News>

Bitget Futures Market Update: Futures CVD Dips As Powell Pushed Back Against Rate Cut Bets

Bitget2024/02/02 05:45

By: Bitget

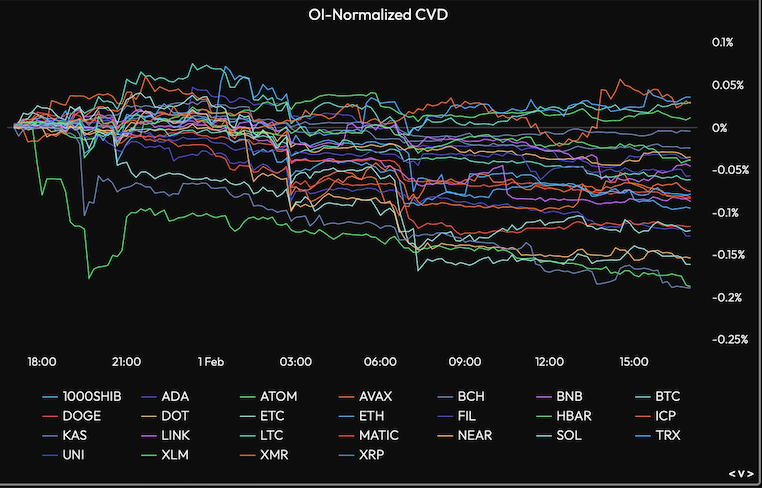

- The chart shows the 24-hour change in cumulative volume delta (CVD) in futures and perpetual futures tied to the top 25 cryptocurrencies by market value.

- Except for BTC, TRX, ATOM, and XMR, the CVD has been negative for most coins, indicating net selling pressure.

- On Wednesday, Federal Reserve Chairman Jerome Powell pushed back against bets of a U.S. rate cut as soon as March, sending the dollar index to seven-week highs.

Source: Velo Data/CoinDesk

Futures Market Updates

Over the past 24 hours, the futures market went through a series of liquidations on short positions after a pullback. Major cryptocurrencies such as BTC and ETH still dominate the market. Investors are balanced between their long contracts and short contracts.

Bitcoin Futures Updates

Total BTC Open Interest: $17.54B (+2.50%) BTC Volume (24H): $37.73B (-19.51%) BTC Liquidations (24H): $9.20M (Long)/$17.51M (Short) Long/Short Ratio: 50.68%/49.32% Funding Rate: 0.0075%

Ether Futures Updates

Total ETH Open Interest: $7.66B (+1.96%) ETH Volume (24H): $13.15B (-33.14%) ETH Liquidations (24H): $5.05M (Long)/$9.02M (Short) Long/Short Ratio: 50.11%/49.89% Funding Rate: 0.0054% ---

Top 3 OI Surges

ZETA: $27.49M (+559.7849.24%) PYTH: $92.88M (+73.56%) JUP: $51.81M (+58.45%)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

Lock now!

You may also like

Crypto prices

MoreBecome a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now