Bitcoin ( BTC ) investments in the United States exchange-traded funds (ETFs) market recorded a net positive inflow right before the Bitcoin halving day following five consecutive days of drain.

Anticipating an increase in market value post-halving, investment strategies worldwide recommended adding Bitcoin to existing portfolios. The Bitcoin ETF market followed through with the strategy while putting an end to an outflow streak dating back to April 12.

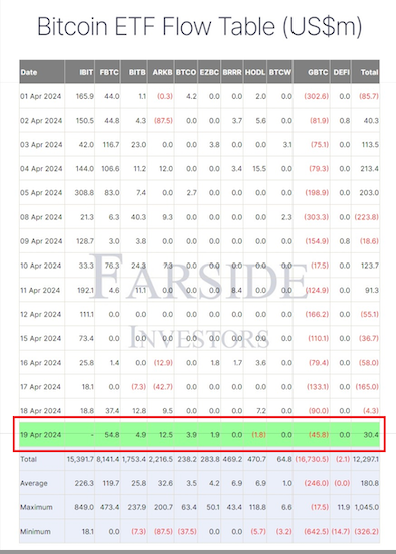

Spot Bitcoin ETF net flows. Source: Farside According to Farside data , the U.S. Bitcoin ETF ecosystem recorded outflows for five straight days between April 12 and 18, owing to a lack of contribution from most players. The outflows are majorly attributed to the Grayscale Bitcoin Trust ETF (GBTC), which has been shedding investments since January when the Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs .

However, on April 19, five of the 10 approved ETFs recorded positive inflows that overshadowed the GBTC outflows, bringing in a total of $30.4 million to the market.

Negating cumulative outflows of $47.6 million from GBTC ($45.8 million) and Fidelity Wise Origin Bitcoin Fund (FBTC) ($1.8 million), Fidelity Wise Origin Bitcoin Fund (FBTC) brought in $54.8 million right before the Bitcoin halving event commenced.

Other inflow contributors include Bitwise Bitcoin ETF (BITB) at $4.9 million, ARK 21Shares Bitcoin ETF (ARKB) at $12.5 million, Invesco Galaxy Bitcoin ETF (BTCO) at $3.9 million and Franklin Bitcoin ETF (EZBC) at $1.9 million.

Bitcoin price between two halving events. Source: TradingView The previous Bitcoin halving took place on May 11, 2020, when the asset had a market value of roughly $8,500. However, the subsequent reduction in BTC issuance appreciated its value to roughly $65,000 in four years, according to data from Cointelegraph Markets Pro and TradingView.

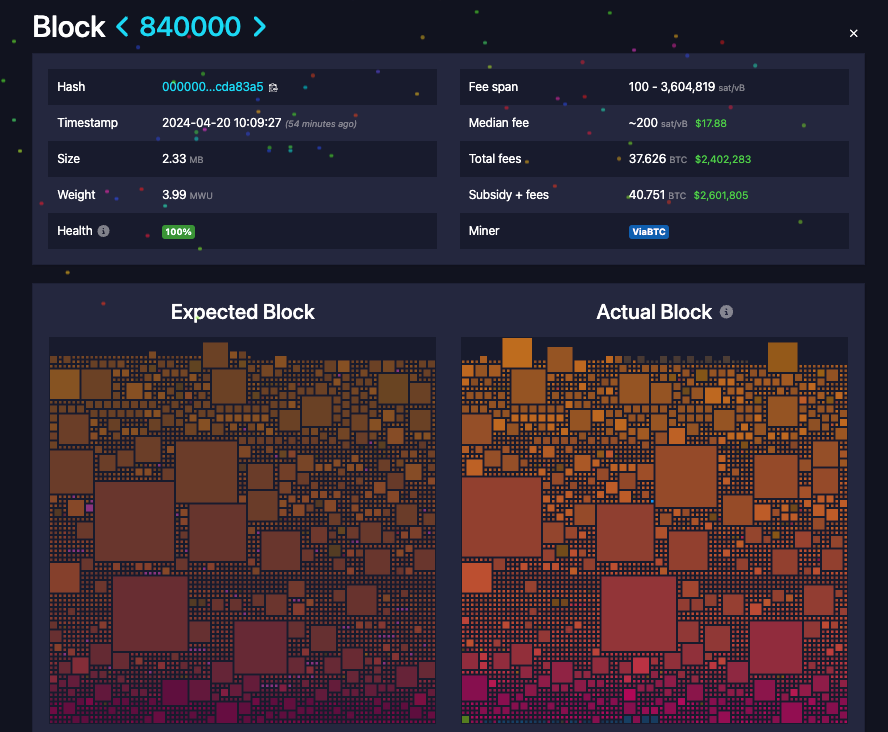

The Bitcoin block 840,000, which triggered the fourth-ever Bitcoin halving event on April 20, at 12:09 am UTC, momentarily spiked the network fees due to high demand.

Users spent $2.4 million in fees to inscribe runes and rare satoshis on the first halving block. Source: Mempool.space As a result, Bitcoin users have spent a staggering 37.7 BTC in fees — worth just over $2.4 million at current prices — to nab their share of limited space on the fourth-ever Bitcoin halving block.