SBI Holdings Files XRP+Bitcoin ETF Applications in Japan

SBI Holdings, a key partner of Ripple, plans to launch two innovative crypto-linked ETFs—marking a significant milestone in XRP’s journey toward institutional recognition and regulatory acceptance in Japan.

The move could unlock new liquidity streams and pave the way for wider institutional participation in digital assets.

XRP and Bitcoin Take Center Stage

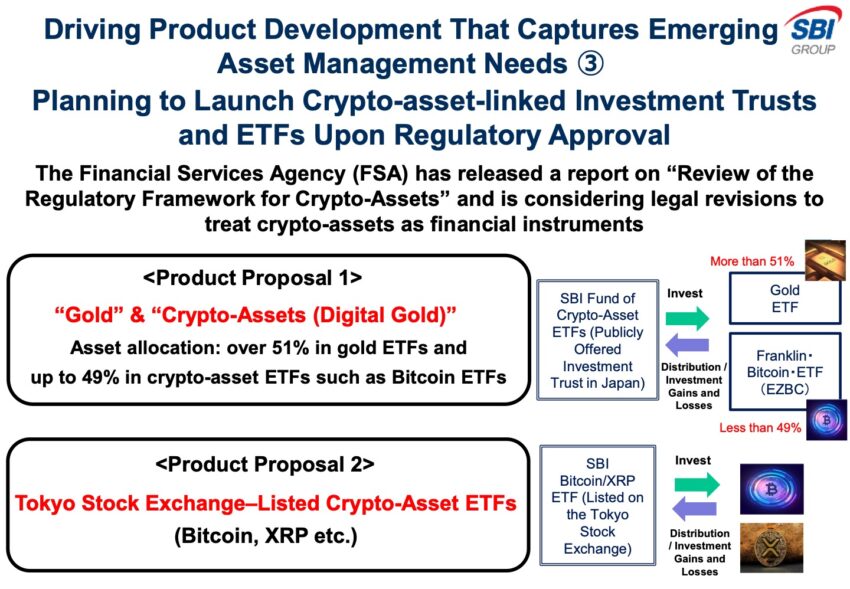

SBI, in its Q2 results announcement, has disclosed the filing of two new exchange-traded funds (ETFs) incorporating XRP, Bitcoin, and gold. The initiative forms part of its Q2 2025 financial strategy. The announcement was first revealed via social media by XRP community figure Amelie.

The flagship product, the Crypto-Assets ETF, will offer direct exposure to both XRP and Bitcoin. If approved, it could serve as a key catalyst for institutional adoption of XRP in Japan. Regulatory hurdles have historically limited such products in the country.

The move has been met with optimism by the “XRP Army,” a vocal community of XRP advocates. It is being seen as a strategic step toward XRP’s broader market legitimization. SBI’s ongoing commitment to Ripple and the digital asset space is evident.

SBI has disclosed the filing of two new ETFs incorporating XRP, Bitcoin, and gold. Source: SBI Q2 Financial Results

SBI has disclosed the filing of two new ETFs incorporating XRP, Bitcoin, and gold. Source: SBI Q2 Financial Results The second fund, the Digital Gold Crypto ETF, takes a hybrid approach combining gold-backed securities with digital currencies. More than 50% of the fund will be allocated to gold ETFs. This aims to create a balanced investment product appealing to both crypto enthusiasts and risk-averse investors.

By merging the growth potential of cryptocurrencies with gold’s stability, SBI offers a novel risk-adjusted vehicle. This strategy caters to a wider investor base. It also positions SBI as a trailblazer at the intersection of traditional finance and blockchain innovation.

SBI (formerly Softbank Investment) is a financial conglomerate focused on financial services, asset management, and biotechnology. Softbank is a global technology and investment company involved in telecommunications, internet services, and more. SBI’s proven track record in crypto includes stablecoin initiatives and blockchain-based payments.

XRP’s Growing Legitimacy

SBI’s inclusion of XRP signals deep confidence in the token’s long-term value and utility. This is particularly relevant for cross-border payments. As a major Ripple stakeholder, SBI has promoted XRP in Asia’s financial corridors.

XRP ETFs are already trading in Canada, but none are approved yet in most major markets, including the United States. However, there is widespread industry expectation that approval will come as soon as September–October 2025.

Should Japan’s Financial Services Agency approve the ETFs, it would mark a critical shift for the XRP ecosystem and the industry. This would grant XRP formal recognition as a regulated investment asset. Such development could boost investor confidence significantly. Market analysts believe SBI’s move could prompt other financial institutions to introduce similar products.

The ETF proposal arrives amid Japan’s evolving regulatory posture toward digital assets. While historically conservative, regulators have recently shown openness to innovation amid recent election results showing possibilities of major changes in tax reform.