Bitcoin ( BTC ) saw snap losses into the Feb. 13 Wall Street open as United States inflation data dealt a blow to risk assets.

Bitcoin ( BTC ) saw snap losses into the Feb. 13 Wall Street open as United States inflation data dealt a blow to risk assets.

Data from Cointelegraph markets Pro and TradingView followed a 3.8% BTC price decline on the day, bottoming at $48,435 on Bitstamp.

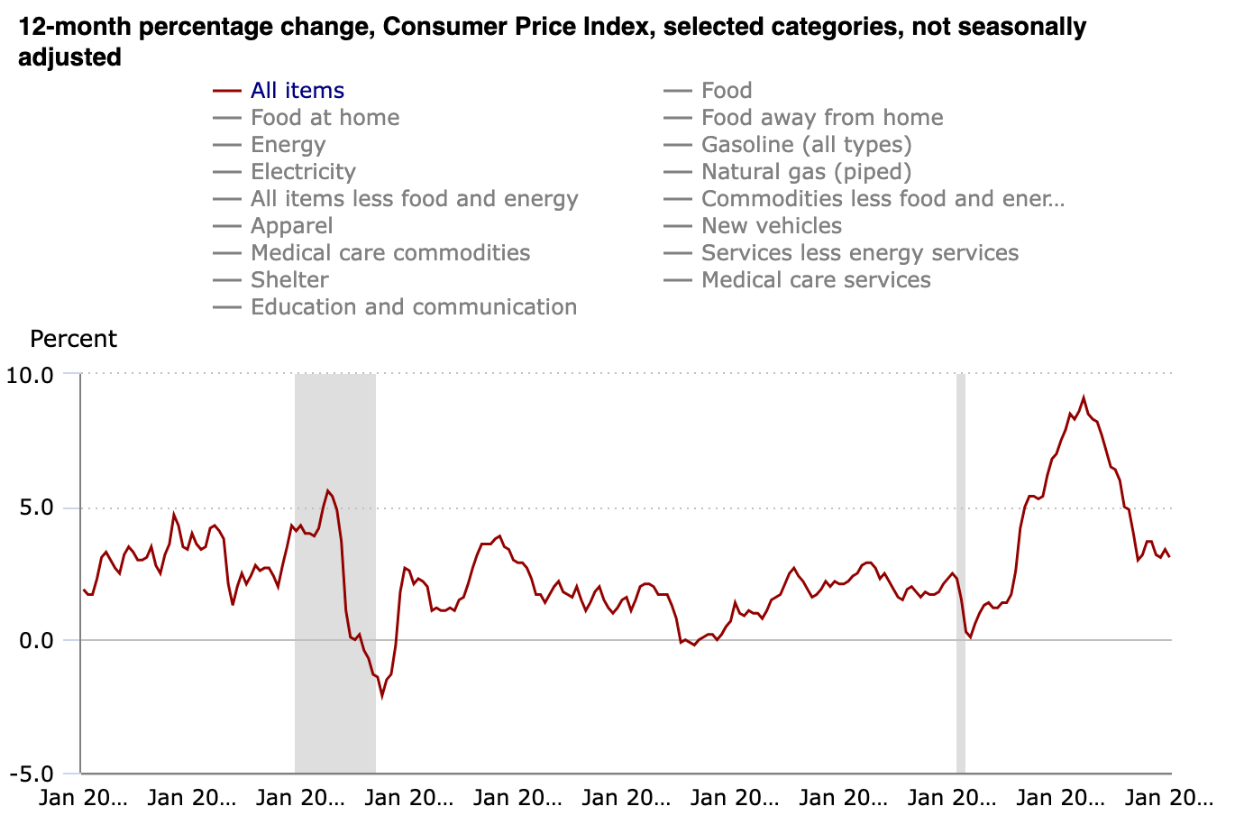

Bitcoin reacted badly to the January Consumer Price Index (CPI) print, which exceeded expectations.

Month-on-month CPI came in at 0.3%, with the year-on-year figure at 3.1% — 0.1% and 0.3% higher than predicted, respectively.

"The index for shelter continued to rise in January, increasing 0.6 percent and contributing over two thirds of the monthly all items increase. The food index increased 0.4 percent in January, as the food at home index increased 0.4 percent and the food away from home index rose 0.5 percent over the month," an official press release from the U.S. Bureau of Labor Statistics read.

"In contrast, the energy index fell 0.9 percent over the month due in large part to the decline in the gasoline index."

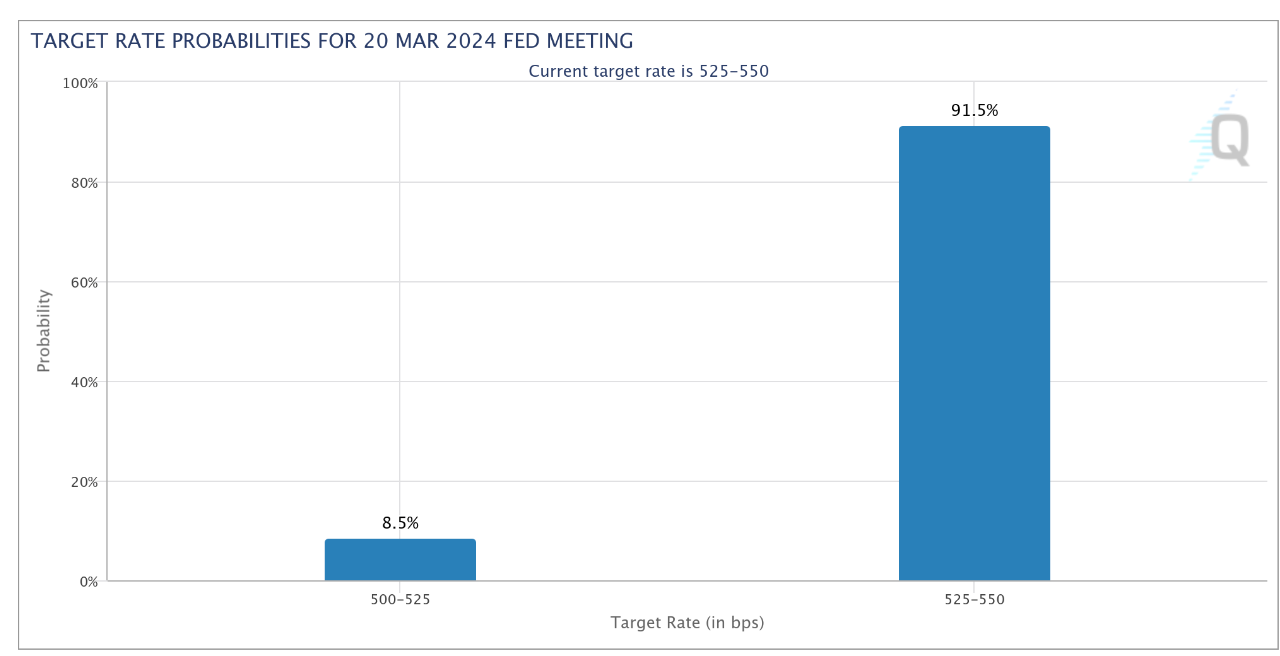

Markets immediately began reassessing the likelihood of the Federal Reserve cutting interest rates, shifting their timing from March to later in the year.

The latest data from CME Group’s FedWatch Tool put the odds of a March rate cut at just 8.5% at the time of writing versus 17.5% on Feb. 12.

“This inflation reading was much hotter than expected all around the board,” trading resource The Kobeissi Letter wrote in part of a reaction on X (formerly Twitter).

“Core CPI was expected to fall and it didn't while CPI inflation came in 20 bps above expectations. A March rate cut is likely gone.”

Kobeissi added that avoiding the premature rate cut, which would boost risk assets including crypto, was the Fed’s “top priority.”

The recommencing of inflows into the spot Bitcoin exchange-traded funds (ETFs) meanwhile did little to steady the ship for Bitcoin.

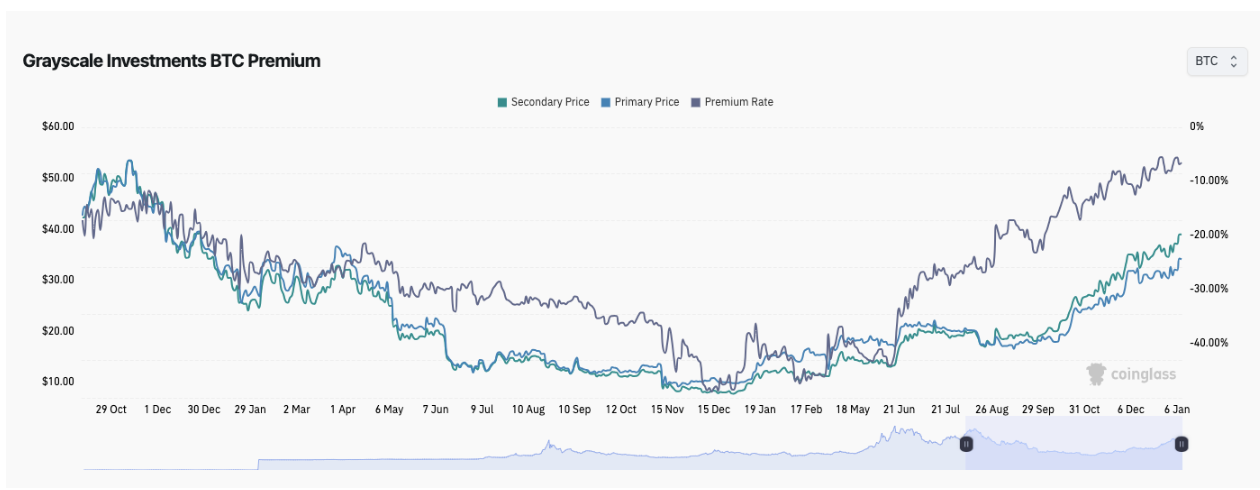

$49,000 remained out of reach at the time of writing, as the day’s outflows from the Grayscale Bitcoin Trust (GBTC) totaled around 2,400 BTC ($117 million), per data from crypto intelligence firm Arkham.

Uploading the numbers to X, popular trader Daan Crypto Trades nonetheless acknowledged positive trends persisting for ETF flows, these now absorbing the BTC supply around twelve times faster than new coins enter the market.

“$GBTC Outflows remain relatively low while the other ETFs are ramping up their buys more recently. Yesterday's ETF net flows saw another massive +$493M increase,” he wrote.

“This makes for $1.4B in net inflows during the past 3 trading days. We now have 12 consecutive positive days of net inflows.”

The difference between GBTC’s share price relative to Bitcoin — the so-called net asset value, or NAV — flipped positive for the first time in nearly three years last week.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.