HYPE Surges to New ATH of $51: Bullish Run or Market Exhaustion?

- HYPE hits $51 ATH with 12% gains as bullish traders fuel momentum in the market.

- Protocol buybacks, whale entries, and institutional custody tighten supply and boost growth.

- RSI and DMI favor buyers’ control, though ADX signals the current trend remains moderate.

Hyperliquid (HYPE) set a new all-time high (ATH) at $51.07. The token is trading at approximately $50.8 at press time, marking a 12% gain within the last 24 hours. The chart indicates stable lows and intense upward pressure, which pushed the price through major resistance levels, up to the ATH.

Source: X

Source: X Why is HYPE’s Price Up?

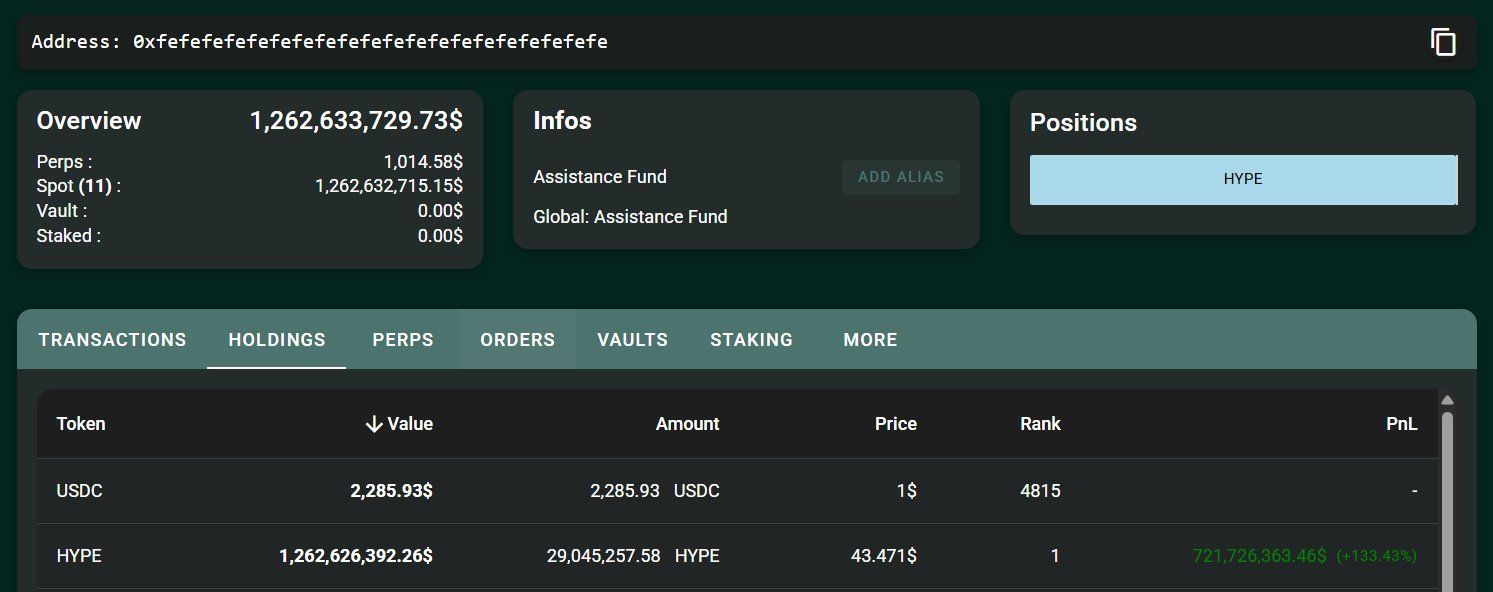

Hyperliquid’s HYPE token has surged in value, fueled by a mix of buybacks, large whale purchases, and growing institutional interest. The main force behind this rally is the protocol’s powerful buyback engine.

Since January, the protocol has funneled 97% of its trading fees—worth an annualized $1.26 billion—into purchasing its own token. This strategy has already pulled nearly 29 million HYPE out of circulation, about 8.7% of what is currently available.

Source: X

Source: X With only a third of the total one billion supply in the market, every buyback deepens the scarcity effect, echoing the shareholder return programs used by the world’s largest corporations. Whales stepping in have reinforced momentum.

On August 17, one investor spent 19.38 million USDC to buy HYPE and holds a total of 555.608 HYPE worth approximately $25.62M. This investor’s actions triggered a sharp climb in open interest. This increase is a clear sign that traders are stacking leveraged bets on further upside.

Institutional adoption is also fueling the fire. HyperEVM’s BitGo now offers custody support, providing a safe entry point for large investors to the ecosystem. Not only does this develop Hyperliquid’s trustworthiness, but it also marks Hyperliquid’s increasing ability to rival centralized exchanges.

Source: X

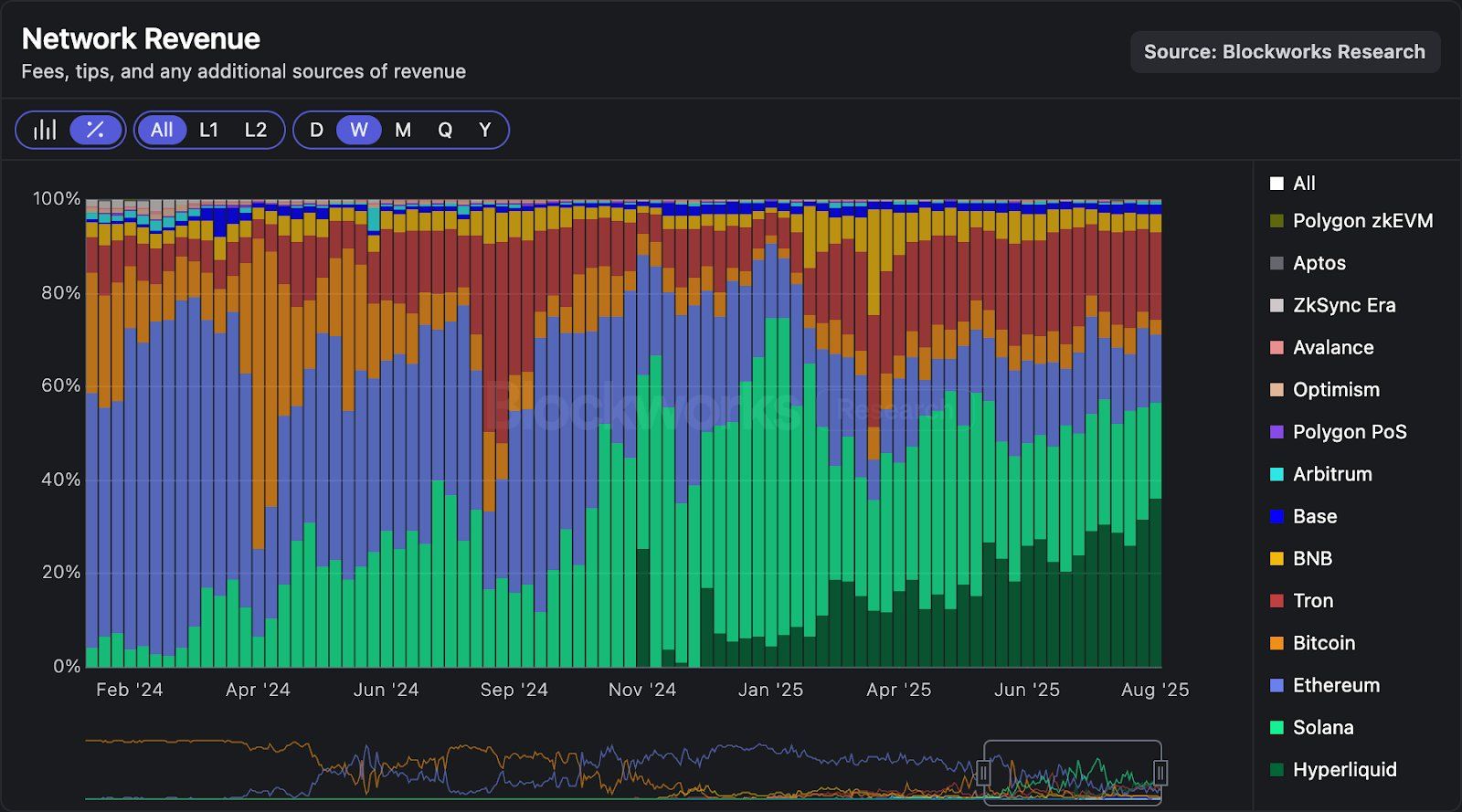

Source: X The fundamentals complete the narrative. Over the last month, Hyperliquid has gathered almost $100 million in fees, with $28 million generated weekly in the last two weeks. The platform’s revenue run rate indicates rapid growth and a step toward dominance, as the data supports that Hyperliquid is slowly eating away market share from centralized exchanges.

HYPE Price Outlook: Bullish Momentum or Fade Out?

Looking at the chart, since July, HYPE has been trading in a large ascending triangle, a chart pattern that usually hints at a bullish continuation. The structure will likely resolve by September, with the move above the $51 resistance level expected to open the path for a new all-time high.

Upon breaking the resistance, the first price targets are $55, $57, and $60 based on Fibonacci extensions. Failure to hold above the resistance area could lead to a drop towards the 50% retracement level at $43 and possibly $40 or even lower.

Source: TradingView

Source: TradingView Momentum indicators are in favor of the bulls. The Relative Strength Index (RSI) is at 58.80, which indicates a potential end of the neutral trend and the start of a bullish trend. This goes in line with the Directional Movement Index (DMI), where +DI is at 22.07 and -DI at 11.50, indicating that buyers are in control.

That said, the Average Directional Index (ADX) is at 19.22, indicating that a trend is present but that it is still on the moderate side. Therefore, traders might have to wait for more directional momentum before taking breakout trades.

Related: Celestia (TIA) Faces 90% Decline: Will Support Hold or Further Losses Loom?

Conclusion

Hyperliquid has surged to a new all-time high of $51 in a defining moment that has been catalyzed by buybacks, whale entries, and new institutional interest. The impulse has been strong, but the question that arises now is whether the rally will extend higher or wear itself out.

Technical indicators point to the possibility of further growth, with bullish structures still in place, but the market is finely balanced. A convincing move above resistance could see HYPE rally to new highs, whilst a failure will likely see it drop back to support. At this point, the question is whether this breakout will be the beginning of a long-term trend or just a temporary high.

The post HYPE Surges to New ATH of $51: Bullish Run or Market Exhaustion? appeared first on Cryptotale.