Strategy Says Even a Bitcoin Crash to $25,000 Wouldn’t Break Its Balance Sheet

Strategy (formerly MicroStrategy) has confirmed that its assets-to-debt collateral ratio would remain at 2.0x, even if Bitcoin (BTC) fell to $25,000, far below its $74,000 average purchase price.

This comes as the company’s stock has declined by 49% and faces the possibility of exclusion from MSCI indices, with a decision expected by January 2026.

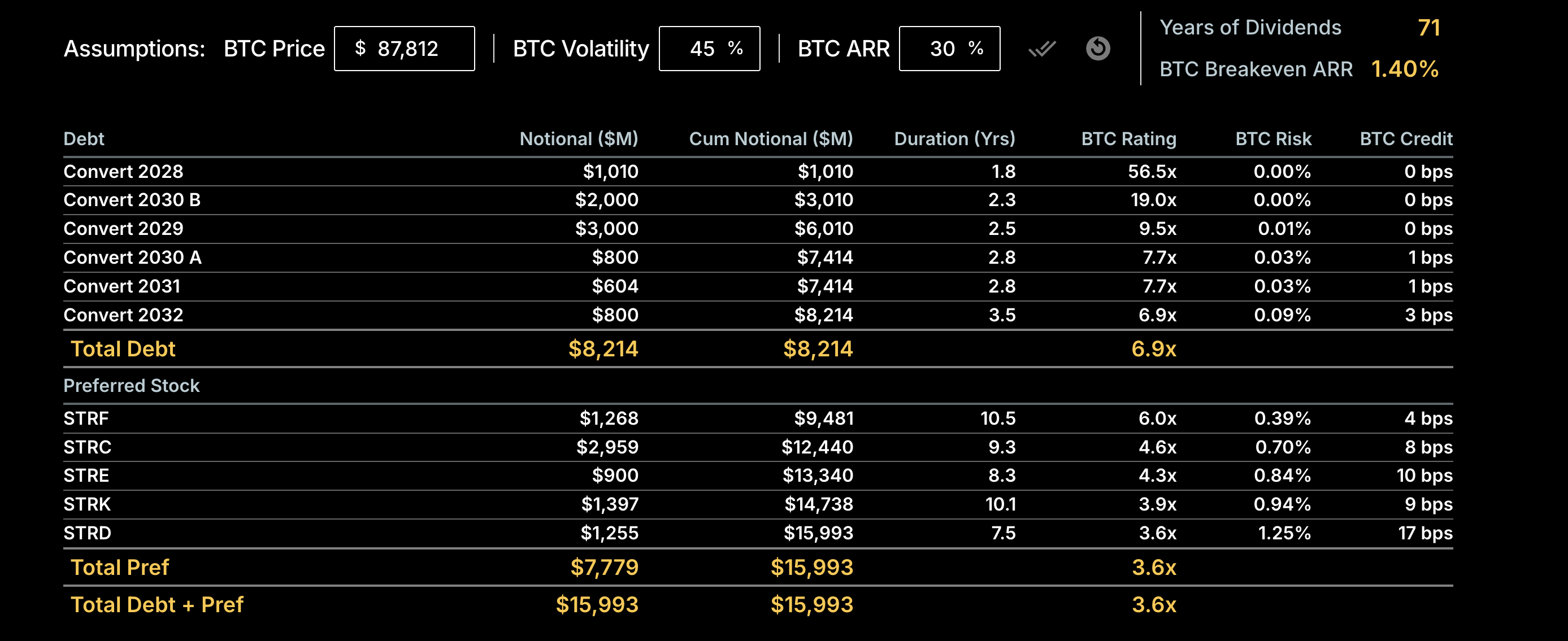

(Micro) Strategy’s $16 Billion Liability Stack Backed 3.6x by Bitcoin

In a recent X (formerly Twitter) post, the company emphasized the strength of its balance sheet by highlighting what it calls the “BTC Rating” of its convertible debt.

“If BTC drops to our $74,000 average cost basis, we still have 5.9x assets to convertible debt, which we refer to as the BTC Rating of our debt. At $25,000 BTC, it would be 2.0x,” the post read.

According to the firm, even if Bitcoin were to fall to $74,000, its average cost basis, the value of its BTC reserves, would still be 5.9 times greater than its convertible debt. In a deeper downturn, with Bitcoin at $25,000, the assets-to-debt ratio would remain at 2.0x.

Based on the current Bitcoin price of $87,812, the company shows a notably strong asset-to-liability profile. According to the credit dashboard, Strategy carries $8.214 billion in total convertible debt with maturities spanning 2028 to 2032.

Most of these convertible notes exhibit exceptionally high BTC Rating, ranging from 7x to more than 50x. The BTC Rating for total convertible debt stands at 6.9x.

Strategy BTC Rating. Source: Strategy Credit Dashboard

Strategy BTC Rating. Source: Strategy Credit Dashboard Below the debt layer, the company holds $7.779 billion in preferred stock across five series (STRF, STRC, STRE, STRK, STRD). These have longer average durations, many running 8 to 10 years or more. Moreover, they carry slightly higher risk profiles than the senior debt stack.

The preferred equity carries a BTC Rating of 3.6x, indicating a solid, though thinner, collateral cushion relative to the company’s convertible debt. Combined, the company’s total obligations, debt plus preferred stock, amount to $15.993 billion.

At the current Bitcoin price, these liabilities are supported by a consolidated BTC Rating of 3.6x, meaning the company holds more than three and a half times the value of its outstanding obligations in Bitcoin-denominated assets.

This indicates that the company is exceptionally well-capitalized, overcollateralized by a substantial BTC buffer, and highly resilient to Bitcoin price declines. This provides it with significant financial stability and strategic flexibility.

According to the data from SaylorTracker, Strategy holds 649,870 BTC valued at $56.99 billion, making it the largest corporate holder globally.

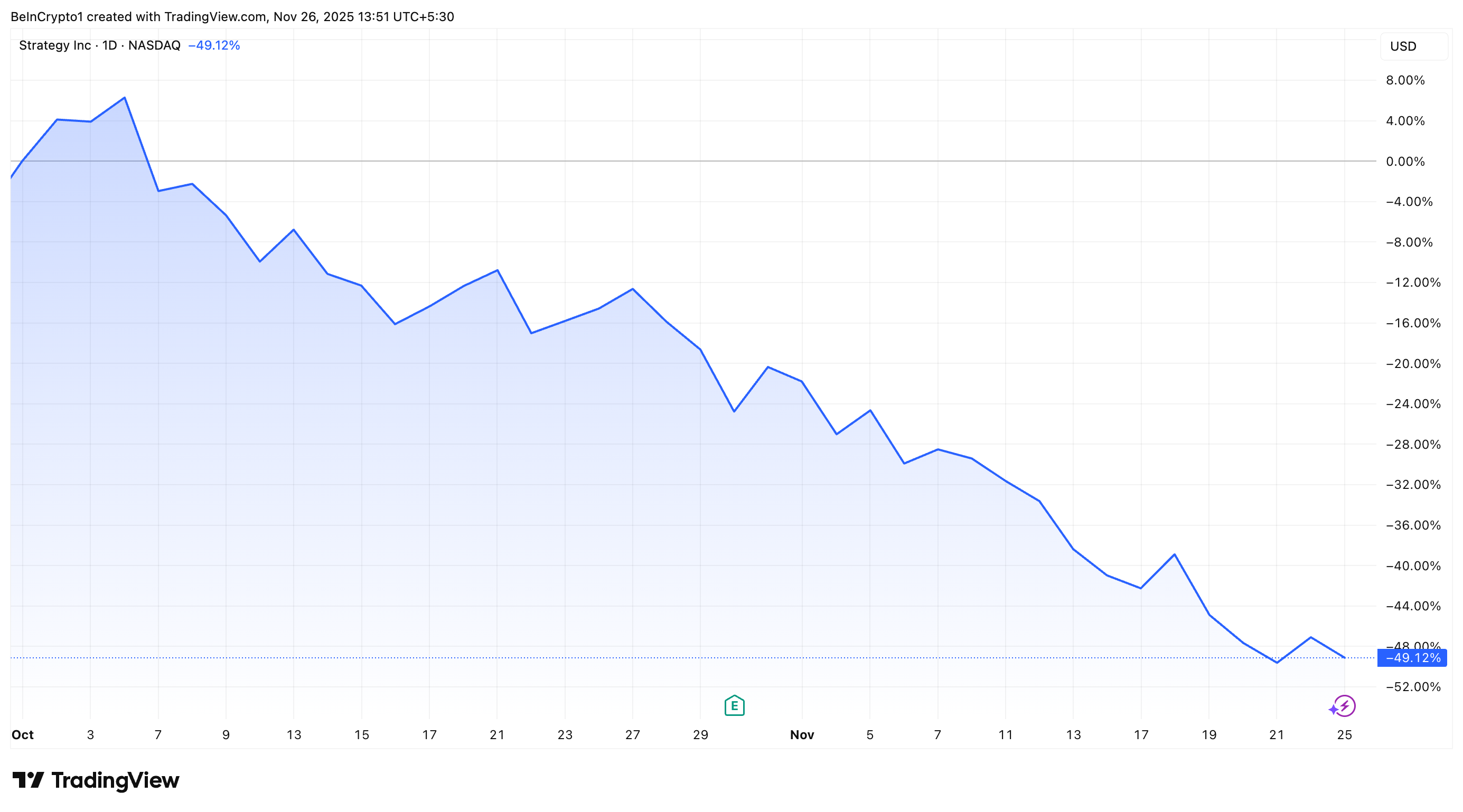

Strategy Confronts Market Slide and Index Uncertainty

Notably, this revelation comes at a time when the firm has been under considerable pressure. MSTR shares have fallen by more than 49% since early October, trading at levels last seen in late 2024.

MicroStrategy (MSTR) Stock Performance. Source: TradingView

MicroStrategy (MSTR) Stock Performance. Source: TradingView Strategy also faces heightened scrutiny from MSCI. It is considering a criterion that would exclude companies where digital assets make up 50% or more of total assets.

A decision is expected by January 15, 2026. JPMorgan research estimates potential outflows could surge as high as $8.8 billion if additional index providers adopt similar rules. According to the bank,

“With MSCI now considering removing MicroStrategy and other digital asset treasury companies from its equity indices…outflows could amount to $2.8bn if MicroStrategy gets excluded from MSCI indices and $8.8bn from all other equity indices if other index providers choose to follow MSCI.”

The company was also left out of the S&P 500, missing another key opportunity. Adding to the challenges, after six consecutive weeks of Bitcoin purchases, the firm has broken its buying streak. This comes as the mNAV premium has collapsed toward near parity.

Nonetheless, the firm is making other strategic moves. Blockchain intelligence firm Arkham reported that Strategy transferred some of its assets from Coinbase to Fidelity Custody. This reflects a plan to split custodial risk between several regulated providers.

“Strategy (MSTR) has been diversifying custodians away from Coinbase, and has moved 58,390 Bitcoin (currently: $5.1 Billion) to Fidelity Custody over the past 2 months….with a total of 165,709 BTC ($14.50 billion) sent to Fidelity Custody,” Arkham stated.

Thus, despite mounting market pressure, index uncertainty, and a sharp decline in its stock price, Strategy remains heavily overcollateralized and structurally resilient. Its Bitcoin-backed balance sheet continues to provide a substantial buffer against volatility. At the same time, ongoing efforts to diversify custodial risk signal a company’s positioning for long-term stability, even in a challenging environment.