Bitcoin Treasury Craze Fades as Investors Grow Selective Amid Market Saturation

Quick Breakdown

- Investor enthusiasm for Bitcoin treasury firms is cooling amid mNAV declines and market saturation.

- Analysts warn that only firms with unique strategies and sustainable models will survive the next phase.

- Despite bubble concerns, experts say Bitcoin treasuries mark a new chapter in corporate finance innovation.

Investor euphoria over Bitcoin treasuries begins to fade

The excitement surrounding Bitcoin treasury companies is cooling as investors become more selective, signaling an end to the initial frenzy around Bitcoin-stacking firms. Despite over 200 publicly listed Bitcoin treasury firms worldwide, many are witnessing steep declines in their market net asset values (mNAVs), exposing cracks in the once-hyped strategy.

David Bailey, CEO of KindlyMD and head of Bitcoin-focused Nakamoto Holdings, told CNBC that the market is “getting more sophisticated” in distinguishing between firms with genuine utility and those merely replicating existing playbooks.

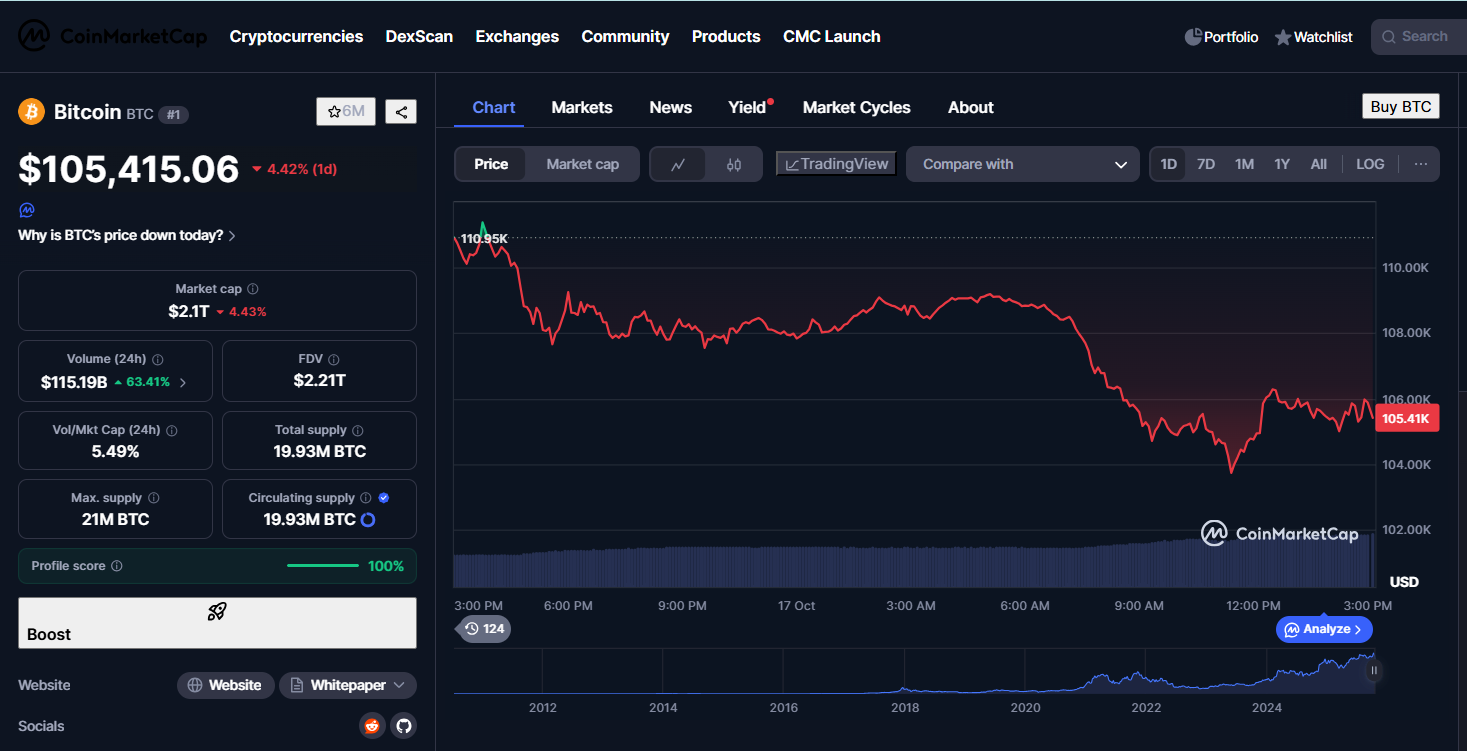

Bitcoin is down 9.90% over the past seven days. Source: CoinMarketCap

Bitcoin is down 9.90% over the past seven days. Source: CoinMarketCap “What’s the edge?” — why new bitcoin treasuries are losing steam

Bailey argued that companies entering the Bitcoin treasury space now need a clear purpose and competitive edge to stay relevant. “It’s kind of like, what’s the edge? Why are you needed?” he said, adding that the market can no longer sustain numerous firms executing identical strategies.

He suggested that future success stories will stem from firms targeting underserved international markets or integrating Bitcoin strategies into broader business operations. Bailey pointed to Michael Saylor’s MicroStrategy model, which is expanding into credit markets, as a strong example of innovation in the sector.

Bailey’s own company, Nakamoto Holdings, merged with healthcare firm KindlyMD in August to create a public Bitcoin treasury vehicle aiming to accumulate up to 1 million BTC. However, its shares have seen turbulent performance—dropping 55% in a single day in September and currently trading at $0.76.

Market maturity and a potential bubble

As of now, public Bitcoin treasuries collectively hold $113.8 billion worth of BTC, data from BitcoinTreasuries.net shows. Yet, analysts warn that market saturation is putting pressure on valuations. Standard Chartered recently noted that mNAV compression among smaller treasuries has heightened risks across the sector.

Meanwhile, David Bailey is seeking to raise between $100 million and $200 million for a political action committee (PAC) focused on promoting Bitcoin-friendly policies in the United States. Breed Capital, a venture firm, predicted that only a handful of Bitcoin treasury companies will survive the coming consolidation, while Glassnode’s lead analyst James Check described the model’s lifespan as “far shorter than most expect.”