News>

Bitget Daily Digest(October 9)|UK FCA lifts retail ban on crypto ETNs; Linea to unlock 1.08 billion tokens tomorrow; Bitcoin ETF sees net inflow of 7,743 BTC in a single day.

Bitget2025/10/09 03:10

By: Bitget

Today's Preview

- The UK Treasury establishes a "Digital Markets Supervisor" to advance the blockchain transformation of wholesale markets;

- BlackRock’s Bitcoin ETF holdings exceed 800,000 BTC. This means that in 437 trading days since launch, IBIT has purchased an average of 1,836 BTC per day.

- Linea (LINEA) will unlock 1.08 billion tokens worth approximately $29.6 million on October 10, 2025 (UTC+8);

Macro & Hot Topics

- The UK FCA will allow retail access to crypto ETNs starting October 8, provided they are listed on FCA-approved UK exchanges. The derivatives ban remains in place;

- A dormant Bitcoin whale sold 3,000 BTC (about $364 million USDC) on the HyperLiquid platform on October 8 after three weeks of inactivity. The whale still holds 46,765 BTC;

- This week sees major token unlocks from several leading projects: Linea (1.08 billion tokens), Aptos (11.31 million tokens, valued at about $61.3 million), and Axie Infinity (652,500 tokens), among others—potentially impacting market liquidity;

Market Updates

- BTC and ETH experienced short-term pullbacks. Market sentiment is optimistic, with active long-short confrontation. Over the past 24 hours, total liquidations across the market reached about $431 million. Investors should stay alert to volatility risks;

- US stocks showed mixed performance: Nasdaq rose 1.12%, S&P 500 up 0.58%, and Dow Jones slightly down;

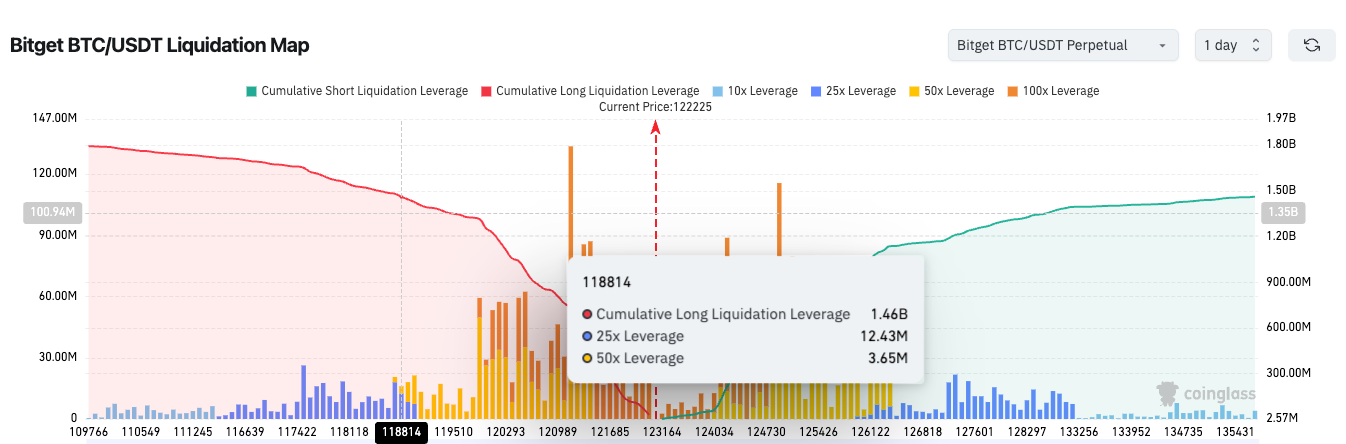

3、Bitget BTC/USDT liquidation map shows the current price at $122,239, with long liquidation strength surging to $1.486 billion; risks are sharply higher for 25x leverage positions—beware of chain liquidation events;

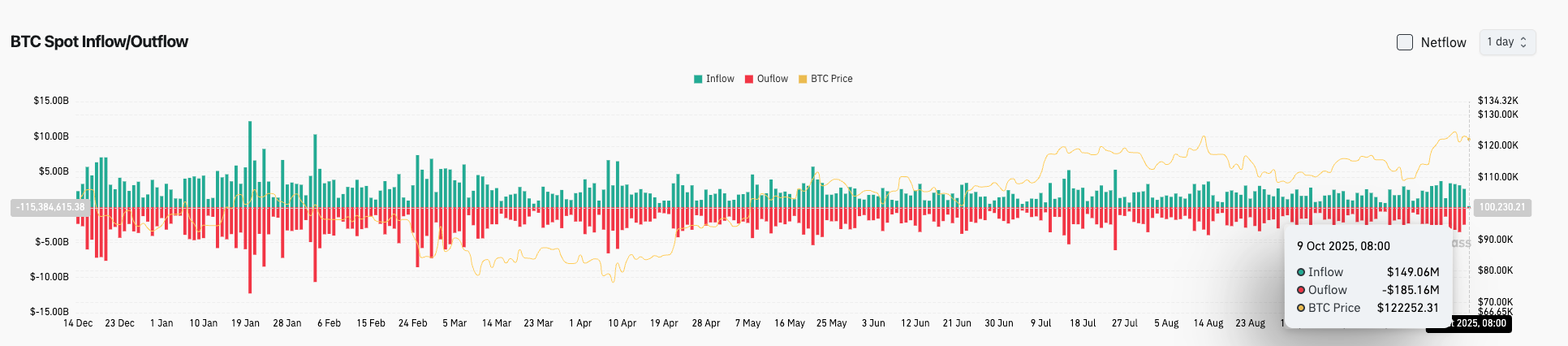

4、In the past 24 hours, BTC spot inflows totaled $149 million, outflows $185 million, for a net outflow of $36 million;

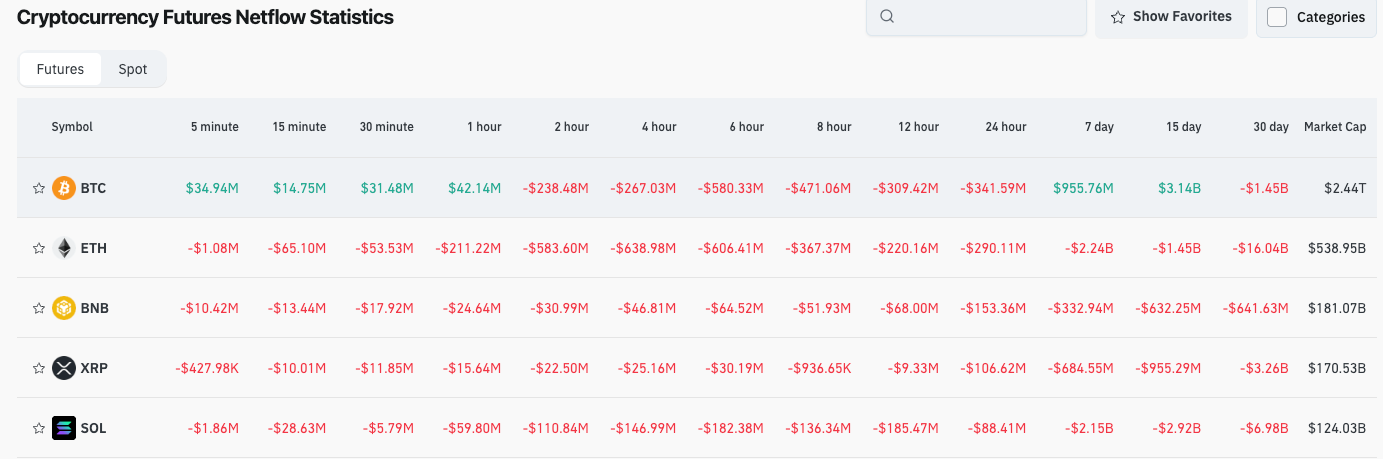

5、BTC, ETH, BNB, XRP, and SOL experienced leading contract (derivatives) net outflows in the past 24 hours—potential trading opportunities may exist;

News Updates

- The US government shutdown has entered its second week, significantly delaying progress on crypto market structure legislation;

- Wisconsin Congressman Bryan Steil stated that the Republican Party aims to advance the “CLARITY Act,” a crypto market structure bill, by 2026;

- SEC Chairman Paul Atkins said the SEC plans to officially establish a crypto “innovation exemption” rule by the end of 2025 or early 2026 to foster the development of emerging digital asset technologies;

Project Developments

- DeFi Development Corp. and Superteam Japan have launched Japan’s first Solana-based treasury project, DFDV JP;

- Aptos (APT) will unlock 11.31 million APT (about 2.15% of circulating supply) on October 11;

- Axie Infinity (AXS) will unlock 652,500 AXS (~0.25% of circulating supply) on October 9;

- Jito (JTO) is scheduled to unlock some tokens this week, specific amounts TBD;

- Solana treasury firm Helius plans to buy at least 5% SOL, and will seek a secondary listing in Hong Kong;

- BlackRock's IBIT and ETCH products have reached new highs in BTC and ETH holdings, respectively;

- HyperLiquid has become the main platform for whale BTC sell-offs;

- Superteam Japan continues to expand Solana ecosystem partnerships in Japan;

Disclaimer: This report is AI-generated with human fact-checking. It does not constitute any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

Lock now!

You may also like

Crypto prices

MoreBecome a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now