News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

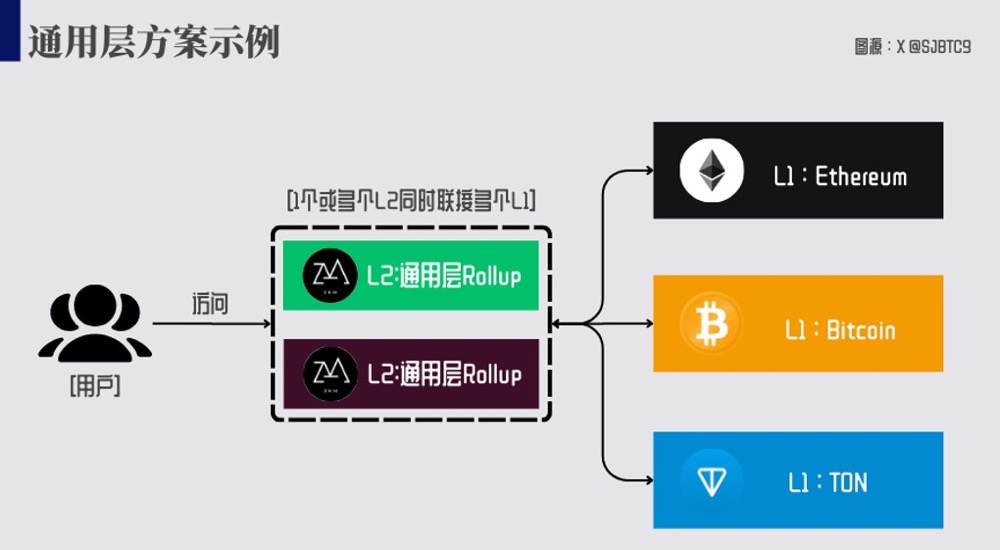

In the context of Ethereum's downturn, where is the breakthrough for the Rollup scheme

Eric SJ(重开版)·2024/09/04 03:52

23 protocols, an overview of the current chain abstraction protocol model

Eric SJ(重开版)·2024/09/02 06:41

Web3 Lawyer: MakerDAO Brand Upgrade, Disillusionment with DeFi and Decentralised Stablecoins

曼昆区块链法律服务·2024/08/30 03:16

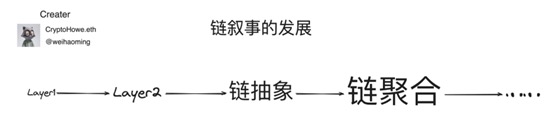

How to view the current blockchain narrative and its future development

cryptoHowe.eth·2024/08/30 03:07

Missed DOGS? Don't worry, it's not too late to pay attention to the new CATS

依始·2024/08/29 10:44

Flash

- 09:59Galaxy Digital increased its holdings by an additional 932,000 SOL worth $230 million in the past 6 hours.On September 14, according to Arkham monitoring, Galaxy Digital has once again increased its holdings by 932,000 SOL (approximately $230 million) in the past 6 hours.

- 09:23Pakistan Invites Global Cryptocurrency Companies to Apply for Operating LicensesJinse Finance reported that Pakistan has recently extended invitations to international crypto enterprises, allowing leading exchanges and Virtual Asset Service Providers (VASPs) to apply for operating licenses under the new federal regulatory framework.

- 09:17Caitong Securities: The bull market is not over, maintain a technology + cyclical allocation strategyJinse Finance reported that Caitong Securities stated that overseas, inflation remains stable, coupled with previous weak non-farm payroll data, the market's expectations for interest rate cuts continue, with expectations of a rate cut in September and three cuts within the year. On the domestic sentiment side, market sentiment remains positive, and investors are still actively increasing positions during pullbacks, with the market having returned to previous highs. Looking ahead: In the long term, with favorable policies, industrial catalysts, overseas monetary easing, and new capital inflows, the long-term trend of the market remains clear. In terms of short-term catalysts, Oracle orders reflect demand for computing power, the Federal Reserve is expected to implement a rate cut next week, and multiple new catalysts continue to support the market. In terms of allocation direction, the bull market is not over. Although market volatility has increased, leading stocks in the main sectors have not been abandoned, and the technology + cyclical allocation strategy is maintained. On one hand, as the Federal Reserve shifts its stance and overseas liquidity eases amid weakening employment, gold, which we previously highlighted, has already started to perform. Going forward, attention should be paid to the rebound in innovative pharmaceuticals and the spread of the AI market, with a focus on leading Hang Seng Internet/AI application stocks with low crowding levels. On the other hand, as the overseas economic cycle seeks a bottom and domestic efforts to reduce internal competition continue, the allocation value of leading cyclical resource stocks becomes prominent.