Cardone Capital Invests $110M in Bitcoin Strategy

- Cardone Capital purchases 1,000 BTC as a strategic move.

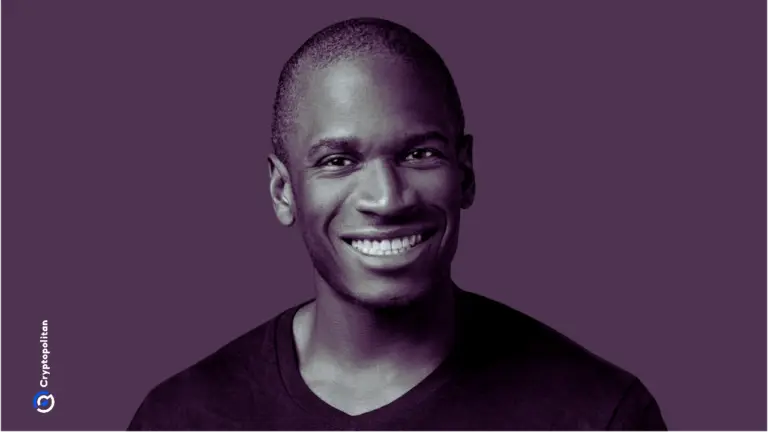

- Grant Cardone leads the firm’s major BTC acquisition.

- Could influence real estate and cryptocurrency markets significantly.

Cardone Capital, led by Grant Cardone, recently acquired 1,000 Bitcoin worth approximately $110 million, marking a significant investment shift in the real estate sector.

This move integrates real estate with Bitcoin investment, likely influencing market dynamics and boosting institutional involvement in cryptocurrencies.

Cardone Capital, a $5.1 billion real estate investment firm, recently made headlines by purchasing 1,000 BTC, worth approximately $110 million. This bold move integrates real estate with direct Bitcoin acquisition, marking a significant strategy shift.

Led by Grant Cardone, the firm aims to blend its real estate expertise with cryptocurrency investment. Cardone Capital’s strategic BTC purchase signals innovation, as the company plans further Bitcoin acquisitions, targeting up to 3,000 BTC by year-end.

Impact on Bitcoin and Real Estate Markets

The investment positions Cardone Capital among the largest BTC holders, alongside giants like MicroStrategy. This could trigger increased BTC market volume and potential liquidity constraints. Industry observers watch as this strategy impacts both cryptocurrency and real estate sectors.

Grant Cardone has highlighted that “Cardone Capital adds 1,000 BTC to balance sheet becoming first ever real estate/BTC company integrated with full BTC strategy combining the two best in class assets.” The connection between real estate cash flows and BTC holdings creates a novel asset management approach.

Changing Investor Perspectives

Cardone’s approach is unique, using rental income for BTC purchases. The move reinforces BTC’s institutional appeal, amid Cardone Capital’s expansive portfolio, including over 14,200 residential units and 500,000 sq ft of office space. Institutional involvement in BTC like Cardone’s can stabilize digital asset markets, influencing prices positively. The firm’s unprecedented strategy integrates real estate cash flows with BTC holdings, eyeing a more diverse asset management landscape.

Experts say such moves enhance institutional confidence in digital assets, possibly driving regulatory advancements. Cardone Capital’s BTC emphasis may reshape investor strategies, aligning real estate investments as parallel to significant cryptocurrency holdings.

“Nobody else has ever done this to scale. Nobody’s ever done this particular model. And the response from our investors is phenomenal.” – Grant Cardone, CEO, Cardone Capital.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

French AI start-up Mistral seeks funding at $10B valuation to compete with U.S., Chinese rivals

Share link:In this post: Mistral has announced its plan to raise $1B at a $10B valuation, up from €5.8B. The company’s revenue is on track to go beyond $100M annually. The raised funds may support its planned €8.5B data center project.

Florida leads U.S. solar boom with 3GW surge, beating California

Share link:In this post: Florida added over 3GW of utility-scale solar in one year, surpassing California. Florida Power & Light built more than 70% of the state’s new solar capacity. Trump’s new law cuts solar tax credits, hurting homeowners and developers.

Arthur Hayes calls BTC at $100K, ETH at $3K after dumping $10M+ crypto

Share link:In this post: Arthur Hayes sold over $13 million in crypto, including ETH, ENA, and PEPE, within hours. He predicts Bitcoin will “test” $100K and Ethereum will dip to $3K due to macroeconomic pressures. The BitMEX founder cites weak U.S. job data and the upcoming tariff bill as key bearish indicators.

Anthropic restricts Claude API access for OpenAI

Share link:In this post: Anthropic cut OpenAI’s API access after discovering it was using Claude in violation of terms, allegedly to benchmark and fine-tune GPT-5 through unauthorized custom API integration. Anthropic will introduce weekly usage caps for Claude Code starting August 28, affecting all paid tiers, to reduce excessive background usage. High demand for Claude Code has strained Anthropic’s systems, causing multiple service outages in the past month.