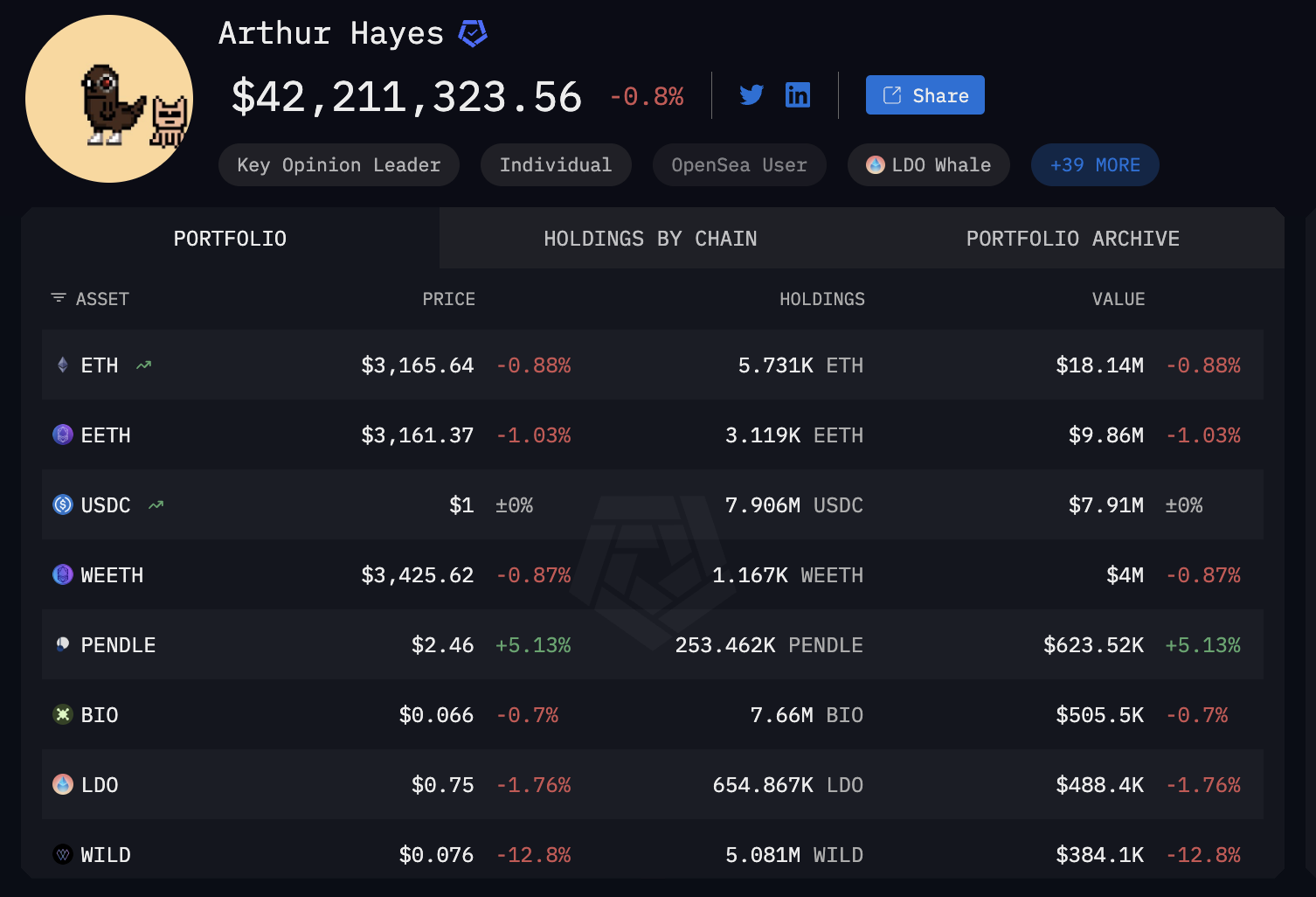

As of the latest data, the current portfolio is concentrated in Ethereum-linked assets, including 5,731 ETH valued at $18.03 million—his largest single holding.

Arthur Hayes’ Crypto Holdings. Source: Arkham Intelligence

Arthur Hayes’ Crypto Holdings. Source: Arkham Intelligence The executive also holds 3,119 EETH worth $9.8 million, 1,167 WEETH valued at $4 million, and $7.9 million in USDC. He continues to hold positions in a range of altcoins, such as PENDLE, BIO, LDO, WILD, SUSDE, BOBA, WBTC, and SENA.

Altcoin Sentiment Hit by Hayes’ Moves

Still, the timing of these sales has prompted scrutiny in the crypto community. While Hayes has issued bullish predictions for many assets, his recent actions are deepening concerns about the health of the altcoin market.

🚨 BREAKINGCRYPTO BILLIONAIRE ARTHUR HAYES IS SELLING ALL HIS CRYPTO.HE'S BEEN A LONG-TIME BULL RUN BELIEVER, BUT TODAY STARTED AGGRESSIVELY DUMPING HIS ENTIRE CRYPTO PORTFOLIO.IS IT REALLY OVER?? pic.twitter.com/8iQOcfn2mX

— 0xNobler (@CryptoNobler) November 16, 2025

According to Orbion, Hayes’ decision to exit early suggests that he believes the current cycle may already be coming to an end. The analyst also noted that a rotation into major altcoins has failed to materialize — and increasingly looks unlikely to happen at all.

For him, this points to a broken narrative. He argued that sophisticated players exit before the broader market realizes the trend has shifted.

“Arthur Hayes just rage quit several tier-1 altcoins. ETH, ENA, LDO, UNI, AAVE – all sold at a loss. These aren’t lowcaps or dead coins – they’re billion-dollar tokens. If even Hayes gave up on them – ask yourself what that means,” the post read.

Orbion also framed Bitcoin’s 665% rally from its January 2023 low as a full macrocycle, not a mid-cycle phase. The lack of post-ETF acceleration, fading meme coin activity, thinning volumes, and declining performance across AI tokens and L2s are, in his view, classic late-cycle exhaustion signals.

As of November, crypto markets remain volatile, and the outlook is uncertain. Whether Hayes’ approach proves correct will depend on crypto market developments in the coming time.