Tom Lee’s BitMine Reveals 3.6 Million ETH Holdings Amid Disputed Average Purchase Price

BitMine has disclosed one of the largest Ethereum treasuries ever recorded, 3.63 million ETH. However, its stated average purchase price of $2,840 has sparked immediate pushback from analysts who claim the math does not add up.

The update is significant because BitMine is now approaching its long-stated goal of acquiring 5% of all Ethereum, a threshold that Fundstrat has dubbed the “Alchemy of 5%.”

BitMine Discloses $11.2 Billion in Crypto and Cash Holdings

In an update on November 24, BitMine (BMNR) reported total holdings of $11.2 billion across crypto, cash, and “moonshots.” The company holds 3,629,701 ETH, 192 BTC, a $38 million stake in Eightco Holdings, and $800 million in unencumbered cash.

🧵BitMine provided its latest holdings update for Nov 24th, 2025:$11.8 billion in total crypto + "moonshots":-3,629,701 ETH at $2,840 per ETH – 192 Bitcoin (BTC)– $38 million stake in Eightco Holdings (NASDAQ: ORBS) (“moonshots”) and– unencumbered cash of $800…

— Bitmine (NYSE-BMNR) $ETH (@BitMNR) November 24, 2025

According to BitMine, the 3.63 million ETH was accumulated at an average price of roughly $2,840 per token. At current market levels above $2,900, the position would be slightly profitable.

Ethereum (ETH) Price Performance. Source:

Ethereum (ETH) Price Performance. Source: Chairman Thomas “Tom” Lee reiterated that BitMine has now acquired 3% of the Ethereum network.

BitMine now has 3% of the ETH supply Two-thirds on the way to the ‘Alchemy of 5%’👏👏👏👏

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) November 24, 2025

Weekly Purchases Show Aggressive Accumulation

BitMine also published its weekly ETH purchases, showing consistent and sizeable inflows throughout October and November.

| Period (Week ending) | Quantity of ETH Purchased |

| November 24 | 69,822 ETH |

| November 17 | 54,156 ETH |

| November 10 | 110,288 ETH |

| November 3 | 82,353 ETH |

| October 27 | 77,055 ETH |

| October 20 | 203,826 ETH |

| October 13 | 202,037 ETH |

| October 6 | 179,251 ETH |

This accumulation cements BitMine as the largest ETH treasury globally. It is also the second-largest overall crypto treasury behind MicroStrategy, which holds 649,870 BTC valued at $57 billion.

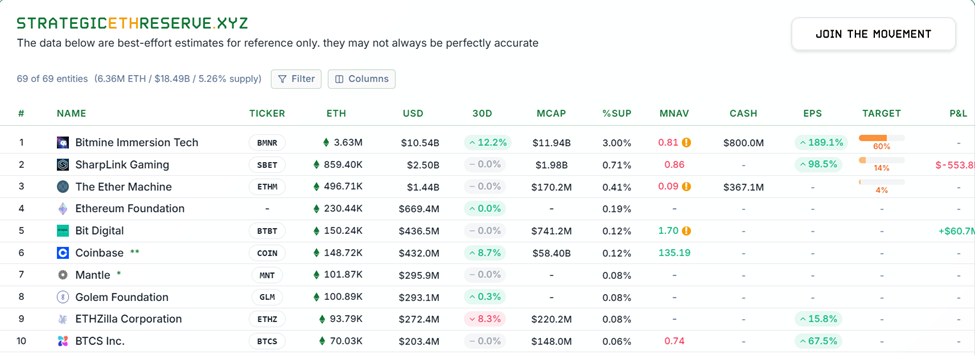

Ethereum Treasuries by Size. Source:

Ethereum Treasuries by Size. Source: Lee argued that the recent downturn in crypto prices aligns with “impaired liquidity since October 10” and weak technical conditions.

.@fundstrat's Tom Lee points out a mechanical ‘glitch’ that may be fueling crypto’s rollover. $BTChttps://t.co/ZrsrCWaDHu

— Power Lunch (@PowerLunch) November 20, 2025

However, he noted that ETH had already neared the previously projected downside level of $2,500 by Fundstrat.

BitMine highlighted the rapid rise of BMNR as one of the most actively traded stocks in the US. Average daily dollar volume stood at $1.6 billion (five-day average as of November 21), ranking the stock #50 nationally, just behind Mastercard and ahead of Palo Alto Networks.

Investors Dispute the Reported Average Purchase Price

Despite the bullish disclosures, market onlookers quickly challenged BitMine’s stated cost basis. Blockchain analytics account Lookonchain estimated BitMine’s average purchase price at approximately $3,997, claiming an unrealized loss of more than $4 billion.

Tom Lee(@fundstrat)'s #Bitmine bought 69,822 $ETH($197.25M) last week and currently holds 3,629,701 $ETH($10.25B).The average buying price is ~$3,997 and #Bitmine is sitting on an unrealized loss of $4.25B.https://t.co/Gw7A8KXKPw pic.twitter.com/TMvDPsroUt

— Lookonchain (@lookonchain) November 24, 2025

Another analyst wrote that BitMine’s “$2,840” figure merely reflected the ETH spot price at the time of the company’s posts, rather than an accurate average purchase price. Additional users independently calculated an implied average closer to $3,800 to $4,000.

“Your average price per ETH should be around $3,840…is this accurate?” they posed.

BitMine has not yet addressed the discrepancy or provided a detailed cost-basis breakdown. Therefore, all eyes now turn to whether BitMine will clarify its accounting, continue its weekly ETH accumulation, and reach the symbolic 5% ownership threshold.

With Made in America Validator Network (MAVAN) set for deployment in early 2026 and BMNR rising in market prominence, BitMine’s treasury strategy is likely to remain a central narrative in the Ethereum ecosystem over the coming months.