Bitcoin Booms: ETFs Surge & Ether ETF Approval Imminent!

From Derbit Insights by Daily Trade Inspiration

View on market

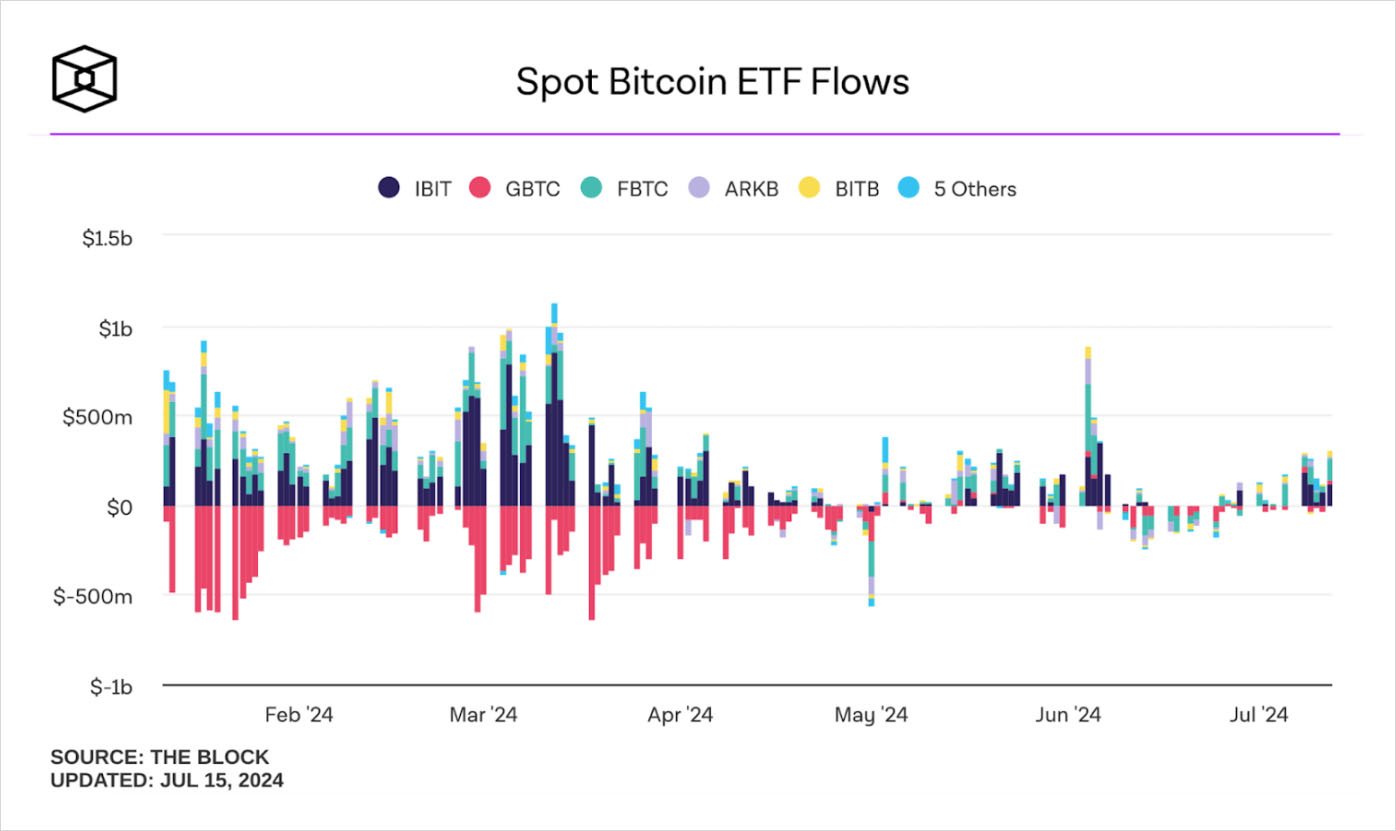

US spot Bitcoin ETFs have attracted $300.9 million on Monday, extending the current streak of consecutive inflow days to seven. BlackRock CEO Larry Fink now recognizes Bitcoin as a legitimate financial instrument. Spot Ether ETFs are set to launch on July 23, with historical patterns suggesting potential market corrections following such regulatory approvals.

Call Ratio Spread

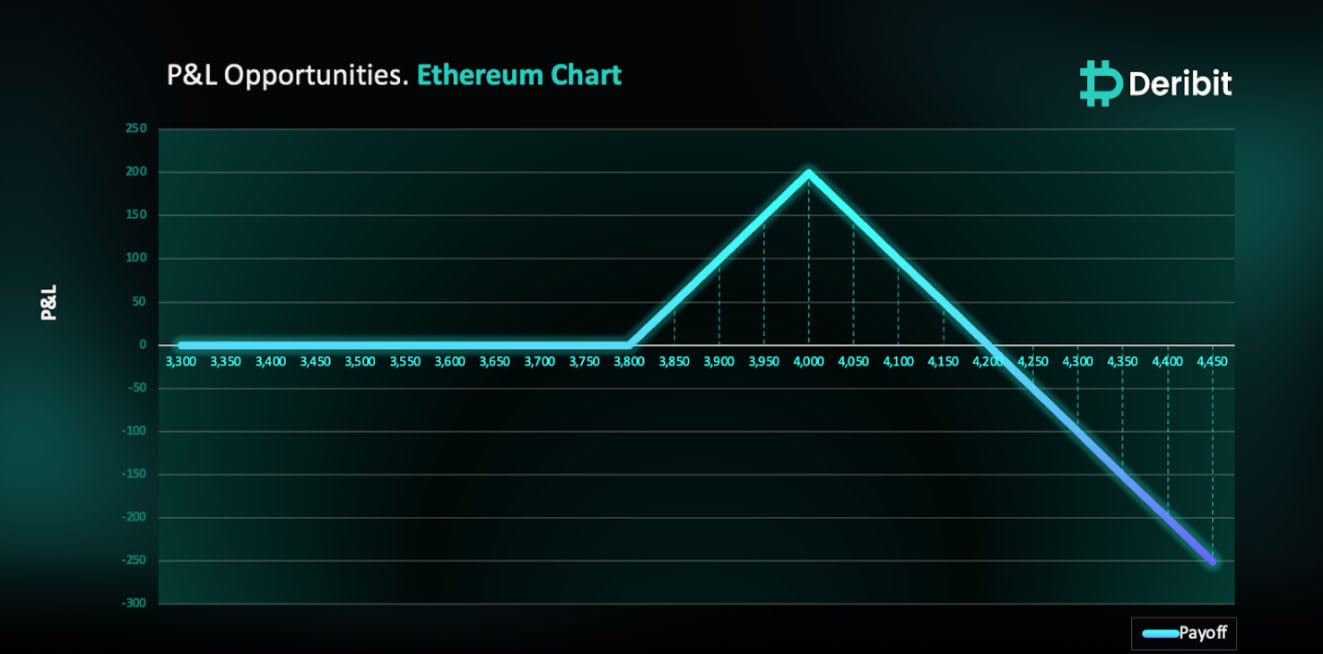

The proposed strategy is a Call Ratio Spread. A Call Ratio Spread involves buying a Call option that is OTM, and then selling two Calls of the same expiry, further OTM.

You may consider taking this trade if you are anticipating continued resistance at the $4,000 levels in ETH. The trade is particularly suitable for those expecting limited upward movement on ETH ETF’s approval.

Trade Structure

(OTM Call) Buy 1x ETH-26JUL24-$3,800-C @ $30.2(OTM Call) Sell 2x ETH-26JUL24-$4,000-C @ $14.85

Target: Spot level < $4,000

Payouts

Maximum Profit: $199.5/ETHDebit of Strategy: $0.5/ETH

Why are we taking this trade?

US Spot Bitcoin ETFs Experience $300.9 Million Inflows Over Seven Consecutive Days

US spot Bitcoin ETFs have seen an impressive $300.9 million in inflows, marking seven consecutive days of positive movement. BlackRock co-founder and CEO Larry Fink, in a CNBC interview on Monday, acknowledged Bitcoin as a “legitimate financial instrument,” admitting that his previous skepticism about the cryptocurrency was misplaced (Source: Farside Investors ).

Spot Ether ETFs Set for July 23 Launch

Spot Ether ETFs are expected to launch on July 23, according to The Block . The SEC has requested issuers to include the Sponsor Fee in their next filings, which are due by Wednesday at 5:30 p.m. EST.

Historical Insights and Market Patterns

As highlighted in the June 27th insights, the listing of regulated exchange products has historically been followed by corrections in Bitcoin prices. This pattern was seen with the CME Bitcoin Futures launch in December 2017, the Coinbase IPO in April 2021, the Bitcoin ETFs based on Futures in October 2021, and the Bitcoin ETFs based on Spot in January 2024. Each correction occurred after a significant price run-up driven by anticipation of these launches. The potential approval of Ethereum ETFs is a positive development, and approval seems imminent.

Technical Analysis and Market Projections for Ethereum

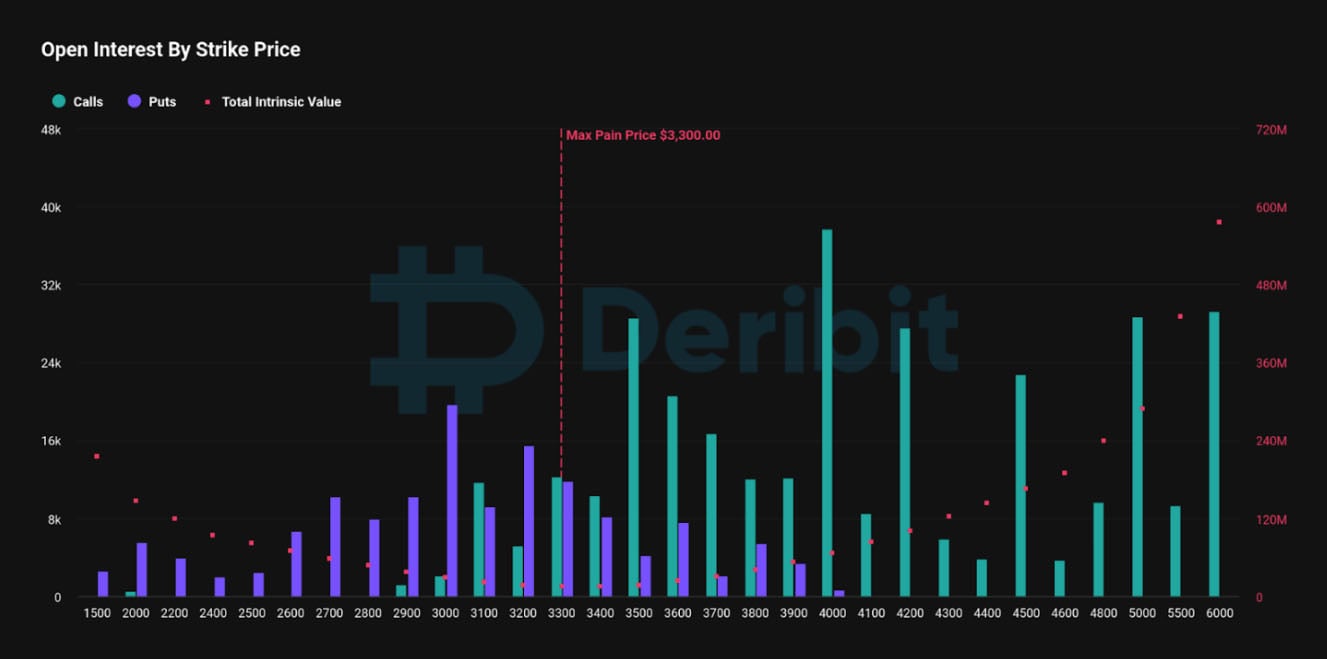

On the technical front, the attached Ethereum chart highlights the $3,800 level as a crucial pivot. With news of ETF approval, Ethereum’s price could aim to breach the $3,800 mark and potentially reach $4,000. However, due to high resistance at this pivot point, a “sell the news” scenario could unfold. Additionally, options data from Deribit indicates high open interest at the $4,000 strike for ETH options expiring on July 26 (Source: Deribit ).

Therefore, traders can consider deploying a Call Ratio strategy to capitalize on the anticipated price movements.

To implement this strategy, traders can buy a Call option (e.g., $3,800) and simultaneously sell Calls in double the quantity (2x) of a higher strike price (e.g., $4,000).

If the price of ETH is at $4,000 when the options expire on July 26th, traders will be at maximum profit from the strategy.

It’s important to note that while the initial debit of this strategy is $0.5, losses beyond the initial debit are possible due to the position’s net short call exposure.