Bitget Futures: Why is my TP/SL order triggered but not executed?

Take-profit (TP) and stop-loss (SL) orders are essential tools for managing risk and securing profits in Bitget futures trading. However, there may be times when your order doesn't execute, even though the market price reaches your set trigger level. In some cases, the order may even be liquidated. This article explains the common reasons why TP/SL orders may fail to execute, and helps you better understand and improve your trading strategy.

1. How TP/SL orders work

A TP/SL order is a conditional trigger order. Its execution happens in two steps:

1. Trigger stage: When the system detects that the market price (mark price or last price) reaches the set trigger condition, the TP/SL order is activated.

2. Order stage: After the TP/SL order is activated, the system automatically places a real order into the matching engine based on the user's preset type (limit price or market price), and waits for execution.

Note: The "trigger" of a TP/SL order does not guarantee execution. If the order fails to execute due to market liquidity or price deviation, the position will remain open and may face liquidation risk.

2. Common reasons why the order fails to close

1. Differences in trigger price types

TP/SL orders support multiple trigger price types, including:

• Market price: the most recent transaction price

• Mark price: the mark price

During volatility, these prices may differ. If the SL order is set based on the last price, but only the mark price reaches the trigger level, the SL order will not be triggered. However, liquidation is determined by the mark price. Therefore, the position may be liquidated based on the mark price before the last transaction price triggers the stop-loss.

2. Order not filled after triggering

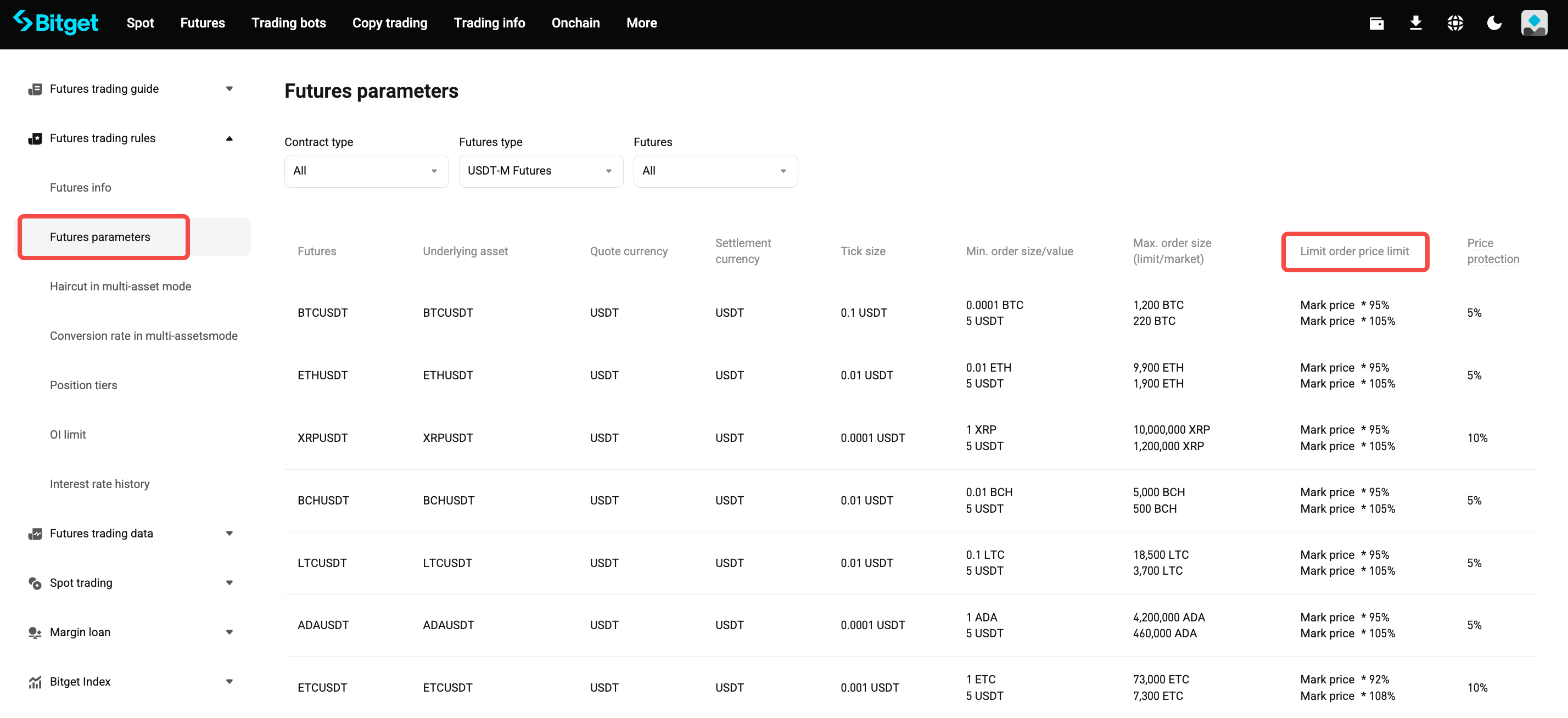

○ After triggering, the order may fail to execute. This can happen if the order price exceeds the price limit, or if the order quantity exceeds the maximum futures order size. For more details, refer to: Futures parameters

○ After triggering, the order is placed successfully. However, it is not fully filled. If the market is highly volatile, lacks depth, or has low liquidity at the time of triggering, the following may occur:

▪ A limit order may not be filled if no one takes the order

▪ A market order may not be fully filled if market depth is insufficient.

3. Invalid parameter settings

○ For example, in a stop-loss limit order, if the order price is set too far from the trigger price, the order may fail to execute after triggering.

4. System delay and extreme market conditions

3. How to optimize your TP/SL settings

To boost the success rate of your TP/SL executions, consider the following strategies:

1. Set a reasonable gap between trigger price and limit price: In volatile markets, it's recommended to leave more room for your limit order price away from the trigger price for a higher chance of execution. For example, if your TP trigger price is 32,000 USDT, consider setting the limit order at 31,950 USDT. When necessary, consider using a market-type TP/SL order.

2. Monitor account margin: Keep sufficient margin in your account to avoid liquidation before the SL order is executed.

3. Pay attention to market depth: Before placing TP/SL orders, check Bitget's market depth data and choose a price range with better liquidity.

4. Use Bitget trading bots and tools: Leverage smart tools like copy trading and grid bots to automate your TP/SL management, reducing the risk of error in manual execution.

4. Conclusion

Take-profit and stop-loss orders are important risk management tools, but their effectiveness still depends on market volatility, depth, and matching mechanisms. You can significantly improve the execution success rate of your TP/SL orders by optimizing your order parameters, maintaining a healthy margin, and using Bitget's advanced trading tools.

Compartir