US Ethereum spot ETFs see $133 million outflows one day after strong debut

Key Takeaways

- Spot Ethereum ETF flows turned negative on the second day.

- Fidelity's Ethereum Fund outperformed BlackRock's Ethereum ETF, which led the first day with over $266 million.

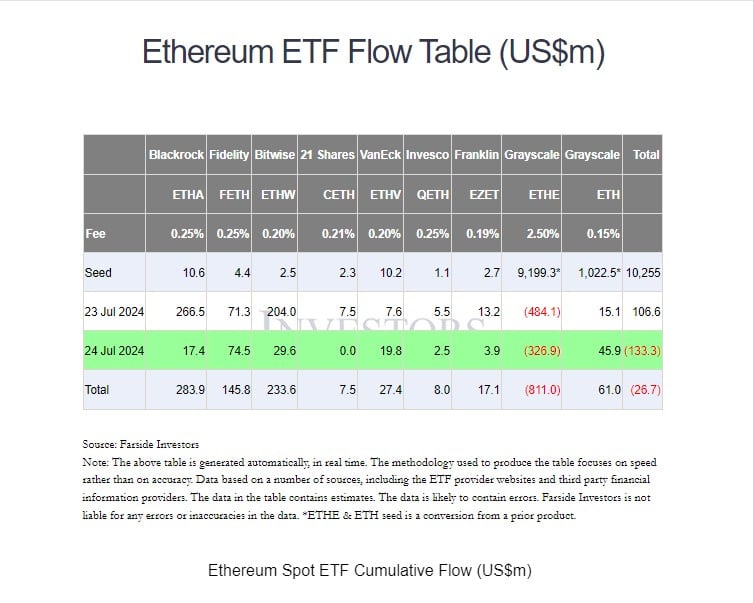

US spot Ethereum exchange-traded funds (ETFs) have seen a decline in net inflows after a strong start with almost $107 million. According to data from Farside Investors, investors withdrew around $133 million from these products on the second day of trading.

Fidelity’s Ethereum Fund (FETH) outpaced BlackRock’s iShares Ethereum Trust (ETHA) to become the day’s leader with $74.5 million in net inflows. Meanwhile, BlackRock’s fund took in nearly $17.5 million on Wednesday.

Source: Farside Investors

Source: Farside Investors On the first day of trading, ETHA led the pack with over $266 million. ETHA’s flows and additional inflows from seven other Ethereum ETFs managed to offset massive outflows from Grayscale’s Ethereum ETF (ETHE) on its debut day.

However, a similar dynamic did not play out on the second day. Grayscale’s ETHE bled nearly $327 million, bringing the total outflows to $811 million since the fund’s conversion. After the second trading day, ETHE’s assets under management dropped to $8.3 billion , down from $9 billion prior to the debut of spot Ethereum ETFs.

In contrast, the Grayscale Ethereum Mini Trust (ETH), a spinoff of Grayscale’s ETHE, recorded approximately $46 million in inflows. The fund is among the lowest-cost spot Ethereum products in the US market.

Bitwise’s Ethereum ETF (ETHW) witnessed over $29 million in net inflows, while VanEck’s Ethereum ETF (ETHV) reported $20 million. Other gains were also seen in Franklin’s EZET and Invesco/Galaxy’s QETH.

21Shares’s Core Ethereum ETF (CETH) saw zero flows.