News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

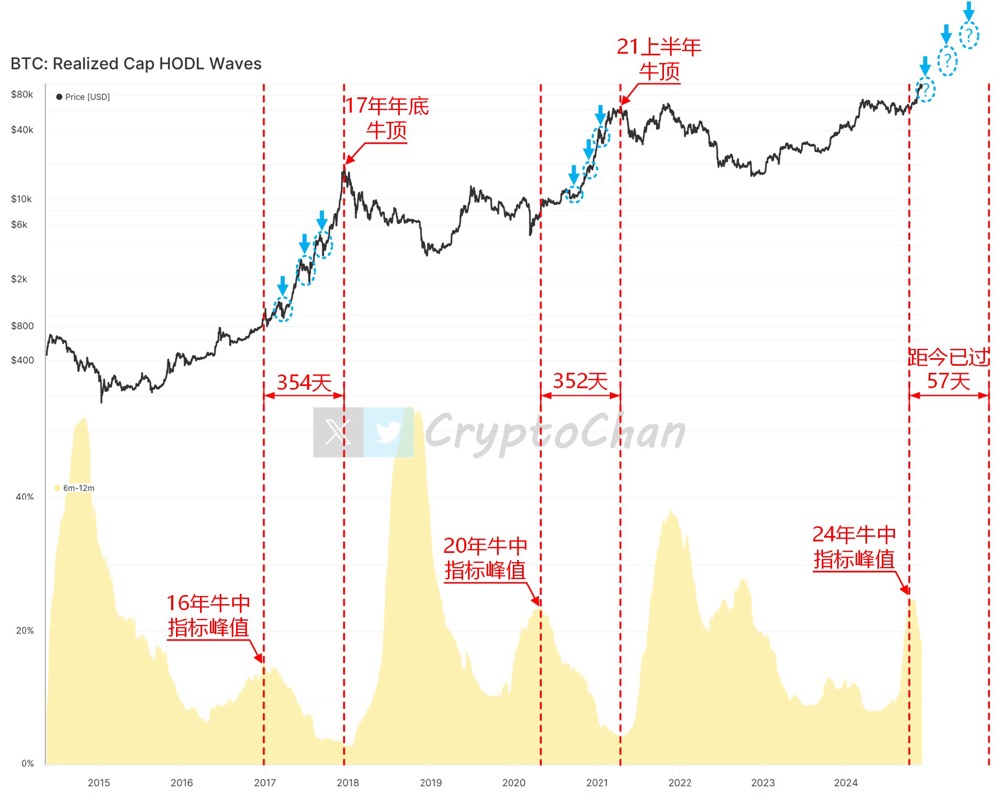

Bitcoin targets £140,000! Fibonacci pricing model reveals potential space

CryptoChan·2024/12/02 03:28

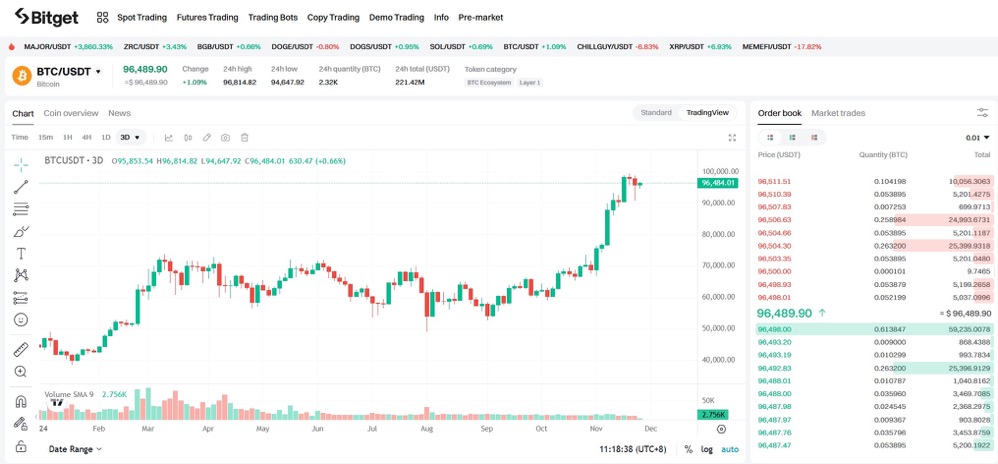

Why not try short selling easily from a market maker's perspective

Bugsbunny—e/acc·2024/11/29 04:18

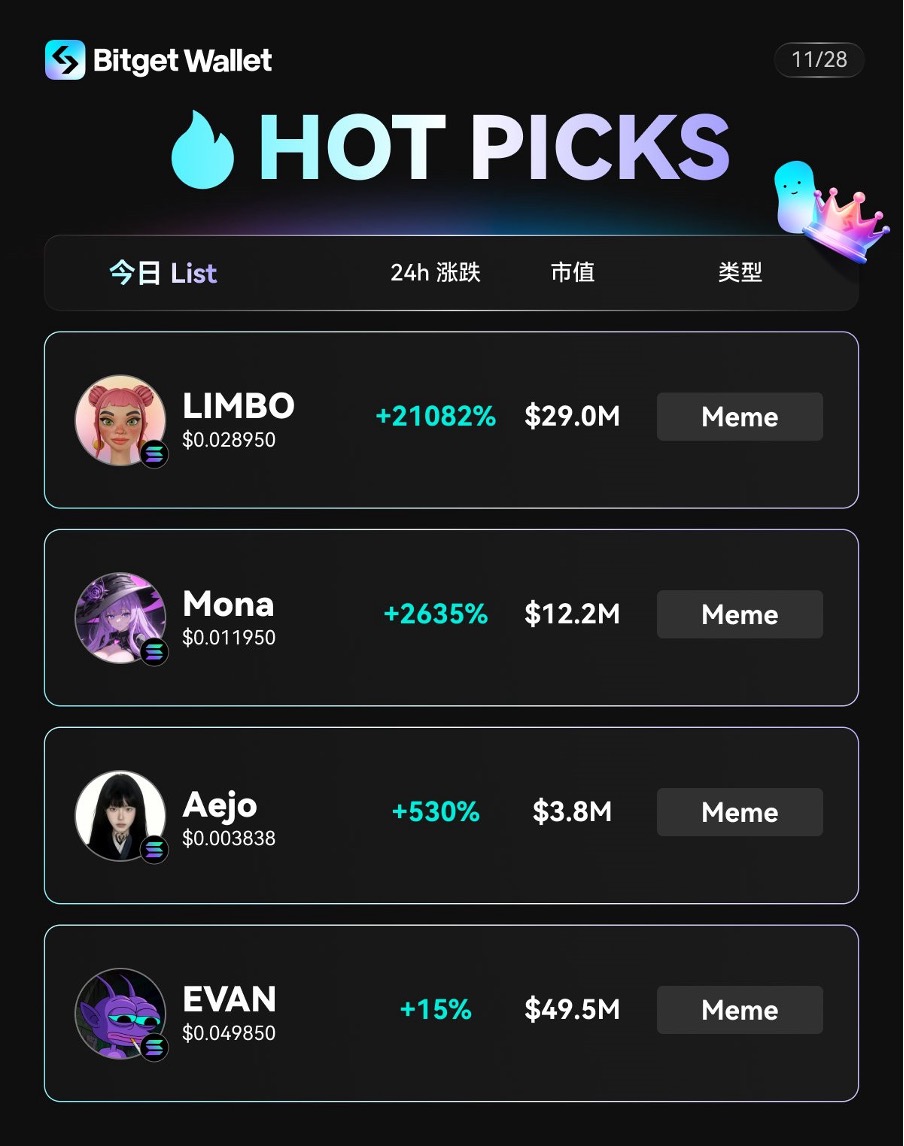

Today's Popular MEME Inventory

币币皆然 ·2024/11/28 10:02

TikTok traffic boost, can CHILLGUY become the next top-tier Meme?

远山洞见·2024/11/28 08:32

Flash

- 07:24Wall Street giant Cantor Fitzgerald launches a Bitcoin and gold fundAccording to Jinse Finance, a chart released by The Bitcoin Historian shows that Wall Street giant Cantor Fitzgerald has just launched a Bitcoin and gold fund. Cantor Fitzgerald, L.P., founded in 1945 and headquartered in New York City, New York, USA, has 14,000 full-time employees. It is an American financial services company specializing in institutional equities, fixed income sales and trading, and serves the middle market through investment banking services, prime brokerage, and commercial real estate financing. The company is also one of the main underwriters of SPACs.

- 07:03Matrixport: Changes in the macro environment may create upside opportunities for BitcoinChainCatcher News, Matrixport published an analysis stating that as gold strengthens, US Treasury yields decline, and the US dollar weakens, the macro environment is developing in a direction favorable to risk assets. Analyst Markus Thielen pointed out that in such an environment, investors typically first hedge growth risks through gold, and then allocate to high-beta assets such as bitcoin. Historical experience shows that bitcoin performs exceptionally well under these macro conditions, often releasing considerable upside potential after a brief consolidation. Current market signals point to policy easing and economic slowdown, and the crypto market is particularly sensitive to these macro changes.

- 07:03The US Congress promotes research on Bitcoin reserves, requiring the Treasury Department to submit a feasibility report within 90 days.According to ChainCatcher, based on relevant documents, U.S. Congressman David P. Joyce has submitted an appropriations bill requiring the Treasury Department to submit a report within 90 days of the bill's enactment on the feasibility and technical considerations of establishing a strategic bitcoin reserve and digital asset reserve. The report should cover aspects such as custody methods, legal authorization, cybersecurity measures, interdepartmental transfers, the presentation of assets on the Treasury's balance sheet, and third-party custodians. The report must also assess implementation obstacles and the impact on the Treasury's forfeiture fund. In March of this year, President Trump signed an executive order to establish a strategic bitcoin reserve and digital asset reserve. Treasury Secretary Scott Bessent stated that they are exploring "budget-neutral" ways to expand bitcoin reserves. Currently, countries around the world hold more than 517,000 bitcoins in reserves, accounting for 2.46% of the total supply.