Ethereum Bulls Remain Unfazed: Analyzing Market Confidence After $232 Million Liquidation

ETH Bulls Unaffected by Unexpected Drop Below $3,700: Analysis of Reasons

The rebound potential of Ethereum's price depends on improvements in US credit and labor data, as traders have shown caution following recent liquidations and volatility in the derivatives market.

ETH futures premiums indicate that even as bank stocks rebound from recent credit concerns, traders remain cautious and avoid using high leverage.

Ethereum whales' activity near $3,700 shows limited bearish conviction, although confidence in a swift recovery to $4,500 remains low.

Last Friday, Ethereum dropped 9.5%, retesting the $3,700 level and triggering $232 million in leveraged long liquidations within 48 hours. This unexpected pullback occurred against a backdrop of broader risk-off sentiment, stemming from two US regional banks announcing write-downs on bad loans, sparking credit concerns.

Ethereum derivatives data shows moderate unease among long traders, but whale positions indicate that most do not expect a deeper decline. The key question now is whether the $3,700 support can hold amid heightened macro risks.

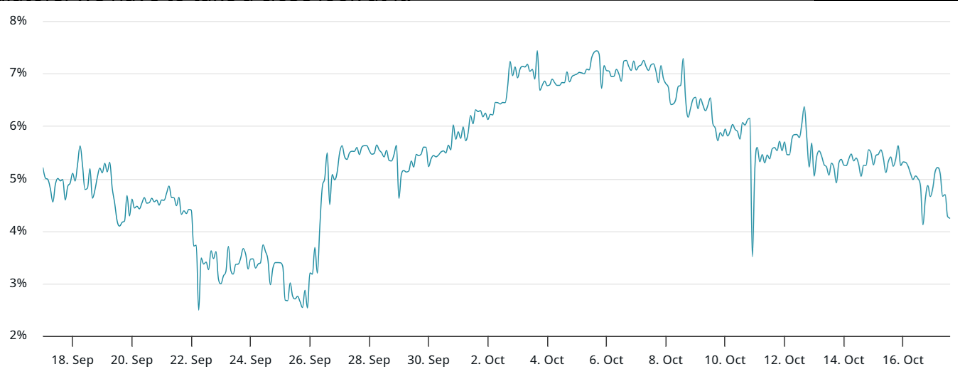

ETH 30-day options delta skew (put-call) at Deribit. Source: laevitas.ch

Ethereum's 25-delta options skew surged to 14% on Thursday, a level difficult to sustain for long and typically associated with heightened market panic. Traders are paying a premium for put (sell) options, indicating that market makers remain uneasy about downside risks. Under normal market conditions, the skew usually fluctuates between -6% and +6%.

The S&P Regional Banks Select Industry Index recovered part of Thursday's losses on Friday, rising 1.5%. However, credit concerns have left a mark on major financial institutions, such as JPMorgan (JPM) and Jefferies Financial Group (JEF), both of which reported losses related to the automotive sector. According to Yahoo Finance, auto loans are the fastest-growing segment in US banking.

Bundesbank President and ECB Governing Council member Joachim Nagel warned that the private credit market could produce "spillover effects," calling it a "regulatory risk." Nagel told CNBC that the global private credit market has exceeded $1 trillion, adding, "As regulators, we must keep a close eye on this market."

ETH 30-day futures annualized premium. Source: laevitas.ch

The monthly ETH futures premium relative to the spot market has dropped to 4%, below the neutral threshold of 5%. Trader sentiment had already been shaken by the flash crash on October 10, and the last significant bull phase occurred in early February. Ethereum traders are increasingly skeptical about the strength of any sustained bullish momentum.

US-China Trade Tensions Escalate, But ETH Whales Are Not Bearish

Trader unease partly stems from deteriorating US-China relations, as the ongoing trade war enters a new phase, including rare earth export controls and sanctions on South Korean shipping companies. US President Donald Trump stated on October 10 that the US may impose an additional 100% tariff on Chinese goods starting November 1.

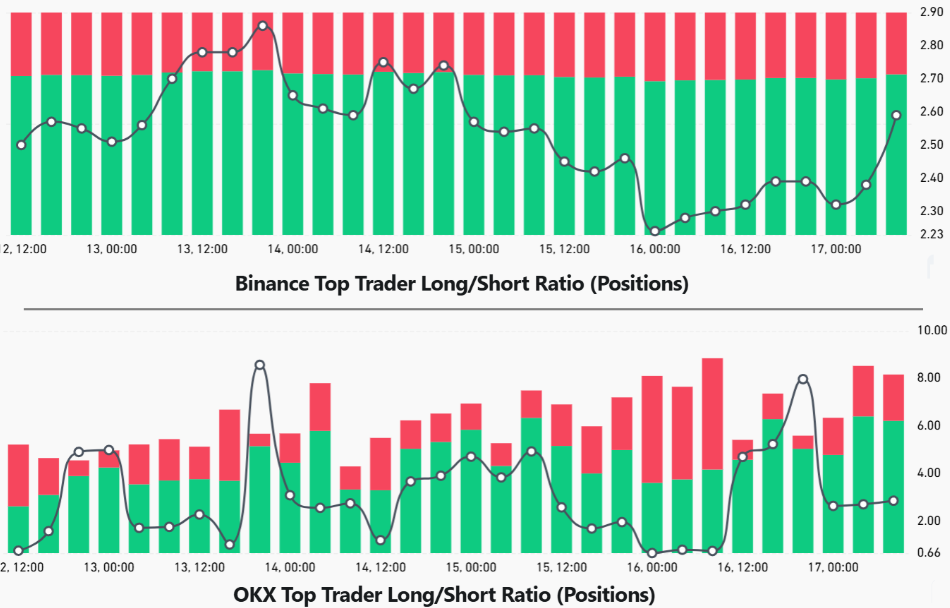

To determine whether Ethereum whales are truly betting on further declines or merely hedging in a worsening macro environment, one can analyze the positions of top traders on derivatives exchanges. This indicator integrates data from futures, margin, and spot markets, providing a clearer view of short-term market sentiment.

Top traders long-to-short at derivatives exchanges. Source: CoinGlass

Top traders on Binance reduced their long (bullish) bets from Tuesday to Thursday, but then changed strategy, increasing their ETH holdings despite weak prices. In contrast, top traders on OKX tried to take advantage of the market by adding positions near $3,900, but ultimately exited when the price fell to $3,700.

The ETH derivatives market does not show warning signals—quite the opposite. After the extreme volatility on October 10, the reluctance of bulls to use leveraged positions is a healthy sign. However, Ethereum's path to $4,500 is likely to depend on clearer signals from US credit conditions and labor market data, meaning any rebound may take time.