Bitcoin mining company

Hive Digital Technologies

has launched a $300 million at-the-market (ATM) equity offering, giving it the ability to raise funds as needed after a record-breaking quarter that featured strong revenue gains and a strategic push into AI infrastructure. Announced on November 25, 2025, the initiative

enables the company to issue common stock

via a group of underwriters—Keefe, Bruyette & Woods, Stifel, and Cantor Fitzgerald—at current market rates on both the TSX Venture Exchange and Nasdaq.

Hive

is not required to use the entire amount, and

the program will automatically end

once $300 million in gross proceeds have been raised or sooner if the company chooses.

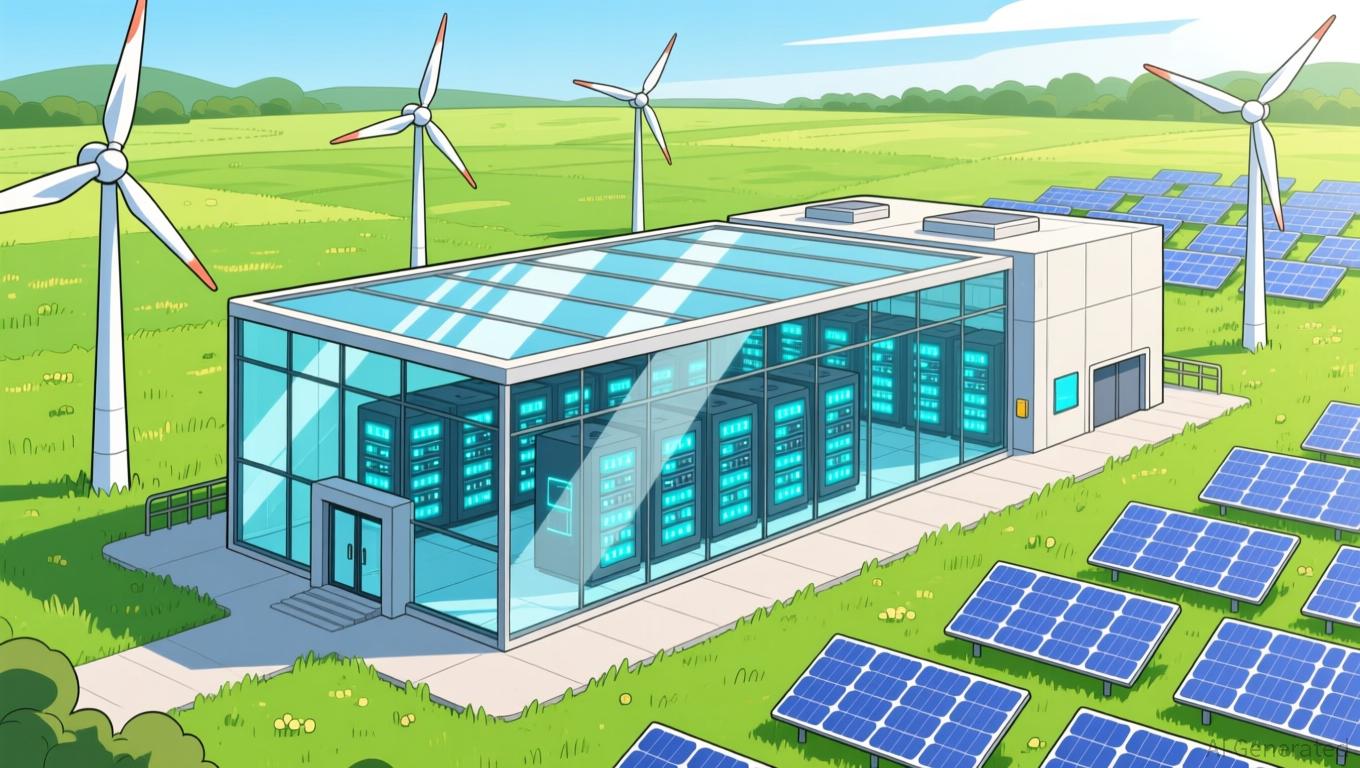

This move highlights Hive's "dual-engine" approach, using

Bitcoin

mining profits to invest in high-performance computing (HPC) infrastructure. The company recently

secured a 32.5-acre property

in New Brunswick, Canada, where it plans to develop a renewable energy-powered data center that can accommodate more than 25,000 GPUs. This strategy mirrors a broader industry shift as mining firms branch out into AI-related operations, a trend evident in Hive's latest financial results.

In the second quarter of 2026, revenue jumped

285% year-over-year to $87.3 million, and Bitcoin output rose 77% from the previous quarter to 717 BTC. Despite these positive results, Hive's stock has dropped to about $3.10, down from a three-year peak of $6.60 reached in early October.

The ATM offering gives Hive a flexible way to access additional capital without committing to a set price or timing, differing from conventional public offerings. Shares can be sold through "at-the-market distributions" under Canadian securities laws and Rule 415 of the U.S. Securities Act, which ensures compliance while preserving operational flexibility

according to reports

. The agreement involves 11 underwriters, with agents such as B. Riley Securities and Northland Securities also taking part in the share distribution

as announced

.

Industry analysts see the program as a strategic lever to advance Hive's infrastructure goals. The company's BUZZ HPC segment is becoming increasingly important to its growth story, reflecting a wider industry transformation as mining companies shift from speculative ventures to critical infrastructure providers for AI and cloud services

according to data

. Still, the recent decline in Hive's share price points to investor concerns about execution risks and competition in the large-scale computing market.

Profit margins from Bitcoin mining and energy expenses are crucial factors in Hive's dual-engine strategy, and the company is keeping a close eye on both operational performance and Bitcoin price swings. Leadership has indicated that the data center's energy mix—90% from renewable sources—will give Hive an edge in both cost efficiency and ESG standards.

Analysts are also tracking

how quickly GPUs are deployed and how BUZZ HPC contracts perform to assess the long-term prospects of Hive's expansion plans.