Metavesco Moves to Tokenize OTC Markets With Blockchain Push

Contents

Toggle- Quick Breakdown:

- Tokenization as a Fix for Market Inefficiencies

- Metavesco’s Strategy in Web3 Finance

Quick Breakdown:

- Metavesco pushes OTC tokenization to bring small-cap equities on-chain and unlock global liquidity.

- Blockchain transparency aims to end toxic financing, naked shorting, and hidden dilution.

- Metavesco to advocate tokenization as the future of OTC markets.

Metavesco Inc. has unveiled a plan to bring over-the-counter (OTC) equities onto the blockchain, positioning tokenization as the solution to decades of inefficiency in small-cap markets. The company said the initiative will deliver transparency, global liquidity, and lower costs of capital for issuers while creating fairer conditions for retail investors.

The announcement comes as Metavesco prepares to join an SEC roundtable on September 4 with Commissioner Hester Peirce, where the firm will advocate tokenization as a regulatory pathway for OTC issuers.

Tokenization as a Fix for Market Inefficiencies

Metavesco pointed to systemic weaknesses in the OTC ecosystem, including illiquidity, lack of analyst coverage, and toxic convertible note financing that often dilutes shareholders. By shifting equities on-chain, the company said these barriers could be dismantled.

Tokenized shares would be tradable across borders, opening access to global capital pools beyond U.S. broker-dealers. On-chain transparency would make every issuance and trade verifiable, reducing market manipulation and naked shorting. Blockchain infrastructure would also lower costs for dividends, rewards, and capital raises.

Metavesco’s Strategy in Web3 Finance

The company has already established a footprint in digital assets with a Bitcoin and Ethereum treasury and mining operations. Its latest initiative seeks to extend that position by building frameworks for tokenized securities in collaboration with regulators and innovators.

“Tokenization is not just innovation but necessity,”

Metavesco said in its announcement, stressing that the future of capital markets must be transparent, global, and blockchain-driven. If successful, the plan could make OTC securities one of the next major frontiers for Real-World Asset (RWA) adoption in crypto markets.

Meanwhile, Toyota Blockchain Lab has introduced its Mobility Orchestration Network (MON) prototype on the Avalanche blockchain. Designed to break down fragmentation in global mobility ecosystems, MON seeks to securely connect automakers, regulators, insurers, and service providers through a unified blockchain infrastructure. MON leverages Avalanche’s multi-layer-1 (multi-L1) architecture, chosen for sub-second transaction finality, scalability , and interoperability.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

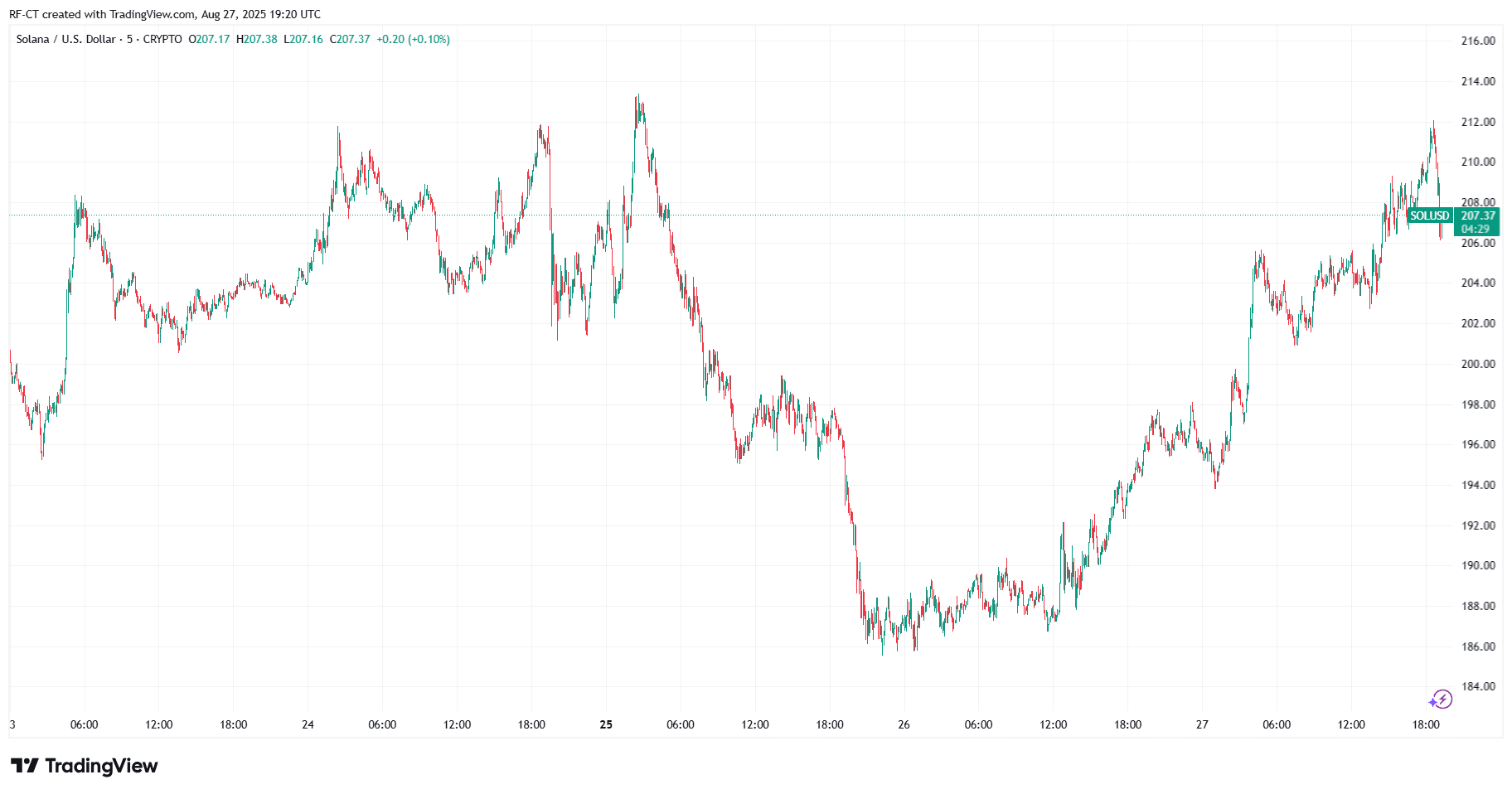

Solana Price Prediction: Can SOL Break $215 and Surge Toward $300?

Bitcoin Price Back Above $112K As Positive BTC NEWS Hits

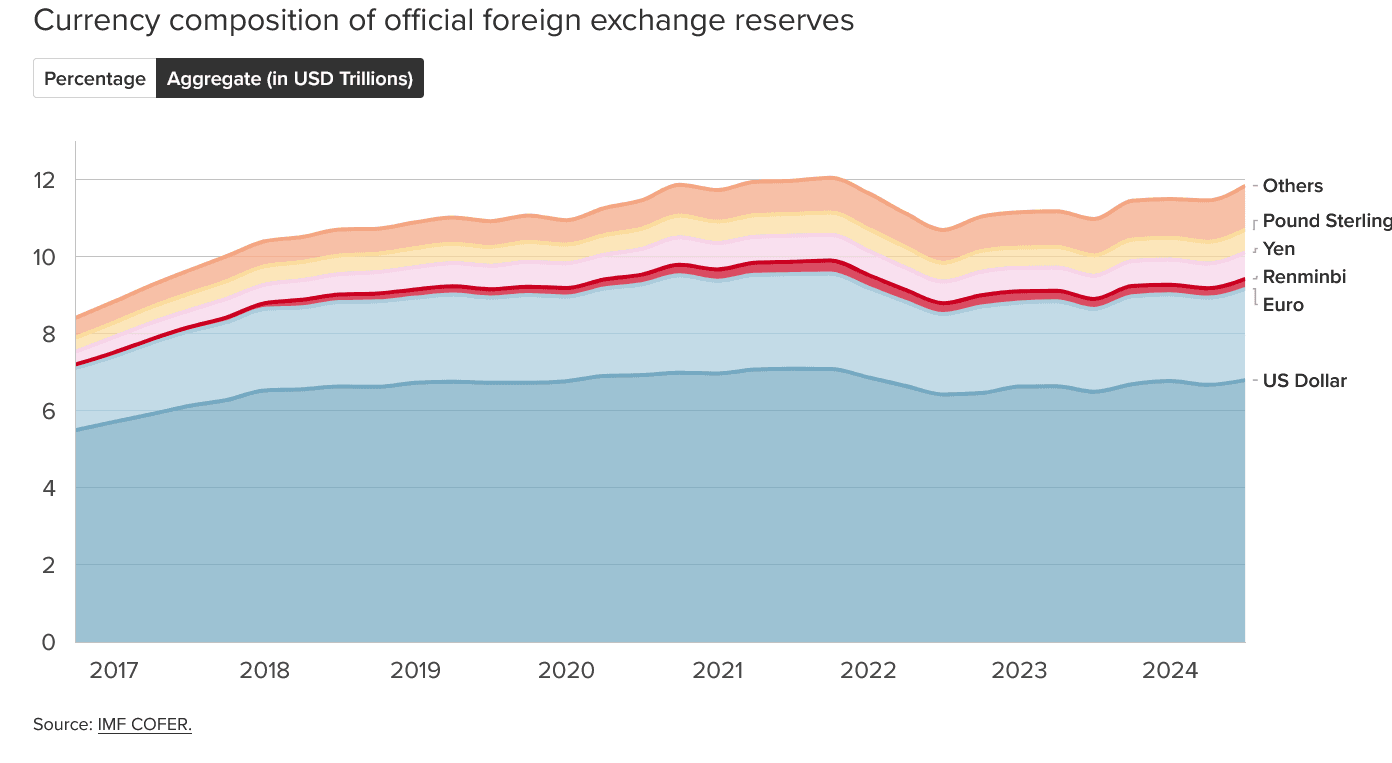

Crypto News: Dollar Weaponization Is Fueling the Next Crypto Boom?

The 2 Most Undervalued Altcoins Poised for Explosive Growth in Q4 2025

- Q3 2025 altcoin market shows optimism with institutional support and on-chain signals, highlighting Maxi Doge (MAXI) and HYPER as undervalued projects with disruptive potential. - Maxi Doge, an Ethereum-based meme coin with 1,000x leverage trading and 383% APY, raised $1.63M in presale, projecting 12.9x price growth by Q4 2025. - HYPER, a Bitcoin Layer 2 solution using ZK-rollups and SVM, aims to boost scalability and enable a $223B Bitcoin-native DeFi ecosystem, with $12.3M raised and 100x gain projecti